Acroud Q2 2025 results are in, showing the business is starting to benefit from its recent restructuring moves. The company reported its strongest-ever quarterly revenue, while both iGaming affiliation and SaaS operations saw solid momentum. Management says the focus now is on efficiency and executing in its core markets.

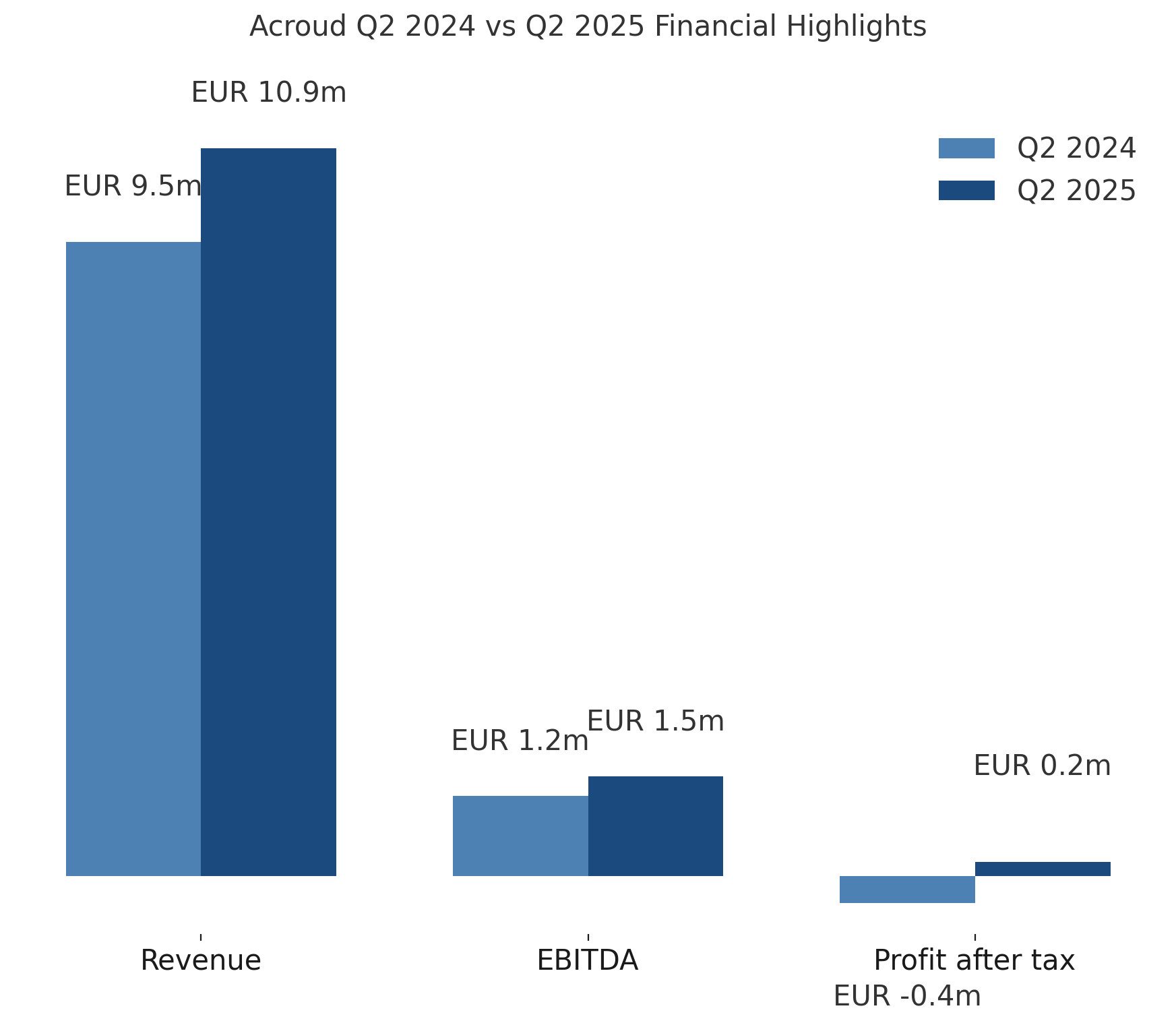

Revenue hit EUR 10.9m in Q2 2025, up 15% from last year and the highest quarterly figure in Acroud’s history. EBITDA came in at EUR 1.5m, improving both year-on-year and quarter-on-quarter. Profit after tax reached EUR 218k compared with a loss in the prior year.

New depositing customers reached 48,802, marking a 7% increase year-on-year but falling 33% compared to Q1. Operating cash flow landed at EUR 1.05m, just ahead of last year’s EUR 1.01m. The company highlighted a stronger balance sheet following its Q1 debt restructuring.

In iGaming affiliation, Acroud rebounded after a slow Q1, with Brazil standing out as a growth driver despite regulatory hurdles. Gaming activity has picked up in the market, suggesting the earlier slowdown was a temporary adjustment. The company said this segment is central to its long-term strategy.

SaaS operations also posted strong growth, with revenue reaching EUR 6.4m, up 15% year-on-year and 12% on Q1. Subscription revenues climbed 30% year-on-year, while network model revenue surged 54%. The segment continues to break records for Acroud in 2025.

During the quarter, Acroud’s AGM approved 2024 accounts and elected a new chairman, Morten Marcussen. After the period, Mikael Strunge was appointed as the new President and CEO. Strunge commented: “Q2 2025 was a showcase of what Acroud can achieve when we execute with discipline and commitment”.

Please find more news here.