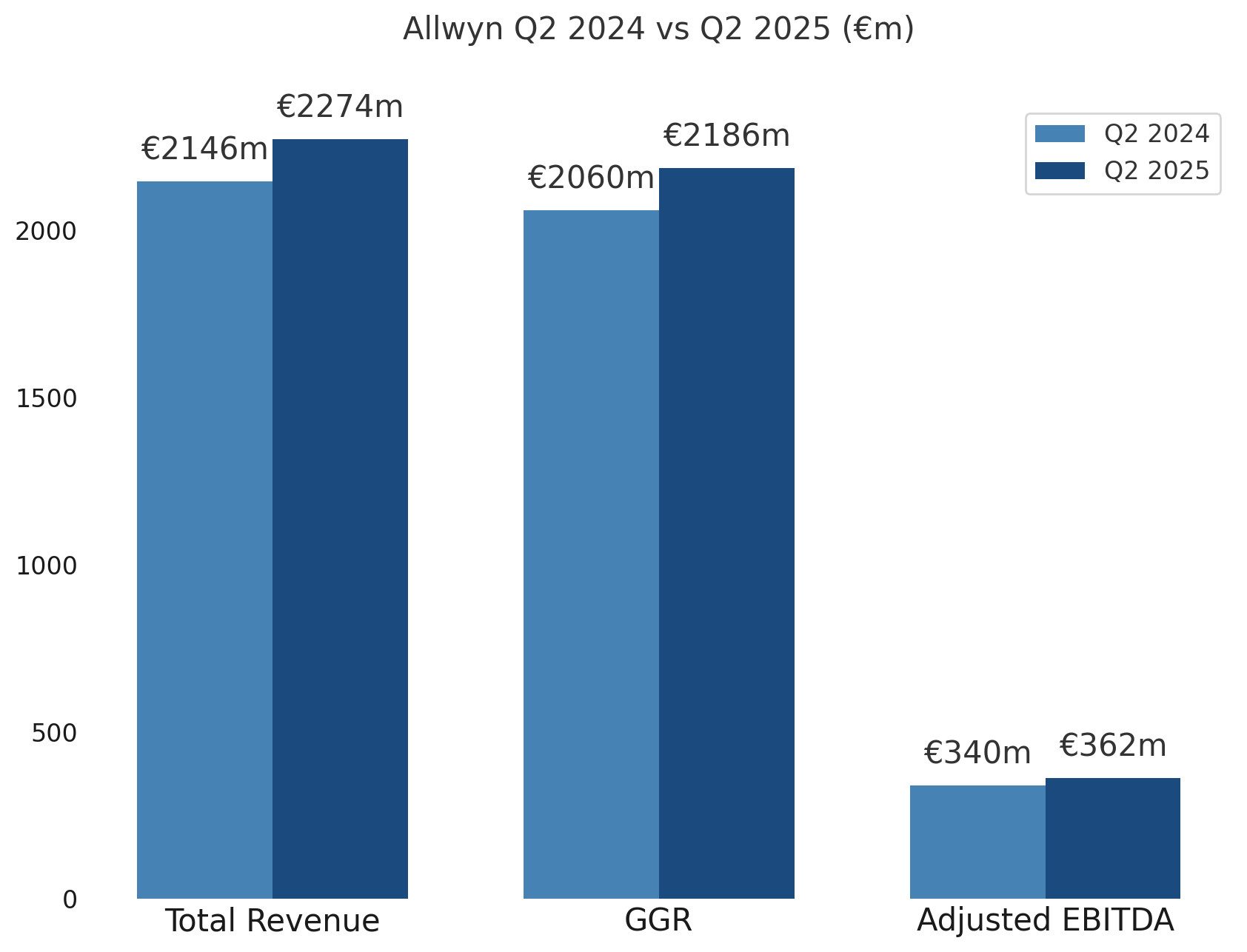

Three months to 30 June brought steady growth for Allwyn. The group reported growth across most markets and product lines. The Allwyn Q2 2025 results headline figure appears in both revenue and EBITDA.

Total revenue came in at €2,274m, up 6% year-on-year; on a like-for-like basis excluding a prior-year UK one-off, growth was 9%. Adjusted EBITDA was €362m, also up 6%, implying a 36.4% margin. Net debt to adjusted EBITDA stood at 2.3x at 30 June.

Online continued to expand, with digital GGR up 16% year-on-year to 42% of group GGR, a four-point rise. Numerical lotteries led product growth at +8% GGR, with iGaming +13%; sports betting dipped 2%.

By market, the UK grew 7% reported—or 14% on an adjusted, constant-currency basis—helped by EuroMillions jackpots and instant win launches. Austria and Greece & Cyprus delivered solid gains; the Czech Republic posted strong top-line but lower EBITDA after higher marketing and donations.

Italy’s LottoItalia consortium was formally awarded the next Lotto licence to November 2034; Allwyn owns 32.5%. The consortium paid the first €500m instalment in July; Allwyn will fund its pro-rata share of the €2.23bn fee and related capex across staged payments. Italy’s equity-accounted EBITDA contribution was €99m in Q2.

Financing was overhauled with a new €2.15bn Senior Facilities Agreement at lower margins and the issue of €600m 4.125% senior secured notes due 2031. Proceeds refinanced nearer-term notes and loans, extending maturities and reducing cost of funds. All revolving credit facilities in Austria and the UK were undrawn at quarter-end.

Portfolio changes included acquiring 25.1% of Germany’s Next Lotto GmbH, selling 10 casinos in Lower Saxony for €68m gross proceeds, and agreeing to sell the Australian Reef Casino Trust stake, with completion targeted in H1 2026. In Greece, OPAP moved to 100% of Stoiximan after buying the remaining 15.51% for €201m.

CEO Robert Chvátal said the business “delivered another quarter of strong financial performance,” highlighting UK digital progress and balance sheet actions. He added that the large UK systems transition “was one of the largest lottery transitions ever delivered.” The company also noted resilient demand despite macro uncertainty.

Ownership changes saw J&T ARCH acquire a 4.27% stake in August for €500m from KKCG’s Allwyn AG; KKCG retains 95.73%. A €230m loan receivable from Allwyn AG was waived in connection with this transaction.

Please find more news here.