Spain’s online gambling market stayed on a growth path in Q3 2025, even as momentum eased compared with earlier in the year according to quarterly figures published by the Spanish General Directorate for Gambling Regulation (DGOJ). The latest figures show Spain online gambling continuing to deliver higher revenue and player spending than a year ago. At the same time, the data reflects a market that is settling into a more mature phase.

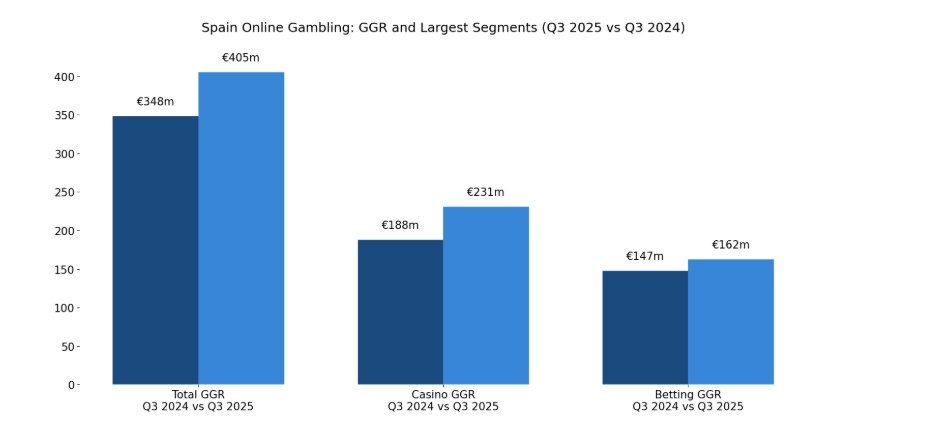

Total deposits came in at EUR 1.35bn, up 18.2% year-on-year, while GGR rose 16.5% to EUR 405.4m. Turnover increased to EUR 9.99bn, representing 14.0% annual growth. Withdrawals also climbed to EUR 936.9m, broadly in line with higher player spending.

On a quarter-on-quarter basis, most financial indicators slipped back from Q2 levels. This followed a particularly strong previous quarter rather than any clear change in player behaviour. Year-on-year comparisons remain firmly positive for Spain online gambling.

The number of active accounts reached 1.66 million, a 14.3% increase compared with Q3 2024. Active gamblers rose more slowly, up 6.7% to 1.04 million. This gap suggests operators are getting more activity out of existing customers.

Acquisition remained subdued during the quarter, with new accounts broadly flat year-on-year and new gamblers down 14.5%. Growth in 2025 is coming less from first-time players. Instead, operators are focusing on keeping players active for longer.

Marketing spend totalled EUR 154.8m in Q3, with bonuses and promotions rising sharply to EUR 82.0m, up 23.5%. Affiliate spending also increased strongly, while advertising growth was more modest. As one operator put it, “bonuses are doing more of the heavy lifting than traditional acquisition”.

Casino continued to extend its lead, accounting for 57.0% of total GGR, up from 54.0% a year earlier. Casino GGR grew 22.9% year-on-year, clearly outpacing betting growth of 10.0%. Bingo and contests now make up a very small share of the market.

Slots remained the core casino product, generating around two-thirds of casino GGR. Live roulette followed with roughly a quarter of casino revenue and showed solid year-on-year growth. Other table games continued to play a supporting role.

In betting, live sports retained its dominant position with around 54% of segment GGR. Pre-match betting softened quarter-on-quarter but still delivered year-on-year growth. Exchange and horse betting continued to decline in relative importance.

Poker posted modest GGR growth of 5.8% year-on-year, with tournaments driving most of the increase. Cash games remained stable but showed slower progress. Poker continues to operate as a niche but steady vertical within Spain online gambling.

The data and analysis focuses on online gambling verticals covered by Spain’s gambling regulator, specifically: sports betting, casino, poker, bingo and contests. Lottery products are regulated separately and not included in this report.

Please find more news here.