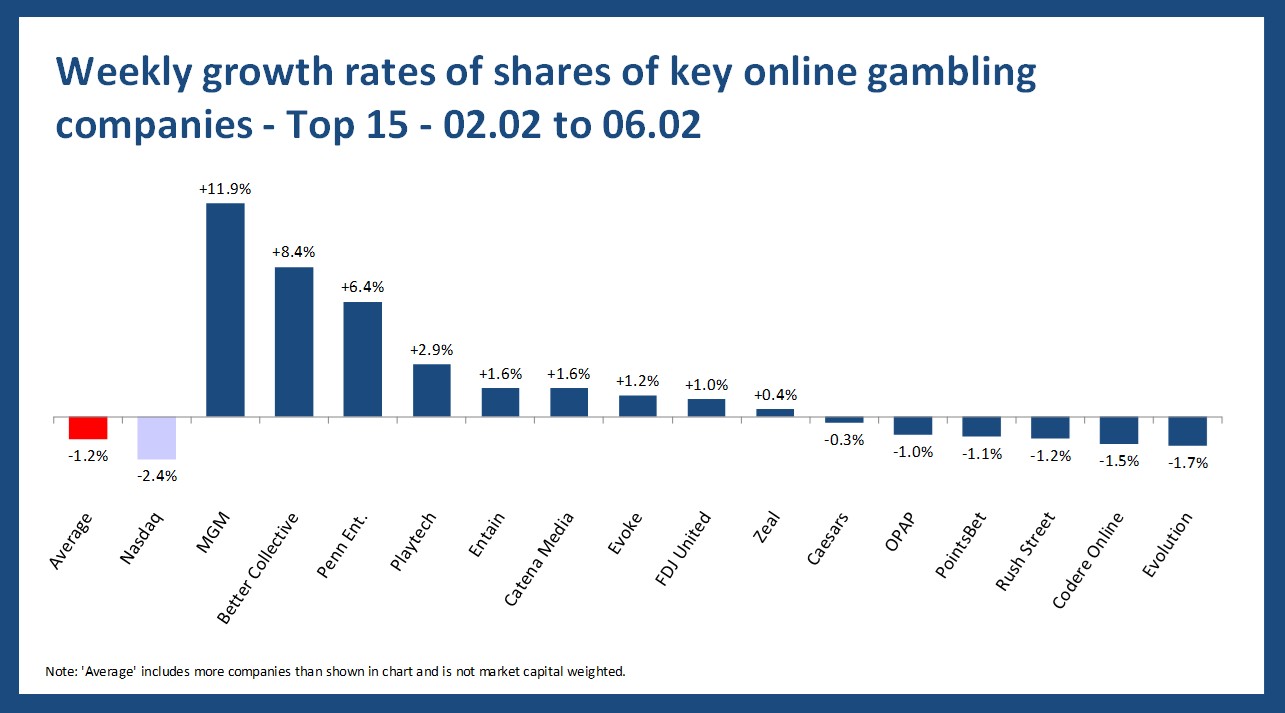

Online gambling stocks performance was mixed over the past week, with the sector slightly outperforming the broader market despite an average share price decline of around 1%. Standout gains from companies like MGM and Better Collective helped offset weaker results from others, while performance varied notably across operators, suppliers, and affiliates. Overall, the industry held up better than the Nasdaq Composite, which posted a steeper drop over the same period.

Overview

- Average growth – On average, share prices analyzed decreased by -1% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by MGM with an increase of +12%, followed by Better Collective (+8%).

- “Loser” – Bragg and Jumbo Interactive had the worst weekly performance in our analysis, with a change of -12% and -7%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (-2%), the average development of the online gambling industry looks “better”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, a decrease of -3%; with Zeal (+0.4%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, MGM is the “winner” with +12% while the average share development was +3%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, a decrease of -5%. The winner is Playtech with +3%.

- Affiliates – On average, affiliates’ shares saw an increase of +0.4% with Better Collective (+8%) leading and Gambling.com (-4%) coming last.

The share increase of MGM

MGM’s share price strength from 02.02 to 06.02 was largely driven by the company’s strong fourth-quarter and full-year 2025 results, which showed solid revenue and profit growth as well as significant cash distributions from its BetMGM joint venture, helping boost investor confidence. The earlier than planned release of these earnings and positive market reaction to the numbers likely supported the stock’s upward trend last week.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.