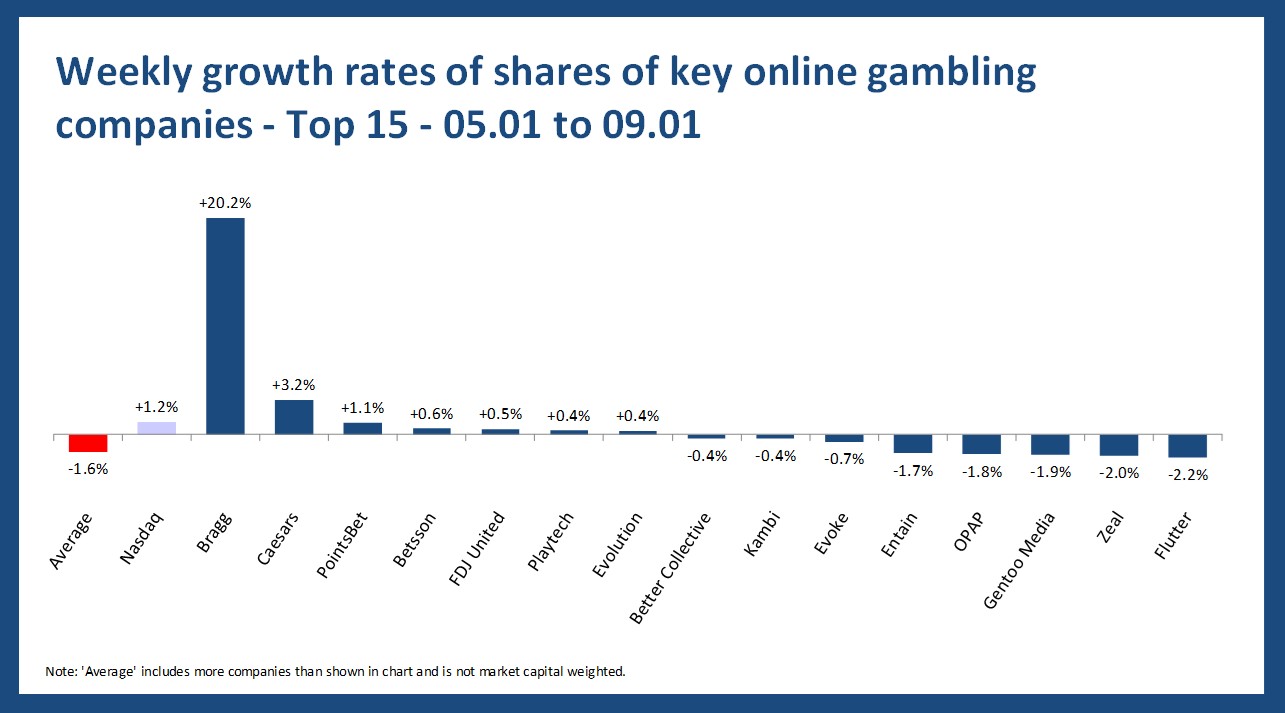

Online gambling stocks performance was mixed over the past week, with the sector overall slipping despite a modest rise in the Nasdaq Composite. While average share prices declined, strong gains from Bragg and Caesars stood out, partially offsetting notable losses among several online operators and affiliates.

Overview

- Average growth – On average, share prices analyzed decreased by -2% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by Bragg with an increase of +20%, followed by Caesars (+3%).

- “Loser” – Super Group had the worst weekly performance in our analysis, with a change of -12%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (+1%), the average development of the online gambling industry looks “worse”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, a decrease of -3%; with PointsBet (+1%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, Caesars is the “winner” with +3% while the average share development was -1%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, an increase of +1%. The winner is Bragg with +20%.

- Affiliates – On average, affiliates’ shares saw a decrease of -3% with Better Collective (-0.4%) leading and Catena Media (-6%) coming last.

The share increase of Bragg

Bragg’s shares jumped last week largely because the company announced a strategic restructuring aimed at reducing costs and improving profitability, a move that appears to have reassured investors about its near-term financial resilience. The press release highlighted plans to streamline operations and pursue an “AI-First” transformation, which likely drove renewed confidence and buying interest in the stock.

The decline of Super Group shares

Last week Super Group’s shares fell in part because of renewed market jitters around the company’s outlook, with technical indicators and investor sentiment turning negative despite solid fundamental drivers. Recent analyst commentary highlighted mixed signals and volatile price action, suggesting that investors were less confident in the stock’s near-term direction, which likely weighed on its performance.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.