Betfred 2025 results cover a 78-week reporting period ending 30 March 2025, following a change to the group’s financial year-end . The extended period makes comparisons with the prior year more limited (only 53 weeks comparative period ending October 1, 2023), but headline figures point to higher activity levels. The bookmaker continued to operate across retail and online markets in several regulated jurisdictions – see more details:

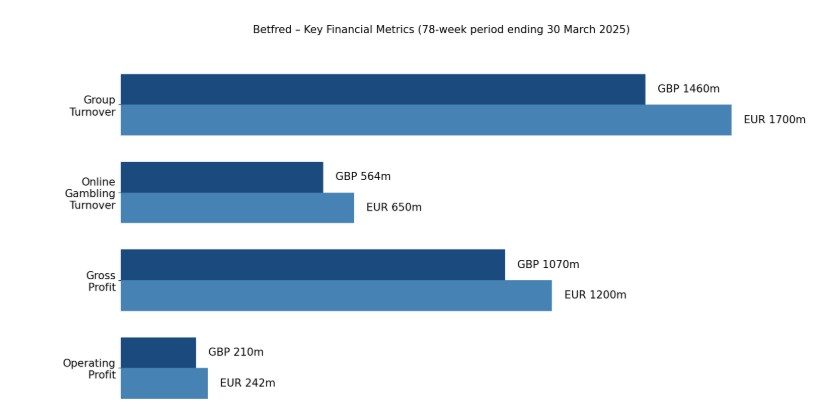

Group turnover rose to GBP 1.46bn (ca. EUR 1.7bn), up from GBP 908.0m (ca. EUR 1.1bn) previously, with retail gambling accounting for GBP 894.8m (ca. EUR 1bn) and online gambling GBP 563.6m (ca. EUR 650m). Gross profit increased to GBP 1.07bn (ca. EUR 1.2bn) over the same period. The company noted that all revenue relates to gambling operations.

Operating profit reached GBP 209.7m (ca. EUR 242m) after exceptional costs of GBP 3.4m (ca. EUR 3.9m), compared with GBP 0.5m (ca. EUR 0.6m) a year earlier. Exceptional items were lower due to reduced impairment charges and fewer onerous contract provisions. The group also exited several unprofitable overseas businesses during the period.

Profit after tax for the period came in at GBP 128.8m (ca. EUR 148.6m), compared with a GBP 71.7m (ca. EUR 83m) loss in the previous reporting period. The group paid an interim dividend of GBP 25.4m (ca. EUR 29m) but did not propose a final dividend. Directors said the longer reporting window was a key factor behind the shift in results.

Betfred continued investment in its online platform, with GBP 88.3m (ca. EUR 102m) in development costs capitalised as intangible assets. The platform went live in December 2023 and was rolled out to existing customers in early 2024.

During the year, the group exited nine US states and completed the disposal of its Spanish online business for GBP 2.0m (ca. EUR 2.3m). It also acquired a South Africa-based investment holding company for GBP 2.0m, supporting its local operations. The acquisition generated goodwill linked to workforce integration and expected cost efficiencies.

Average employee numbers stood at 9,622 during the period, with full-time equivalent staff at 7,872. Total payroll costs increased to GBP 361.6m (ca. EUR 417m), partly reflecting the longer reporting period. A portion of staff costs was capitalised as part of ongoing technology development.

Please find more news here.