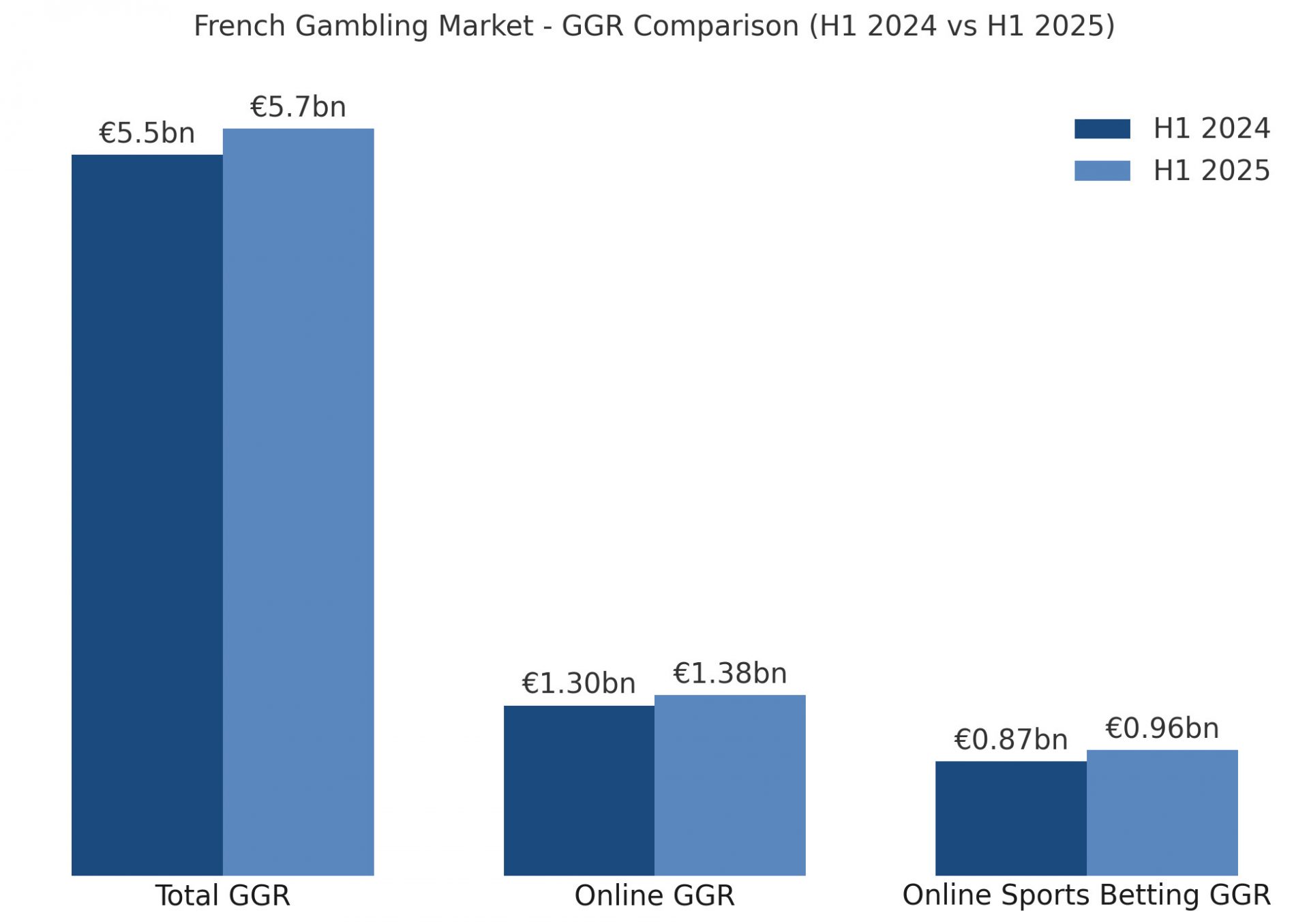

The French gambling market H1 2025 numbers show the sector is still moving upwards according to figures published by ANJ (The National Gambling Authority) – see more details:

- GGR revenue (excluding casinos and gaming clubs) stood at EUR 5.7bn in H1 2025. That’s 3.5% higher than last year. Despite fewer major sporting events compared to 2024, betting demand stayed strong.

- Online gambling GGR rose 6% year-on-year to EUR 1.4bn. Sports betting is the engine of growth. Horse racing managed only slight gains, and poker recorded a drop.

- Online player activity increased, with active accounts climbing 9% to EUR 4.7m. Growth was seen across all online segments. Operators are still pushing cross-selling to draw in casual players with smaller stakes.

- Online sports betting kept up the pace with stakes reaching EUR 6bn, up 15% from H1 2024. GGR also rose 10% to EUR 961m. Wagering volume and unique players both grew more than 10%.

- Online horse racing slowed sharply after stronger years, with stakes barely up 1% at EUR 795m. GGR was stable at EUR 174m. While active player accounts grew 3%, the number of unique players slipped by 3%.

- Online poker GGR dropped 4% year-on-year to EUR 246m, even though player numbers went up. Cash Games took the biggest hit, down 15% to EUR 47m, while tournaments and Sit&Go formats held steady at EUR 199m. More players joined overall, helped by cross-selling from other products.

Please find more news here.