Raketech has posted a weaker Q4 2025 as it continues to restructure parts of the business. The Raketech Q4 2025 results underline pressure in SubAffiliation and lower new depositing customer volumes. Management says the group remains focused on its platform-first model and tighter cost control.

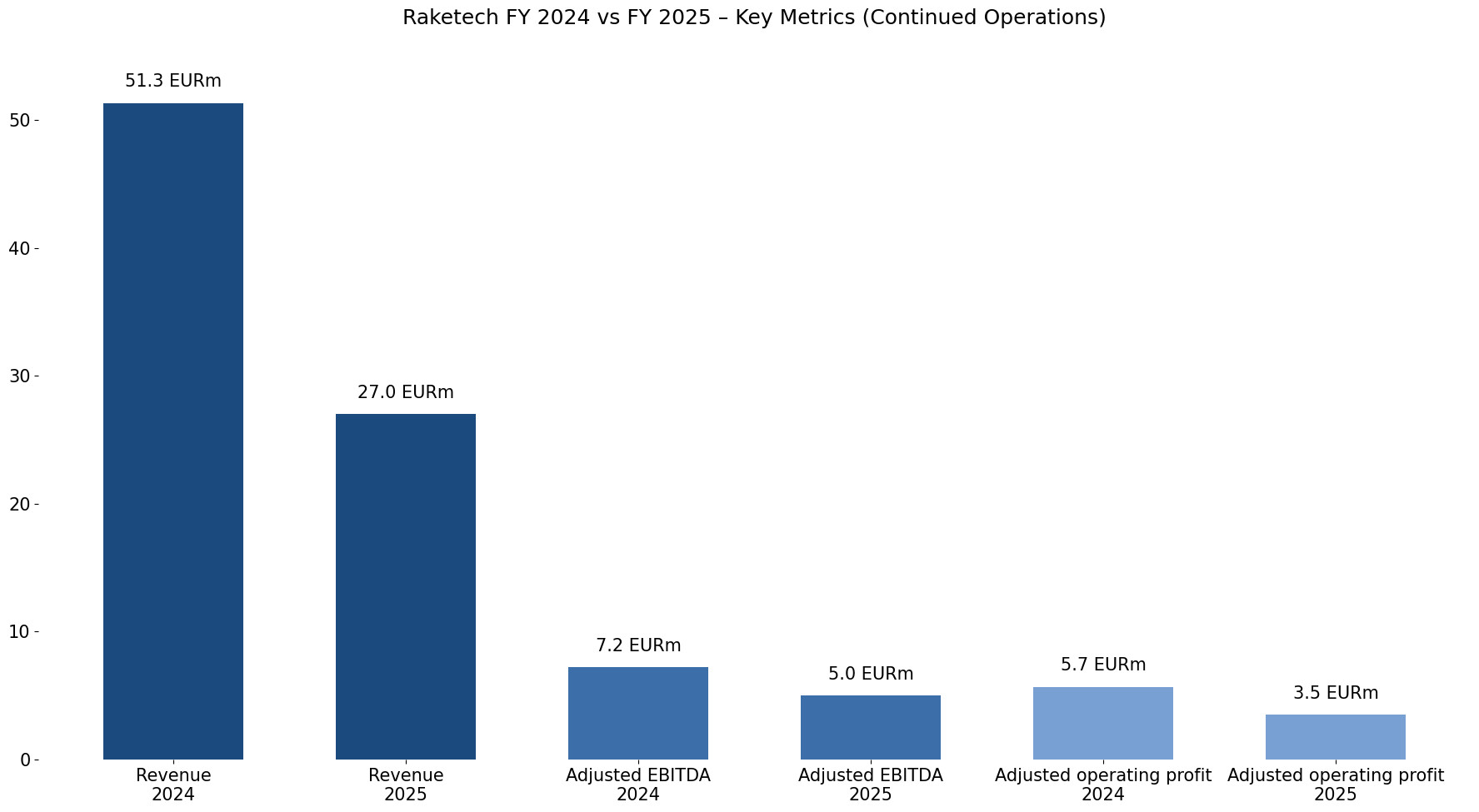

Revenue from continuing operations in Q4 reached EUR 5.7m, down 45.5% year-on-year from EUR 10.5m. For the full year, revenue declined 47.4% to EUR 27m compared with EUR 51.3m in 2024 as result of weaker performance in the Paid Publisher Network within SubAffiliation and lower NDC levels.

Adjusted EBITDA for continuing operations came in at EUR 1.1m in Q4 2025, compared with EUR 1.7m a year earlier. The adjusted EBITDA margin improved to 18.8% from 16.4%, reflecting cost reductions. Reported EBITDA stood at EUR 0.8m for the quarter.

SubAffiliation revenue from continuing operations fell 64.7% year-on-year to EUR 1.8m. The company has stopped onboarding new paid publishers and is phasing out the remaining Paid Network. At the same time, the external Organic Publisher Network delivered quarter-on-quarter growth, partly offsetting the decline.

Affiliation Marketing revenue, covering Raketech-owned publishers, totalled EUR 3.9m in Q4, down 17.4% year-on-year. Performance improved toward the end of the quarter following a positive Google Core Update across Nordic assets. CEO Johan Svensson said: “With disciplined execution and a continued shift toward growing the Organic Publisher Network, we are strengthening the foundations for long-term value creation.”

During the quarter, Raketech finalised the divestment of its Casumba assets, booking a EUR 10.1m loss in discontinued operations. The fixed consideration of EUR 12.0m will be paid in instalments through December 2029, with a carrying value of EUR 7.2m at year-end. The Raketech Q4 2025 results also show net interest-bearing debt of EUR 21.6m as of 31 December 2025.

Please find more news here.