Online gambling stocks performance was mixed over the past week, with the sector underperforming the broader market as average share prices declined by around 2%, compared to a 1% drop in the Nasdaq Composite. While Playtech and Catena Media stood out with gains, sharp declines at DraftKings and Entain weighed heavily on overall sentiment. Performance varied notably across segments, with affiliates showing relative resilience and multi-channel operators facing the strongest pressure.

Overview

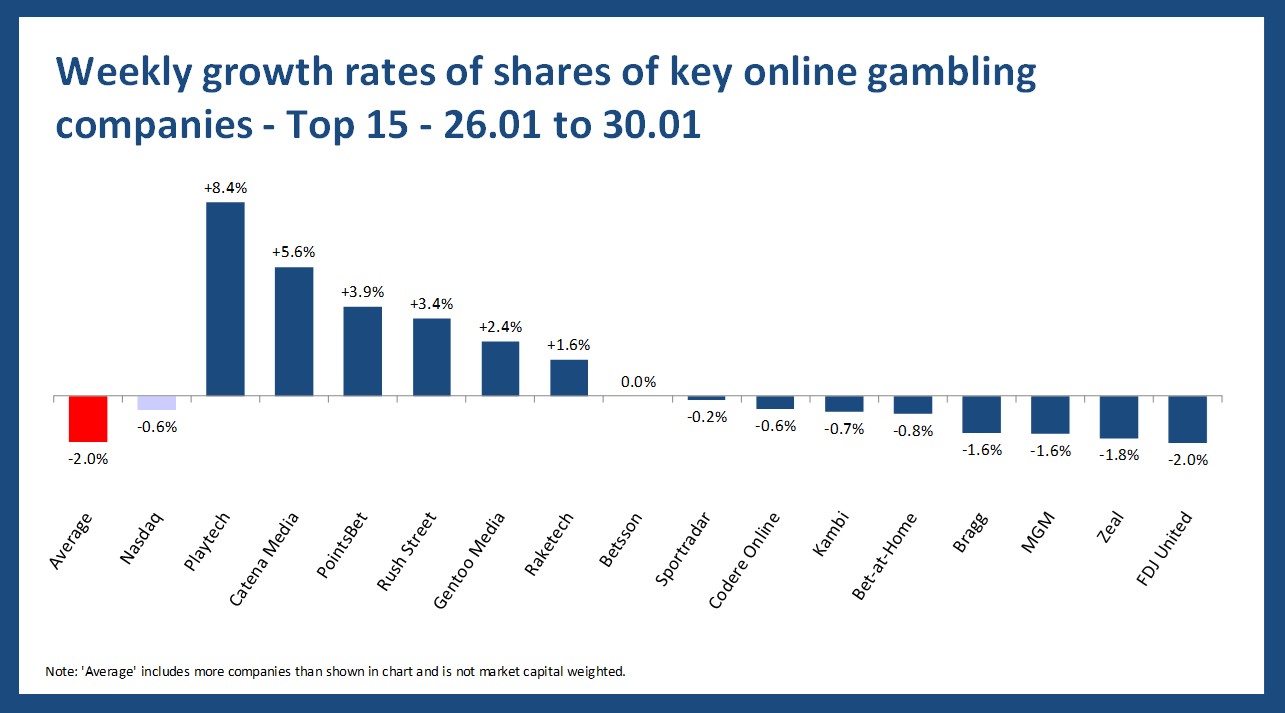

- Average growth – On average, share prices analyzed decreased by -2% in the last week.

- “Winner” – The most significant leap in our sample of online gambling-focused companies was taken by Playtech with an increase of +8%, followed by Catena Media (+6%). Until Tuesday this week, Playtech had already lost most of last week’s gains.

- “Loser” – DraftKings and Entain had the worst weekly performance in our analysis, with a change of -10% and -9%.

- Comparison to the Nasdaq Composite – Compared to the development of the Nasdaq Composite (-1%), the average development of the online gambling industry looks “worse”.

Segment-specific developments

- Online-focused operators – The shares of online-focused operators included in the analysis saw, on average, a decrease of -2%; with PointsBet (+4%) leading the ranking.

- Multi-channel operators – Among the multi-channel operators that also operate a relevant retail business, MGM is the “winner” with -2% while the average share development was -6%.

- Suppliers – The shares of the suppliers included in the analysis saw, on average, a decrease of -0.4%. The winner is Playtech with +8%.

- Affiliates – On average, affiliates’ shares saw an increase of +0.9% with Catena Media (+6%) leading and Gambling.com (-3%) coming last.

The share increase of Playtech

Playtech’s shares got a lift late last week after trading data showed a notable uptick in price around 27 January 2026, suggesting renewed investor interest. While there wasn’t a single blockbuster announcement in that exact period, the broader positive sentiment likely stemmed from recent strategic developments — including expanding partnerships with major operators like bet365 in the U.S. and new market deals in South Africa, which have been highlighted in company press releases and industry coverage in January.

The decline of DraftKings shares

DraftKings’ shares slid largely because several Wall Street analysts lowered their price targets ahead of the company’s upcoming fourth-quarter earnings release, signaling caution about near-term results and competitive pressures. This negative sentiment around expected earnings and guidance weighed on investor confidence throughout the week, contributing to the stock’s weaker performance.

Please find more data and the methodology applied in the current edition of the OGQ Magazine. Also, find more content in our data section.