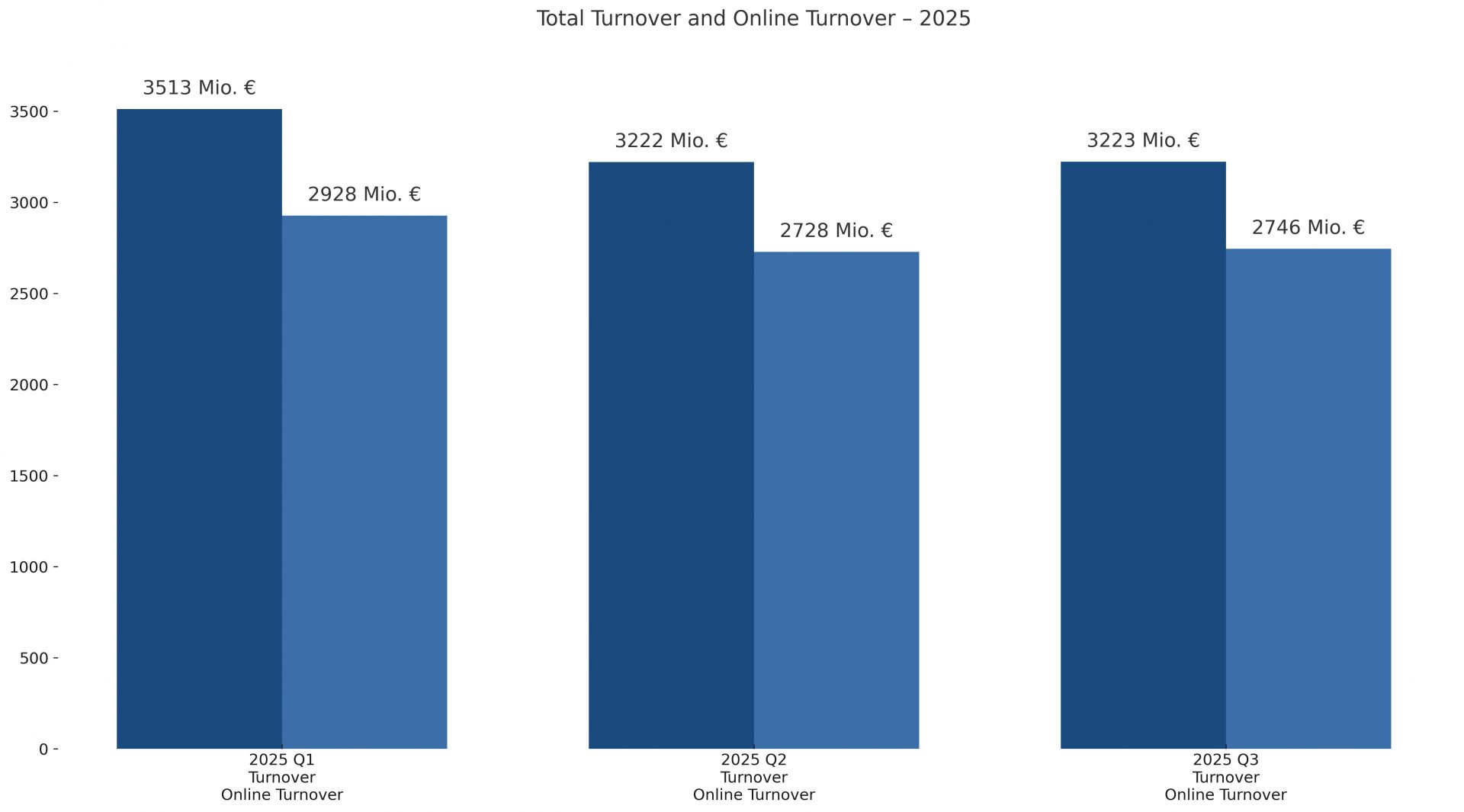

Three months into the latest reporting cycle, data published by Germany’s gambling regulator (Gemeinsame Glücksspielbehörde der Länder or short GGL) shows a market that has cooled since Q1 but levelled out in Q3 2025. Operators reported a slight uptick after a sharp Q2 drop, with virtual slots again the most stable vertical. Germany’s gambling stakes remain dominated by online channels, which saw a modest recovery – see more details:

• Total gambling stakes/turnover (online+offline) reached EUR 3.22bn in Q3 2025 after a steep Q2 decline (without lotteries). The quarter-to-quarter change was flat, with a +0.03% shift from Q2. Online stakes accounted for EUR 2.75bn, marking a +0.7% increase from the previous quarter.

• Sports betting (retail and online combined) slowed again in Q3 2025 with EUR 1.88bn in stakes, down –0.5% from Q2. Online betting accounted ca. EUR 1.4 bn in Q3 2025, thus reflecting the biggest market share (ca. 43%).

• Virtual slots grew for the second consecutive quarter, ending Q3 2025 at EUR 1.12bn. The quarter-to-quarter uplift of +0.5% follows a +1.5% rise in Q2. This segment now represents the most consistent part of the Germany gambling stakes market (ca. 35% of total turnover).

• Online poker saw a minor rebound with EUR 192m in Q3 2025, up +1.1% from Q2. The recovery follows a –9.5% dip earlier in the year. Activity remains below Q1 but shows stabilisation heading into Q4.

• Horse betting online rose again to EUR 33m in Q3 2025, a +3.1% increase versus Q2. This follows a strong Q2 jump of +28%. Although small in absolute size, the segment continues to show steady user engagement.

Please find more news here.