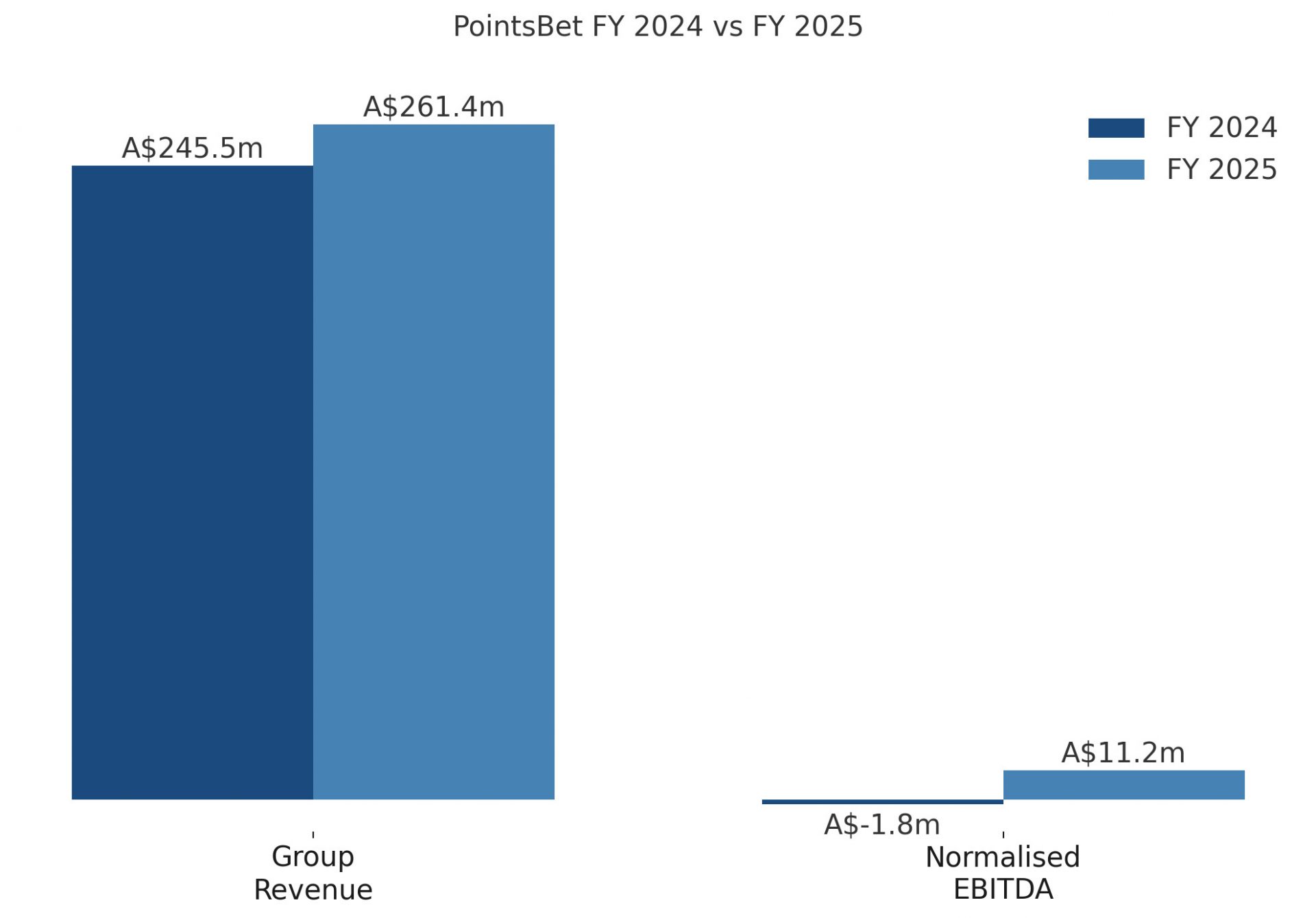

PointsBet has filed its FY25 preliminary numbers, and there’s a clear shift in the P&L mix. Revenue nudged up, costs were tighter, and EBITDA turned positive on a normalised basis. Here’s how the PointsBet FY25 results break down.

Group revenue reached A$261.4m, up 6% year on year. Normalised EBITDA came in at A$11.2m versus a loss in FY24, while statutory EBITDA was A$4.2m. The net loss after tax narrowed to A$18.2m from A$42.3m.

Total net win across sports betting and iGaming was A$283.6m, up 6%. Sports betting net win rose 4% to A$257.6m; iGaming net win increased 39% to A$26.0m. Gross profit improved 6% to A$137.0m despite higher product fees and point-of-consumption tax in Australia.

Australia delivered A$218.5m in revenue, up 3%. Statutory segment EBITDA was A$30.1m, marking a sixth straight year of positive EBITDA. Net win margin hit 10.4%, with promo spend falling to 23.6% of gross win from 26.0%.

Canada posted A$42.9m in revenue, up 26%. Statutory segment EBITDA was a loss of A$15.1m, an improvement from a A$19.7m loss in FY24. iGaming net win rose 39% to A$26.0m as content suppliers grew from four to fifteen and the catalogue topped 1,000 titles.

Marketing spend decreased to A$62.5m at Group level, down from A$71.0m. Management cites better efficiency in both markets, with a larger mass-market contribution supporting retention. Employee benefits rose modestly, while product and technology costs increased on cloud hosting and post-US separation run-rate effects.

Cash at 30 June 2025 was A$40.2m, including A$17.5m of client cash. Operating cash flow was an inflow of A$17.1m; excluding player cash movements, operating cash outflow was A$13.6m. Net tangible assets per share stood at negative 6.2 cents.

Active customers reached 295,757 for the period, an all-time high. The company highlights growing use of higher-margin products such as same-game multis. PointsBet FY25 results also note seasonally stronger H2 cash generation, with second-half net cash inflows of A$7.9m.

Please find more news here.