Light & Wonder earnings got a boost in Q2 2025 despite a small dip in revenue. The gaming supplier posted higher margins and stronger profit on the back of record iGaming numbers and continued success in operations. The company also completed its Grover acquisition and pushed ahead with plans to shift to a sole listing on the ASX.

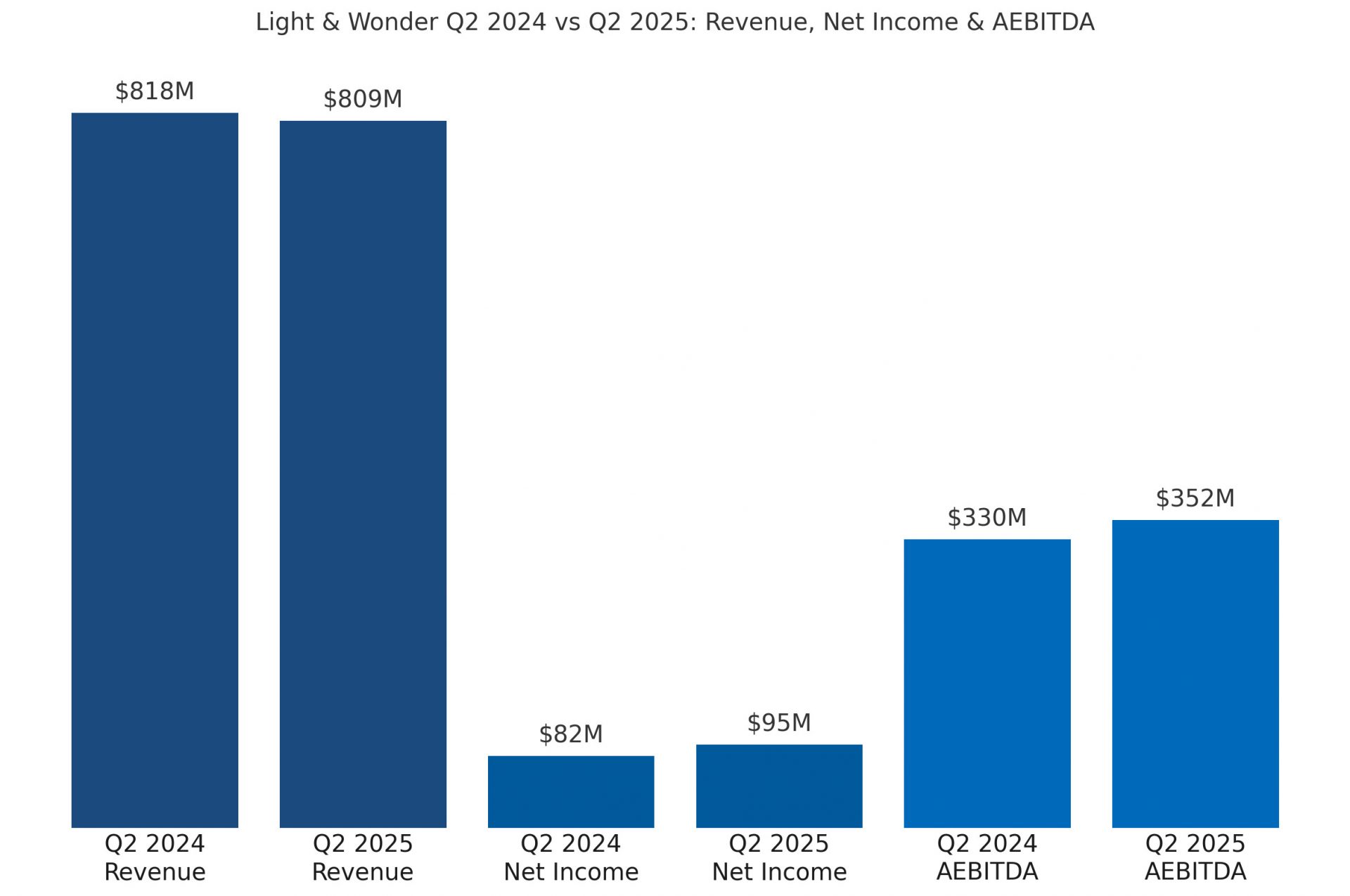

Q2 revenue landed at $809 million, just 1% lower than the same quarter last year. Net income rose to $95 million, up 16% year-on-year, and consolidated AEBITDA grew 7% to $352 million. The company noted that cautious spending by some customers impacted machine sales timing.

Gaming operations added 2,780 units in North America, taking the installed base to 35,346 units. This marks the 20th straight quarterly increase in premium placements, which now make up over half of the total installed base. Grover contributed $21 million to gaming revenue following the May 2025 acquisition.

Over 9,000 new gaming units were sold globally in the quarter. However, machine sales revenue dipped due to delayed capital spending by clients. Despite that, Light & Wonder maintained strong market share momentum in the segment.

SciPlay revenue dipped 2% to $200 million, but margins improved due to the growth of its direct-to-consumer platform. Average revenue per daily active user rose to $1.08, and monthly revenue per paying user hit a record $128.96.

iGaming revenue jumped 9% year-on-year to a record $81 million. Wagers processed hit $26.6 billion for the quarter. AEBITDA for the segment also grew 17% to $28 million, supported by North American growth and new partnerships.

Light & Wonder returned $266 million to shareholders in the first half of 2025 through buybacks. An additional $500 million was approved for repurchases, bringing the total program to $1.5 billion. Since 2022, the company has bought back $1.3 billion worth of shares.

The company is moving forward with its planned delisting from Nasdaq by November 2025. It will retain a sole primary listing on the ASX, citing stronger trading volume and long-term alignment with investor interest.

Debt rose to $4.9 billion following the Grover acquisition, but leverage remains within the target range. Net debt leverage ratio was 3.4x on a combined basis. Light & Wonder says it expects to stay within its long-term financial targets.

Guidance for full-year 2025 was reaffirmed, with AEBITDA forecast between $1.43 billion and $1.47 billion. Adjusted NPATA is expected between $550 million and $575 million, including about $65 million in contributions from Grover.

CEO Matt Wilson commented, “We remain committed to R&D investment to further proliferate our high-performing content across channels… The integration of Grover is progressing ahead of schedule, and we are very well-positioned in the charitable gaming business.”

Please find more news here.