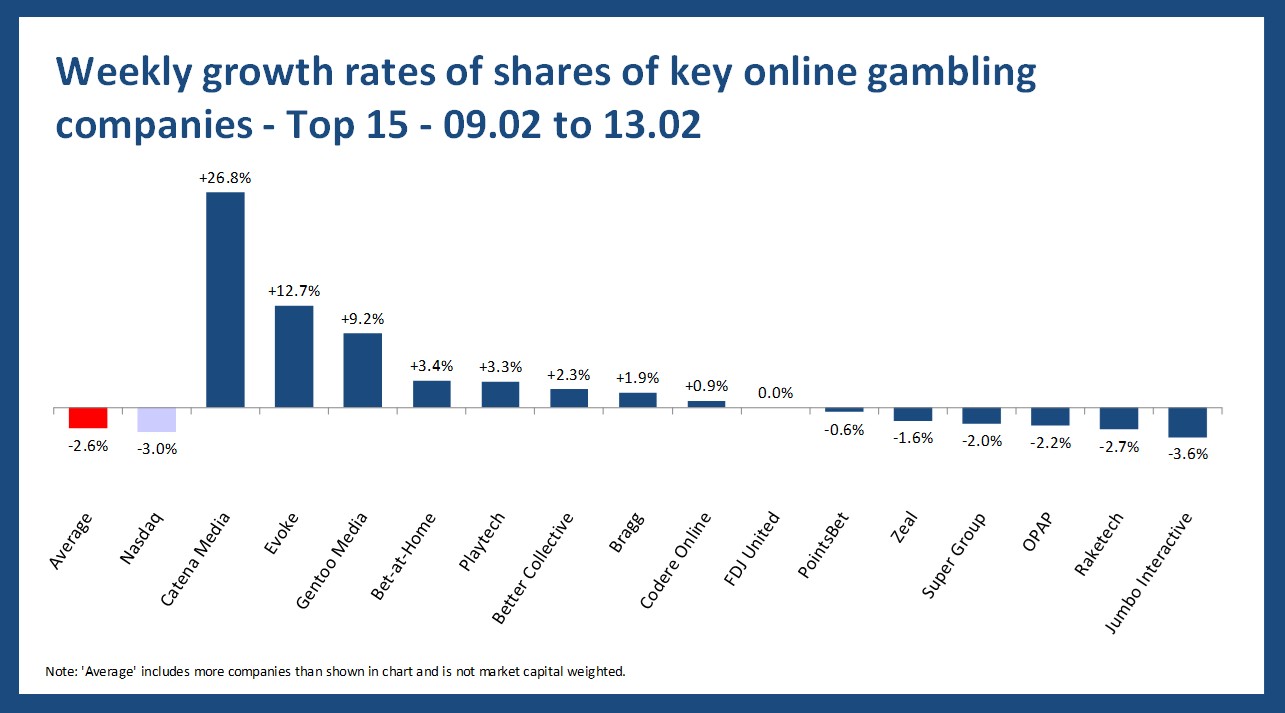

The latest online gambling stocks performance shows a mixed picture, with share prices across the sector declining by an average of 3% last week, slightly outperforming the Nasdaq Composite. While heavyweights like DraftKings and Flutter weighed on overall results, sharp gains from Catena Media and Evoke provided bright spots. Performance varied across segments, with affiliates standing out on average, while operators and suppliers faced modest pressure.

Overview

- Average growth – On average, share prices analyzed decreased by -3% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by Catena Media with an increase of +27%, followed by Evoke (+13%).

- “Loser” – DraftKings and Flutter had the worst weekly performance in our analysis, with a change of -20% and -17%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (-3%), the average development of the online gambling industry looks a bit “better”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, a decrease of -6%; with Bet-at-Home (+3%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, Evoke is the “winner” with +13% while the average share development was -5%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, a decrease of -2%. The winner is Playtech with +3%.

- Affiliates – On average, affiliates’ shares saw an increase of +6% with Catena Media (+27%) leading and Gambling.com (-6%) coming last.

The share increase of Catena Media

Catena Media’s share jump from 09.02 to 13.02 appears to be linked to the publication of its Q4 2025 earnings and revenue update on February 10, 2026, which highlighted solid revenue growth and improved profitability in the quarter — news that likely boosted investor confidence.

The decline of DraftKings shares

DraftKings’ weaker share performance from 09.02 to 13.02 seems tied to the company’s February 12 earnings release and 2026 guidance, where it reported solid revenue but missed Wall Street’s expectations on earnings per share and set a full-year revenue outlook below consensus, which disappointed investors and weighed on sentiment.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.