DraftKings has reported steady top-line growth and lifted its guidance for the year. The DraftKings Q3 2025 results showed momentum across revenue and customer engagement, even as sports outcomes trimmed margins. Management also raised its share buyback plan and highlighted optimism about 2026 performance.

Revenue reached USD 1.14bn (ca. EUR 988m), up 4% year on year. Sportsbook revenue slipped 9.3% to USD 596m (ca. EUR 517m) on tighter margins, but iGaming grew 24.9% to USD 451m (ca. EUR 391m). Management said performance would have been stronger excluding customer-friendly sports outcomes.

Monthly Unique Payers averaged 3.6m, up 2% from last year, or 6% when excluding Jackpocket. Average revenue per player rose 3% to USD 106 (ca. EUR 92). DraftKings noted continued growth in parlay mix and engagement across core states.

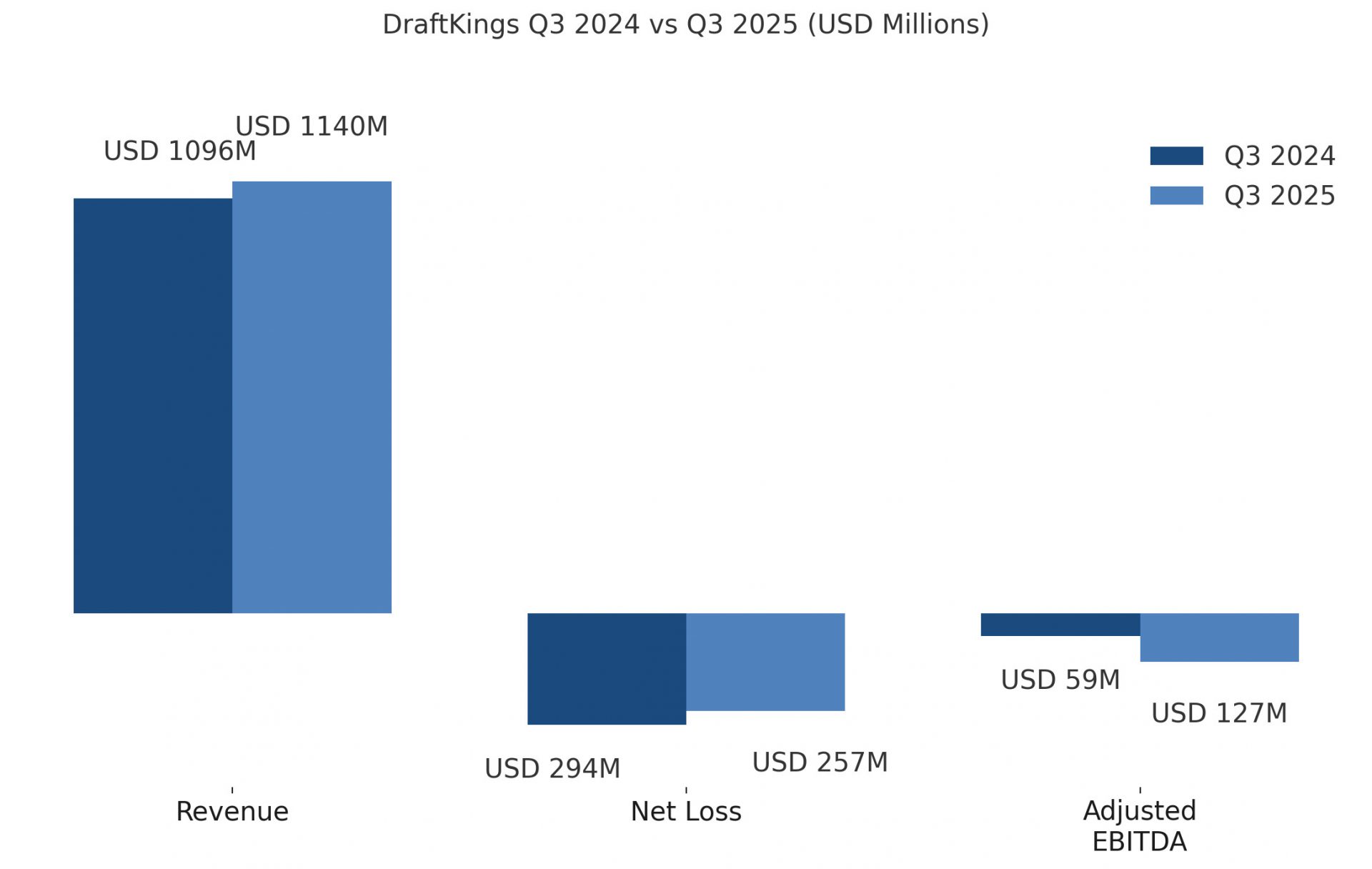

Net loss narrowed to ca. USD 257m (ca. EUR 223m) from ca. USD 294m (ca. EUR 255m) a year ago. Adjusted EBITDA was a loss of ca. USD 127m (ca. EUR 110m) versus ca. USD 59m (ca. EUR 51m) last year, while year-to-date adjusted EBITDA stood at ca. USD 277m (ca. EUR 240m). Operating cash flow for the first nine months reached ca USD 342m (ca. EUR 297m).

The company raised its full-year 2025 guidance to between USD 5.9bn (ca. EUR 5.1bn) and USD 6.1bn (ca. EUR 5.3bn)in revenue, implying 24%-28% growth. Adjusted EBITDA is now expected at USD 450m-USD550m (ca. EUR 390m – EUR 477m). DraftKings Q3 2025 results also include plans for a new “DraftKings Predictions” product pending regulatory approval.

DraftKings’ sportsbook is live in 25 states plus Washington D.C., covering 49% of the U.S. population, with iGaming active in five states. CEO Jason Robins said he was “the most bullish I have ever felt about our future,” pointing to handle growth, parlay expansion and a USD 2bn (ca. EUR 1.7bn) share buyback programme.

Please find more news here.