Last week was dominated by the UK government’s announcement to increase the remote-gaming duty from 21% to 40%. Many market insiders saw the end of the online gambling industry in the UK and beyond. In reality, the online gambling industry outperformed the Nasdaq Composite last week, and we saw only three shares with relevant declines: Evoke, SGHC, and Raketech.

Overview – Minimal effect of the planned UK gambling tax increase

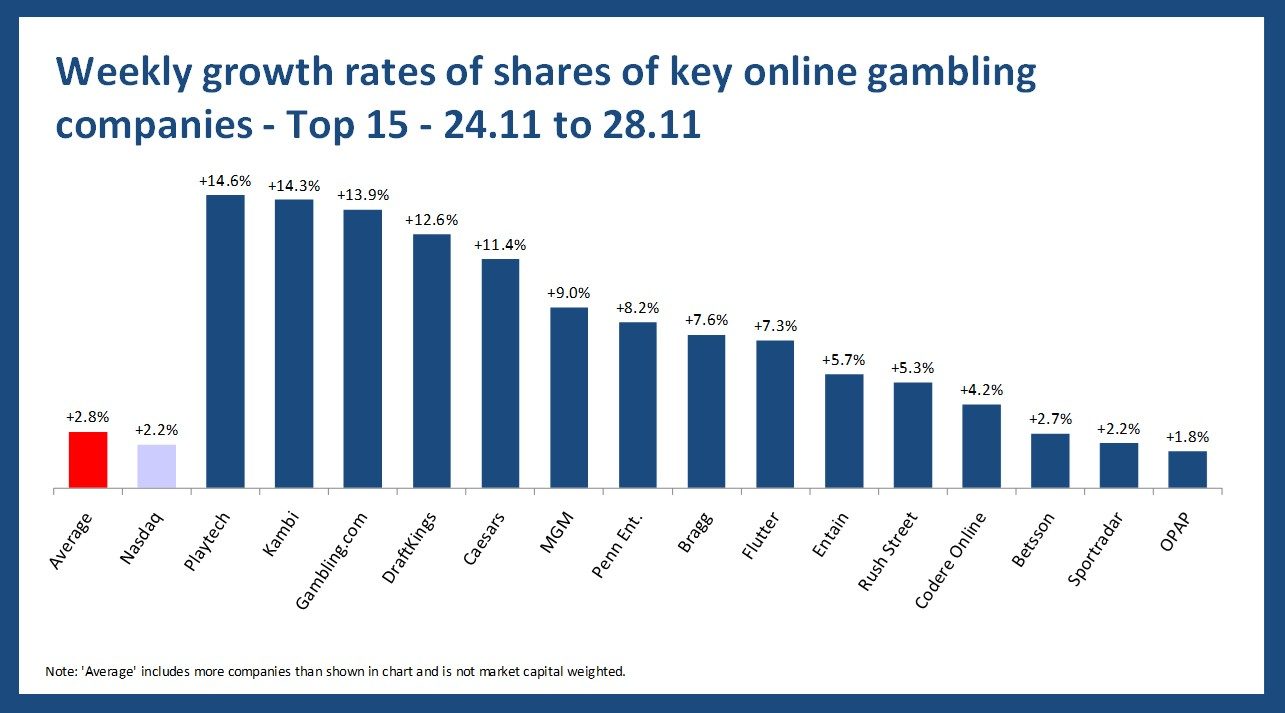

- Average growth – On average, share prices analyzed increased by +3% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by Playtech with an increase of +15%, followed by Kambi (+14%).

- “Loser” – Evoke and Super Group had the worst weekly performance in our analysis, with a change of -26% and -10%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (+2%), the average development of the online gambling industry looks “better”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, an increase of +2%; with DraftKings (+13%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, Caesars is the “winner” with +11% while the average share development was +2%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, an increase of +7%. The winner is Playtech with +15%

- Affiliates – On average, affiliates’ shares saw an increase of +0.4% with Gambling.com (+14%) leading and Raketech (-10%) coming last.

The share increase of Playtech

Playtech’s strong share-price jump in the week from 24.11 to 28.11 likely reflects renewed investor confidence – after recent investor updates the company reiterated that it remains on track to beat full-year EBITDA expectations, thanks to robust B2B growth, a healthy cash position and strong momentum in key markets like the U.S. and Canada.

The decline of Evoke shares

The share drop of Evoke plc between 24.11 and 28.11 is tied to the UK government’s announcement of sharp tax increases on online gaming – specifically, a planned rise in the remote-gaming duty from 21% to 40%. Investors reacted quickly, fearing that the heavier tax burden will hit profitability hard.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.