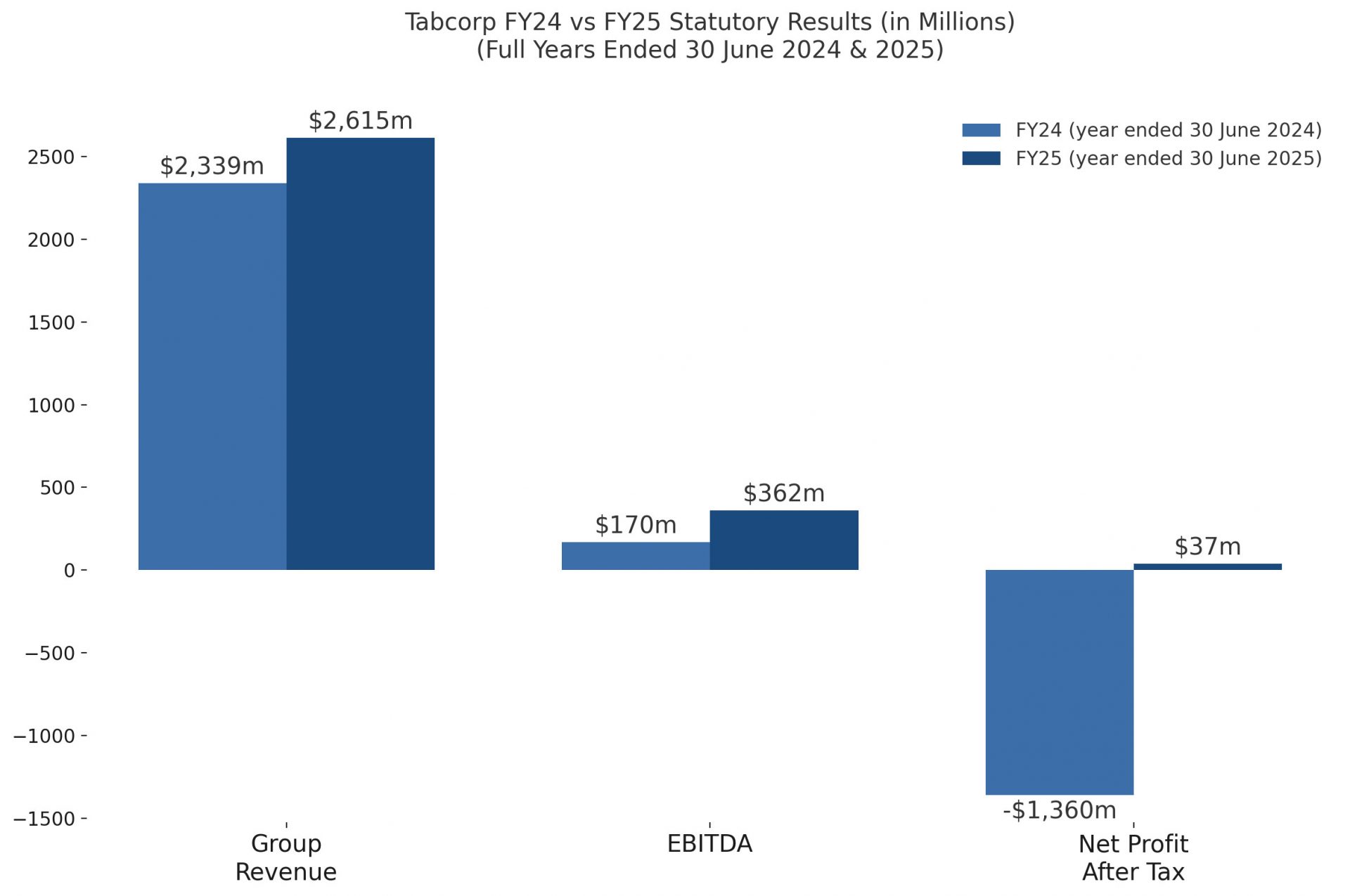

Tabcorp has bounced back into profit for the year to 30 June 2025. The group posted revenue of $2.61bn and confirmed a dividend of 2.0c per share. The Tabcorp FY25 results got a major lift from the new Victorian wagering and betting licence.

Group revenue climbed 11.8% to $2.61bn, while net profit after tax was $36.6m, a turnaround from last year’s loss. Underlying EBITDA increased 23.2% to $391.5m, showing stronger operations. Earnings per share landed at 1.6c, or 3.9c after adjusting for one-off items.

Wagering and Media brought in $2.44bn, up 12.8% year on year. Digital betting jumped 16% to $1.07bn, while retail betting grew 17.5% to $965.7m. Media revenue edged slightly higher at $370.6m.

The Victorian Licence added an estimated $83.7m in EBITDA across 10.5 months. Profit margins in Wagering and Media lifted by 250 basis points to 37.6%. A new retail model rolled out in July 2025 aimed at strengthening venue performance.

Operating costs were $697.2m before one-offs, shaped by licence and demerger effects. After adjusting, costs rose just 0.5%, helped by $38.8m in savings. Capital spending dropped to $115.2m, compared with $150.8m last year.

Debt levels eased, with net debt at $609.4m and leverage at 1.6 times EBITDA. Cash conversion remained strong at 99%, and the company held $803m in available cash and facilities. No debt repayments are due until FY28.

Shareholders will receive a 1.0c final dividend, taking the full-year payout to 2.0c per share. Both dividends are unfranked due to limited franking capacity, while a dividend reinvestment plan will apply to the final payout.

Tabcorp pointed to new customer features including “TAB Time” in venues and “Tap In-Play” trials in NSW. Sports betting turnover grew 10.3% in the second half, while in-venue digital turnover rose 20.5%. “We’re pleased to deliver an improved financial result,” said the Chair and CEO.

The Integrity Services (MAX) unit reported $175.8m in revenue and $62.4m in EBITDA. Adjusted for the sale of MAX Performance Solutions, the division grew, with 126,970 gaming machines now monitored across four regions. Expansion plans are underway for monitoring and value-added services.

Strategic goals include new safer gambling tools, innovation in tote betting and a standalone media platform. Cost control and retail upgrades are also on the agenda to boost customer engagement. These priorities were reinforced in the Tabcorp FY25 results.

Looking forward, Tabcorp expects modest growth in the wagering market. The focus will remain on profitable retail operations, stronger omnichannel products and meeting compliance obligations. Management says the momentum built in FY25 sets the tone for the next phase.

Please find more news here.