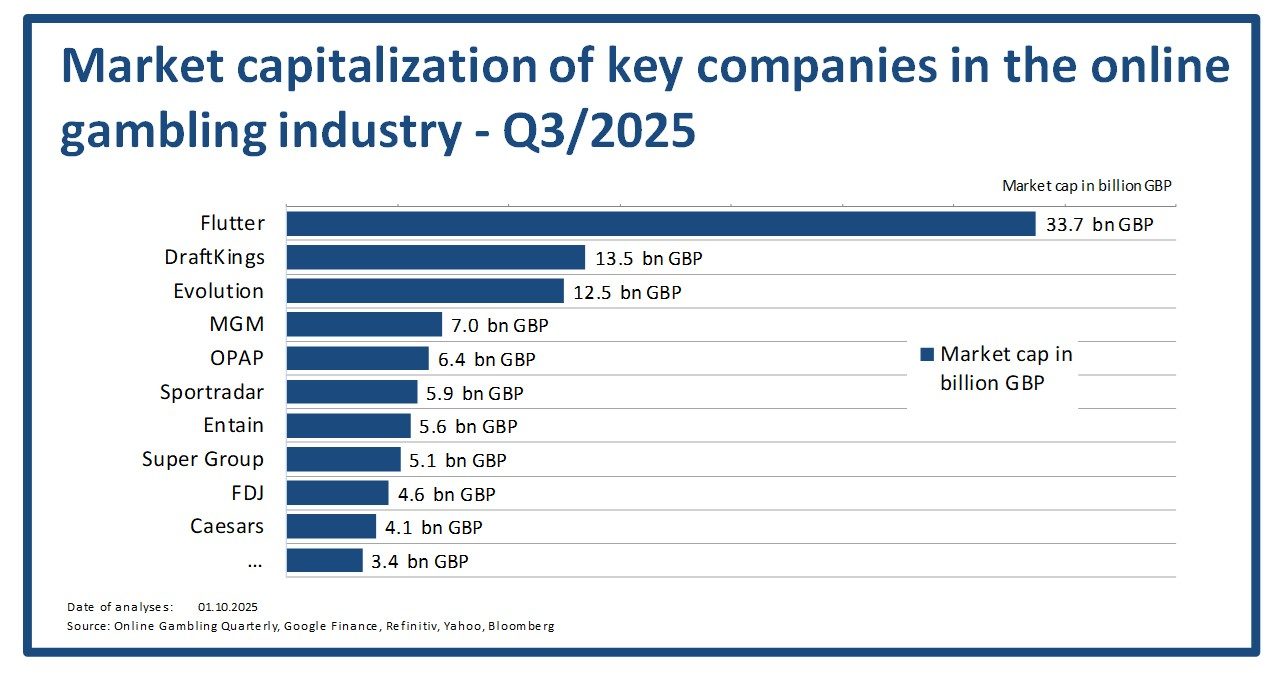

In these analyses, the OGQ takes an in-depth look at the following topic: Market capitalization of key companies in the online gambling industry – Q3 2025. The data research explores how publicly listed betting and gaming companies perform in terms of market value.

Market capitalization of key companies in the online gambling industry – Q3/2025

This chart shows the market capitalization ranking of leading online gambling companies as of October 2025. Flutter remains firmly at the top, ahead of DraftKings and Evolution.

Flutter leads the industry ranking with a market capitalization of GBP 33.7 billion, reaffirming its dominant global presence in betting and gaming.

DraftKings follows in second place, highlighting the strength of the U.S. market.

Evolution, ranking third, maintains robust growth through its strong B2B casino product line and live gaming dominance.

The average market capitalization across all analyzed firms is GBP 3.5 billion, showing a clear divide between industry giants and smaller players.

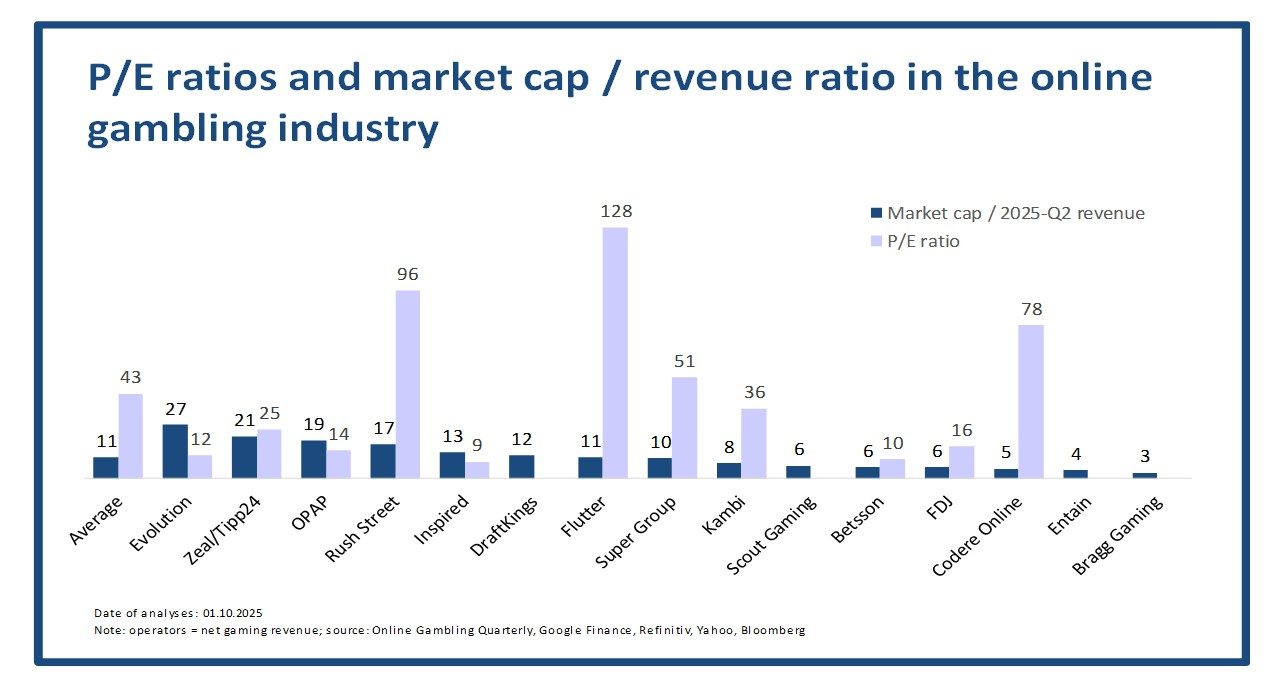

P/E ratios and market cap / revenue ratio – Q3/2025

This chart compares companies’ price-to-earnings ratios and their market capitalization relative to Q2 2025 revenues. The analysis highlights major valuation contrasts between established and growing operators.

Flutter has the highest P/E ratio at 128, reflecting strong investor expectations and sustained growth potential.

The average P/E ratio across companies stands at 43, with a median of 25, showing large valuation gaps within the industry.

Evolution leads the market cap-to-revenue ratio with a value of 27, followed by Zeal/Tipp24 (21) and OPAP (19).

The average market cap/revenue ratio of 11 demonstrates balanced valuation levels relative to quarterly revenues.

More info about this analysis: Market capitalization of key companies in the online gambling industry – Q3 2025. Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.