Online gambling stocks performance was mixed over the past week, with modest average gains masking sharp differences between individual names and segments. While Penn Entertainment and Codere Online stood out with strong advances, several affiliates and suppliers lagged behind, pulling the sector’s overall performance below that of the Nasdaq Composite. Overall, the data points to selective investor interest rather than a broad-based move across the online gambling space.

Overview

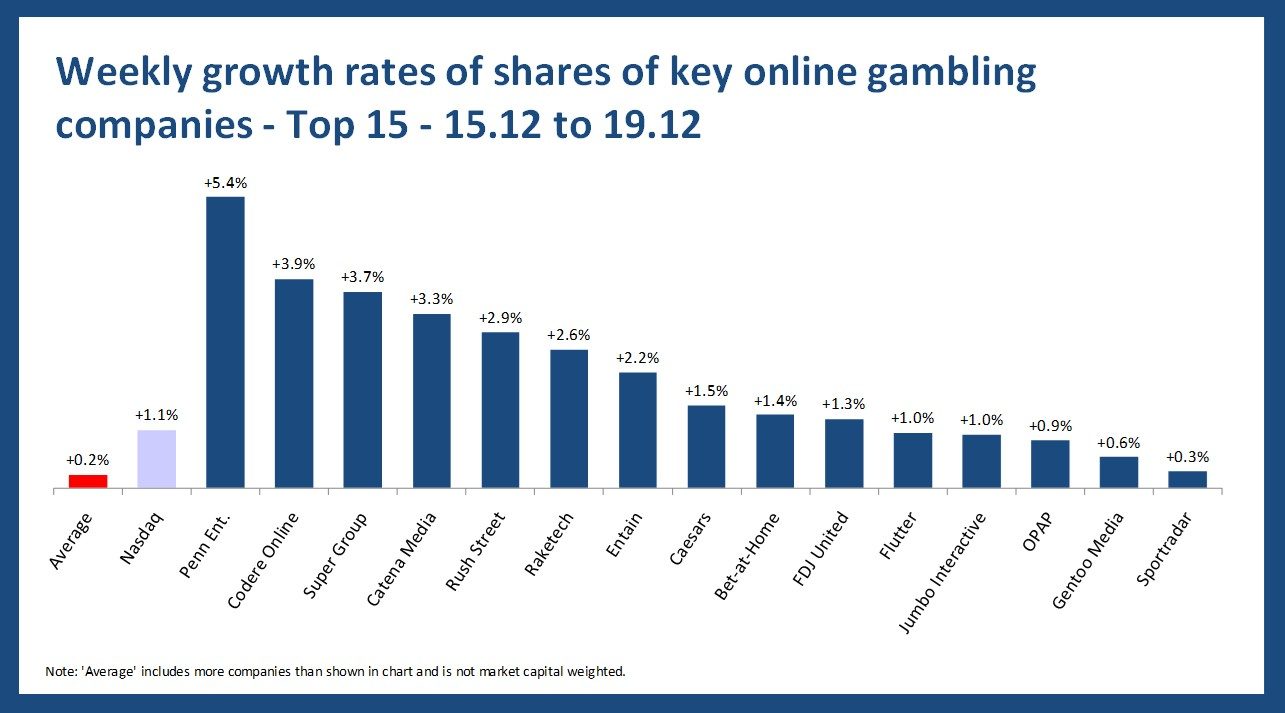

- Average growth – On average, share prices analyzed increased by +0.2% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by Penn Ent. with an increase of +5%, followed by Codere Online (+4%).

- “Loser” – Gambling.com and DraftKings had the worst weekly performance in our analysis, with a change of -6% and -4%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (+1%), the average development of the online gambling industry looks “worse”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, an increase of +0.8%; with Codere Online (+4%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, Penn Ent. is the “winner” with +5% while the average share development was +1%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, a decrease of -1%. The winner is Jumbo Interactive with +1%

- Affiliates – On average, affiliates’ shares saw a decrease of -0.2% with Catena Media (+3%) leading and Gambling.com (-6%) coming last.

The share increase of Penn Entertainment

Penn Entertainment had a good week in the market, with its shares ticking higher as investors reacted to some encouraging company news. The opening of the second hotel tower at the M Resort in Las Vegas was a clear highlight, and the company also continues to push its Score Bet product into more U.S. states.

The decline of Gambling.com shares

Gambling.com’s shares moved the other way last week, and the reasons are fairly straightforward. Investors are still digesting the company’s latest earnings update, which came with mixed numbers and a toned-down outlook for the year. While the Missouri sports betting supplier license was a positive development, it wasn’t enough to shift sentiment. Ongoing pressure in the core search marketing business and questions around near-term growth continue to hang over the stock, keeping buyers on the sidelines for now.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.