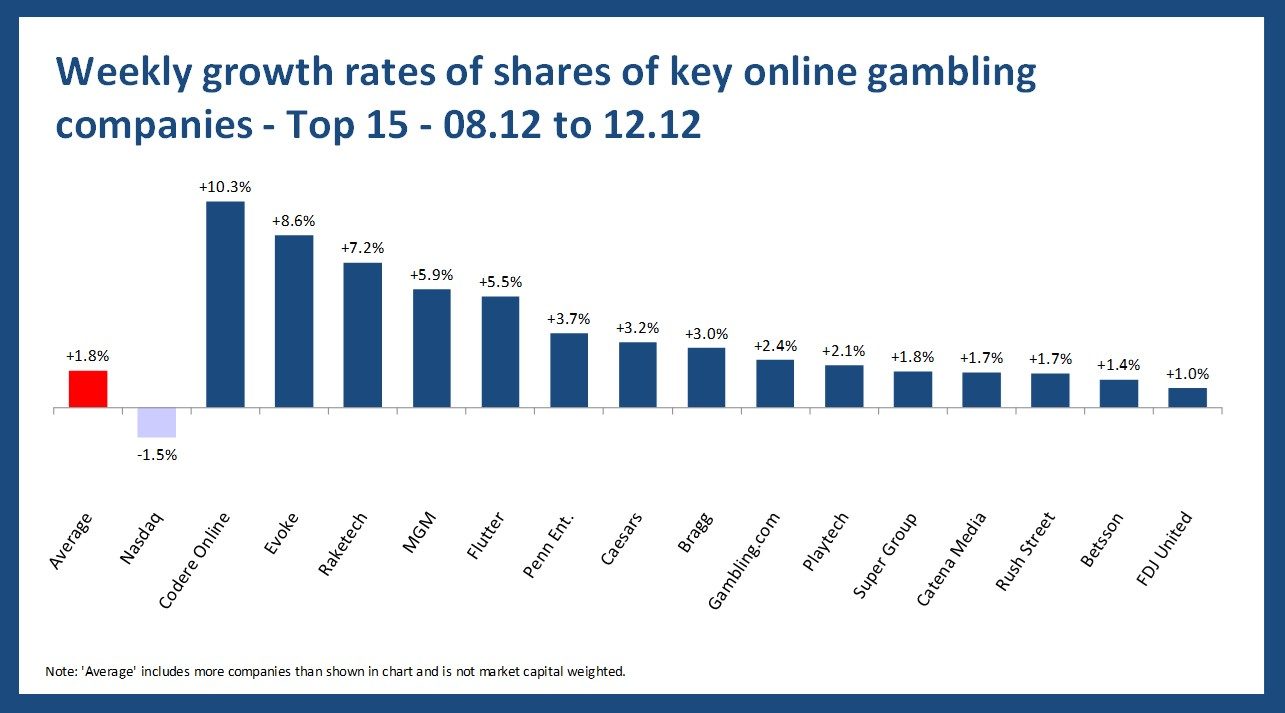

Last week’s online gambling stocks performance was broadly positive, with the sector posting an average share price increase of around 2%, clearly outperforming the Nasdaq Composite, which slipped by 1%. Gains were driven by strong moves from selected operators such as Codere Online and Evoke, while a few names like Gentoo Media and Bet-at-Home weighed on overall sentiment. Overall, most segments ended the week in positive territory, underlining the sector’s relative resilience.

Overview

- Average growth – On average, share prices analyzed increased by +2% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by Codere Online with an increase of +10%, followed by Evoke (+9%).

- “Loser” – Gentoo Media and Bet-at-Home had the worst weekly performance in our analysis, with a change of -6% and -3%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (-1%), the average development of the online gambling industry looks “better”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, an increase of +2%; with Codere Online (+10%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, Evoke is the “winner” with +9% while the average share development was +3%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, an increase of +0.9%. The winner is Bragg with +3%

- Affiliates – On average, affiliates’ shares saw an increase of +1% with Raketech (+7%) leading and Gentoo Media (-6%) coming last.

The share increase of Codere Online

Last week’s positive share move in Codere Online was largely driven by upbeat investor sentiment following the company’s recent investor communications, including the release of its third-quarter results and a clear outlook reaffirmation, as well as news that management expanded and extended its share buyback program – all of which signaled confidence in growth prospects and helped support the stock.

The decline of Gentoo Media shares

Last week’s downturn in Gentoo Media’s share price appears to be tied to lingering investor concerns around the company’s recent interim reporting and its strategic positioning, with the market reacting to a lack of fresh positive catalysts following the Q3 2025 interim update that didn’t yet offer clear new growth signals. While Gentoo reaffirmed progress on its operating model in press releases, the absence of stronger near-term guidance and continuing headwinds in affiliate markets likely weighed on sentiment.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.