Bally’s Q2 2025 results are in, and the numbers show the company is holding its ground. The mix of new property integrations, steady online growth and a big strategic deal made for a busy quarter. Casinos and resorts led the charge, but interactive gaming also pulled its weight.

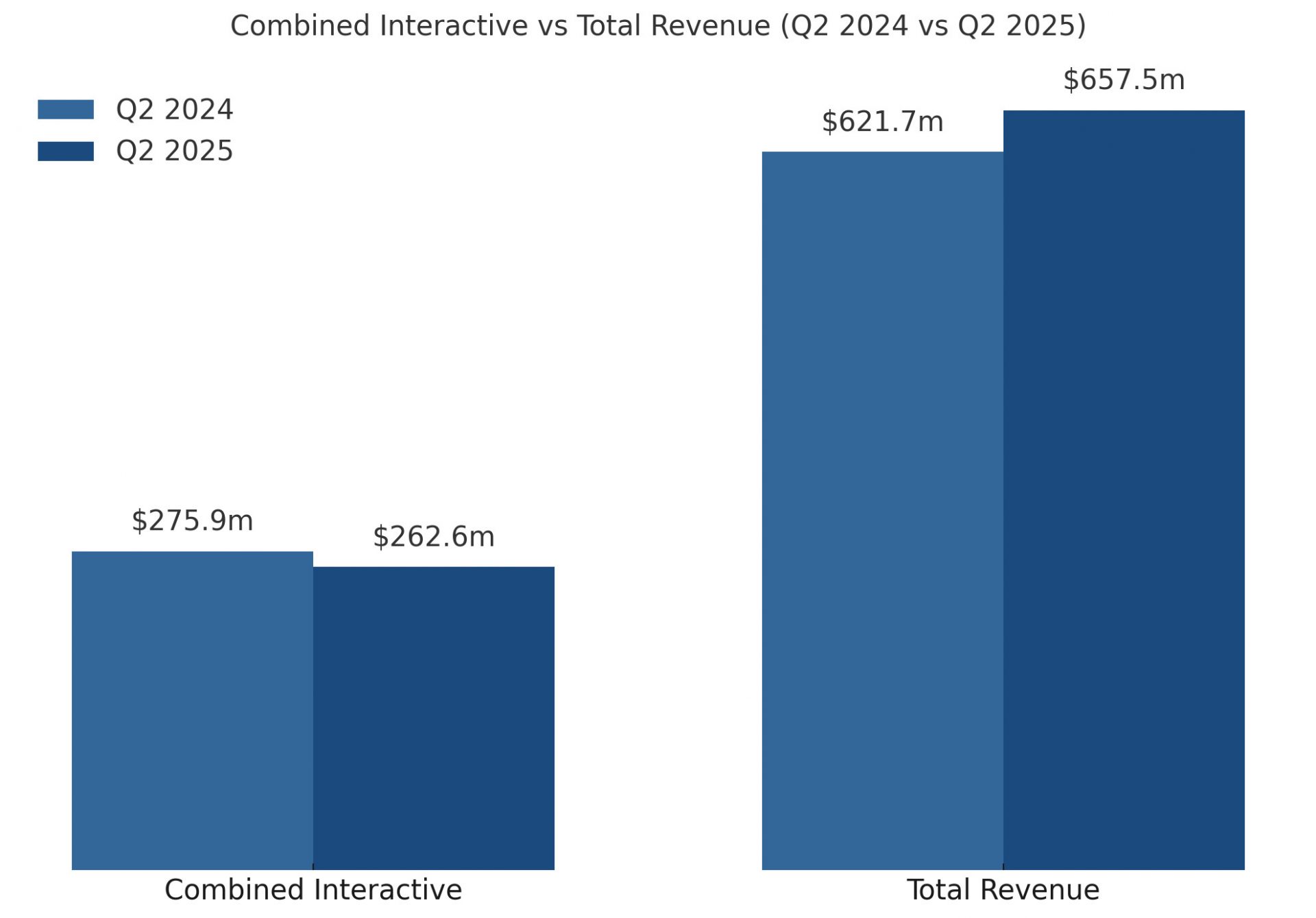

Bally’s booked $657.5m in total revenue for the quarter, a 5.8% lift from last year. Casinos and resorts brought in $393.3m, helped by the four new regional properties folded in from the Queen Casino & Entertainment deal earlier this year. Segment adjusted EBITDAR came in at $106m, up 6.2%.

International Interactive revenue landed at $206.1m, down 10.2% because of last year’s Asia business sale. Strip that out, and the segment actually grew 10%, powered by 8.8% growth in UK online and strong results in Spain. Adjusted EBITDAR ticked up 1.1% to $82.2m.

North America Interactive posted $56.5m in revenue, a 21.5% jump year-on-year. Gains came from both the Queen integration and growth in iGaming and online sports betting. The segment swung to a $2.5m profit from a $2.2m loss last year, with BallyBet now live in 13 states plus Ontario.

In July, Bally’s unveiled a €2.7bn agreement to sell its International Interactive arm to Intralot S.A., made up of €1.53bn cash and €1.14bn in stock. The deal will make Bally’s the majority shareholder in Intralot, with cash proceeds aimed at boosting liquidity and paying down 2028 debt.

The company’s $4bn plan for a casino and resort in the Bronx is still on the table, pending a NYC gaming licence. CEO Robeson Reeves said the project could be “the largest private investment in the borough’s history” and a driver for jobs and economic activity.

Bally’s is also moving into Australia with an AUD $200m investment in Star Entertainment Group. Shareholders signed off on the deal in June, giving Bally’s a foothold in Sydney, Brisbane and the Gold Coast.

Please find more news here.