Evolution published its financial results for 2025. The year was characterized by regulatory headwinds, currency effects and ongoing security challenges. Despite this, the company continued to expand its global footprint – see more details:

In Q4 2025 net revenues declined 3.7% year-on-year to EUR 514.2m, while total operating revenues fell to EUR 565.9m. Adjusted EBITDA dropped 6.1% to EUR 341.5m, with the margin easing to 66.4%. Profit for the quarter reached EUR 306.8m, compared with EUR 377.1m in the same period last year.

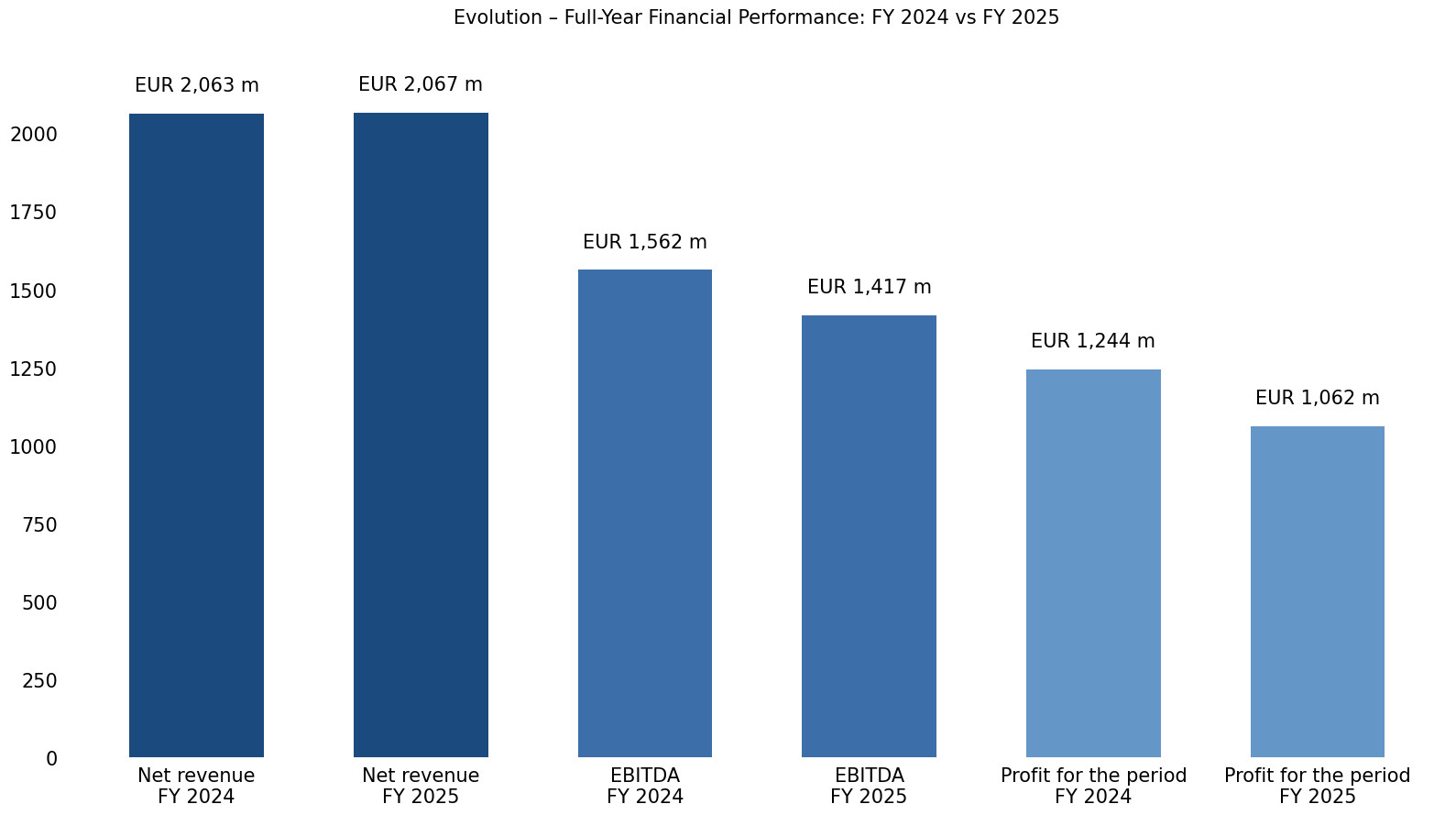

For the full year 2025, net revenues increased slightly by 0.2% to EUR 2.07bn, while total operating revenues declined 4.3% to EUR 2.12bn. Adjusted EBITDA came in at EUR 1.37bn, down 3.2%, with a margin of 66.1%. Profit for the year totalled EUR 1.06bn, compared with EUR 1.24bn in 2024.

CEO Martin Carlesund said constant currency net revenue growth in Q4 2025 was estimated at 4.9%, underlining the impact of foreign exchange on reported figures. He described the year as operationally strong despite the financial outcome. “Overall, we are proud but not happy with 2025,” Carlesund said.

Asia returned to growth in the Q4 2025 after a weaker Q3 2025, which the company linked to progress in addressing cybercriminal activity. Evolution said improvements in the region are gradual and require continued focus. Its studio operations in the Philippines continued to develop during the quarter.

North America recorded steady growth during the period, supported by the re-launch of the Ezugi brand in New Jersey. Latin America also grew year-on-year, with Brazil progressing under new regulation and an additional studio acquired in Argentina. Europe remained under pressure due to regulatory developments, while Africa continued to deliver growth.

Please find more news here.