Scout Gaming – Three months of trading can shift quickly, and this quarter shows that clearly. The company’s update highlights a softer top line and the impact of write-downs. The Q3 2025 results also contrast sharply with the healthier year-to-date numbers.

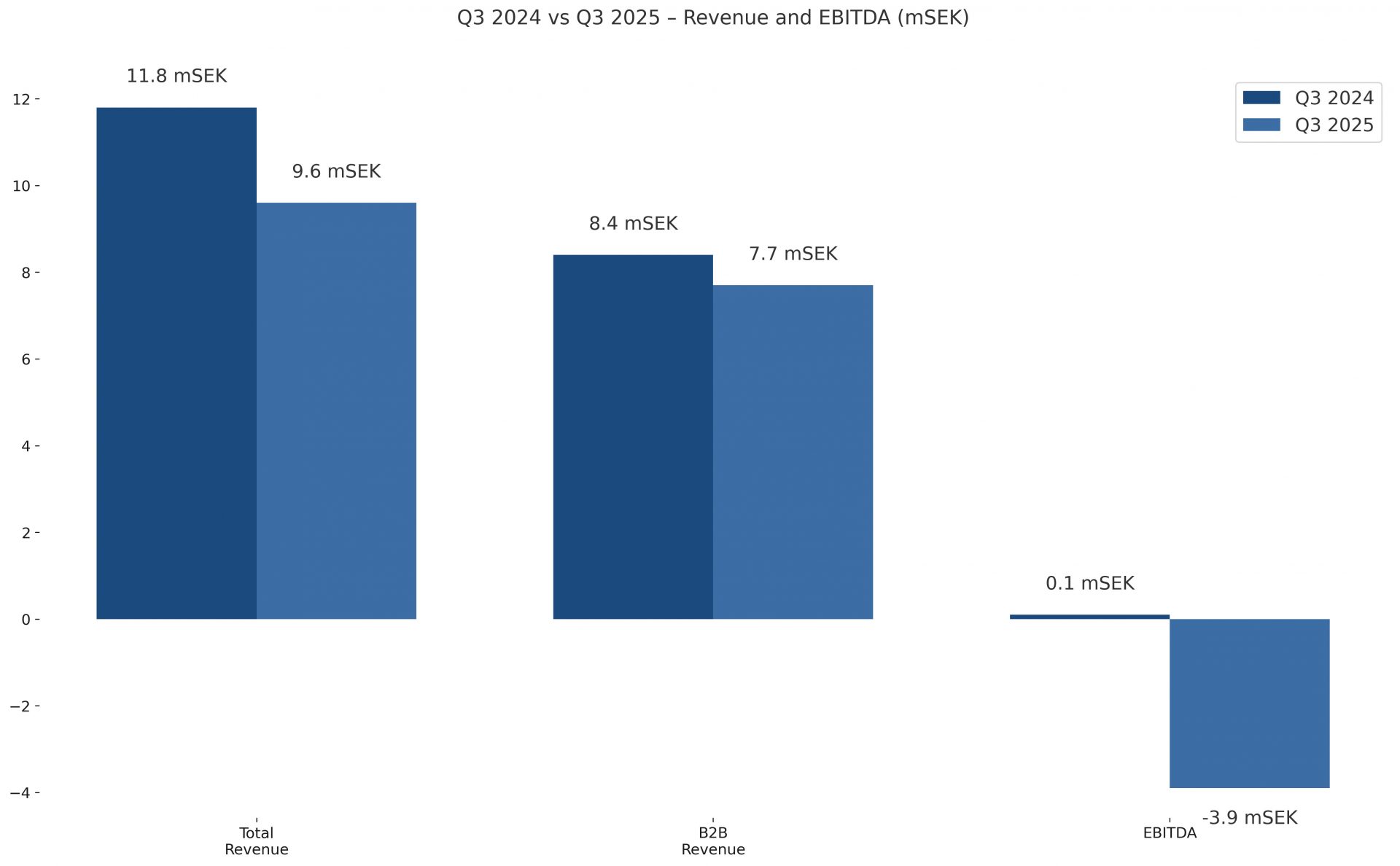

Total revenues came in at SEK 9.6m (ca. EUR 0.9m) compared with SEK 11.8m (ca. EUR 1.1m), a 19% drop, reflecting declines in B2B, B2C and other income; the Q3 2025 results highlight variance between quarterly and year-to-date trends. B2B remained the main contributor despite a 9% fall to SEK 7.7m (ca. EUR 0.7m). Management pointed to the sharp fall in other revenues as a key quarterly swing factor.

B2C revenues closed at SEK 1.6m (ca. EUR 0.15m) versus SEK 1.7m (ca. EUR 0.16m), a 7% decrease, showing softer customer activity; yet the Q3 2025 results differ from the nine-month view, where B2C is up 6%. Other revenues dropped 80% to SEK 0.4m (ca. EUR 0.04m) after a strong comparison period.

Quarterly EBITDA in Q3 2025 landed at SEK -3.9m (ca. EUR -0.34m) with a net result at SEK -4.7m (ca. EUR 0.43m; Year-to-date EBITDA stood at SEK -5.1 (ca. EUR -0.47m), down from SEK -3.6m (ca. EUR -0.33m).

For January – September 2025, total revenues increased 10% to SEK 33.8m (ca. EUR 3.1m) from SEK 30.9 (ca. EUR 2.8m), supported by 10% B2B growth to SEK 25.5m (ca. EUR xm) and 12% growth in other revenues to SEK 3.5m (ca. EUR 2.3m). The company also reported B2C revenue of SEK 4.9m (ca. EUR 0.45m) for the period, up from SEK 4.6m (ca. EUR 0.42m). As the CEO noted, “Our year-to-date revenue trend remains intact despite a softer third quarter.”

- Scout Gaming – being listed – is primarily a B2B fantasy sports and gaming provider offering fantasy sports platforms, pooled betting products and related technology to operators. While it has had some B2C activity, this is small-scale and not comparable to a full commercial operator. The company is licensed in Malta and UK with multiple certifications in US states and also Greece.

Please find more news here.