Caesars Entertainment finished 2025 with slightly higher revenue but a wider net loss. The group pointed to steady land-based trading and a sharp improvement online. Caesars Q4 2025 results show the digital division continuing to reshape the earnings mix – see more details:

Q4 2025 revenue reached USD 2.9bn (ca. EUR 2.5bn) compared with USD 2.8bn (ca. EUR 2.4bn) in Q4 2024 while adjusted EBITDA edged up to USD 901m (ca EUR 762m) from USD 882m (ca. EUR 745m). The company posted a net loss of USD 250m (ca. EUR 212m) for the quarter, versus net income of USD 11m (ca. EUR 9m) a year earlier, as the prior-year period benefited from more than USD 350m (ca. EUR 295m) in asset sale gains.

The digital division showed the clearest growth in Q4 2025 with digital revenue rising by ca. 39% year-on-year to USD 419m (ca. EUR 353m). Adjusted EBITDA for digital business was to USD 85m (ca. EUR 72m), up from USD20m (ca. EUR 18m), marking its strongest quarterly performance to date.

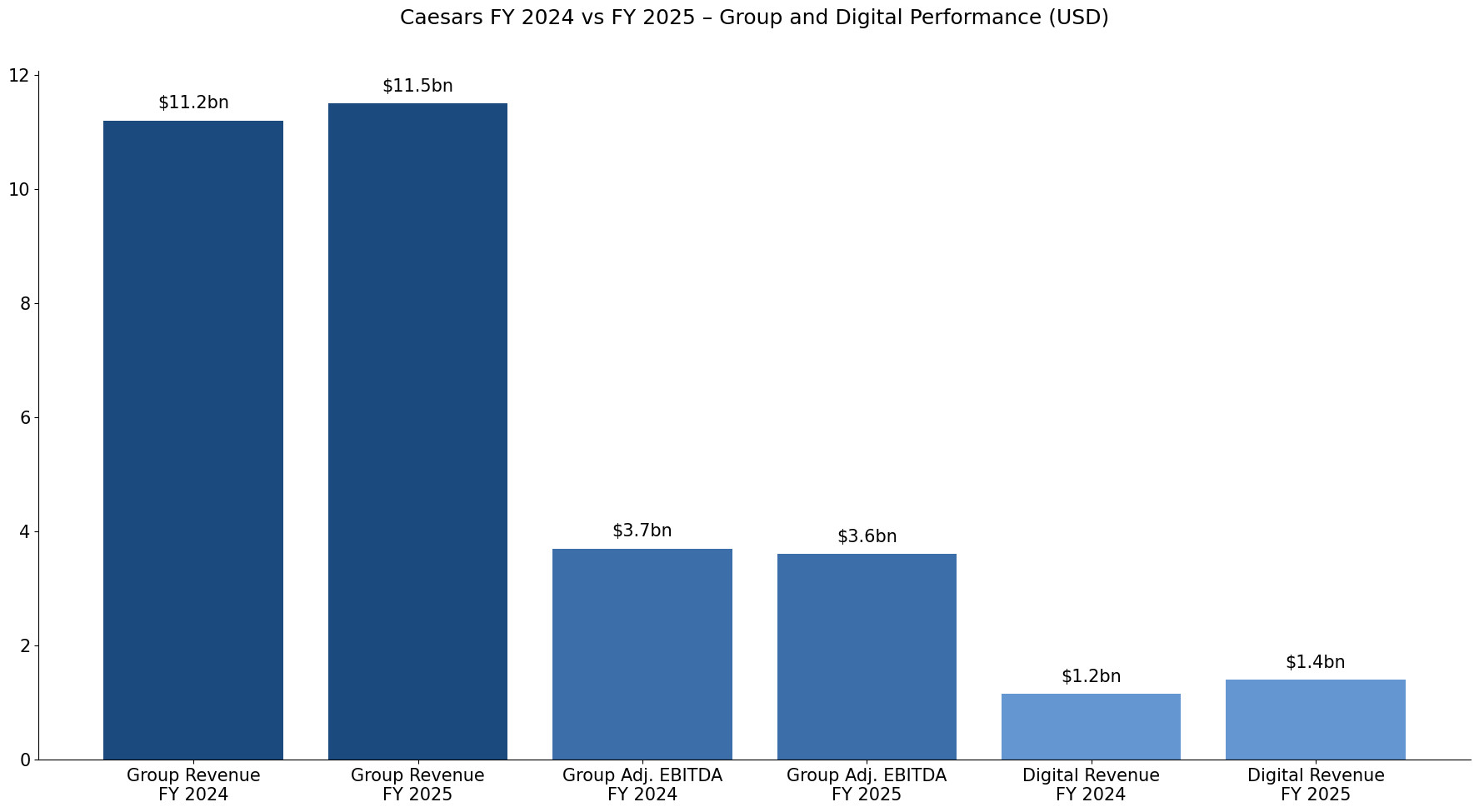

For the full year, revenue totalled USD 11.5bn (ca. EUR 9.7bn), up from USD 11.2bn (ca. EUR 9.5bn) in 2024 while adjusted EBITDA came in at USD 3.6bn (ca. EUR 3bn), slightly below the previous year’s USD 3.7bn (ca. EUR 3.1bn). The group recorded a net loss of USD 502m (ca. EUR 426m), wider than the USD 278m (ca. EUR 235m) loss in 2024, again reflecting the absence of one-off disposal gains.

Segment performance in 2025 for the full year was mixed. Las Vegas revenue declined 4.7% to USD 4bn (ca. EUR 3.4 bn) for the year, while Regional revenue increased 3.9% to USD 5.8bn (ca. EUR 4.9bn). Caesars Digital revenue rose 21.1% to USD1.4bn (ca. EUR 1.2bn), with Digital adjusted EBITDA more than doubling to USD 236m (ca. EUR 200m).

CEO Tom Reeg said: “Fourth quarter consolidated … adjusted EBITDA grew year over year driven by Caesars Digital which set a new quarterly record …” At the end of 2025, total debt stood at USD 11.9bn (ca. EUR 10bn), with net debt at USD 11bn (ca. EUR 10.3bn). The company repurchased 14.7 million shares for USD 420m (ca. EUR 395m) since mid-2024 and expects lower capital spending and interest costs to support cash flow in 2026.

Please find more news here.