BetMGM Q3 2025 results show the Entain–MGM joint venture continuing its strong run through the second half of the year. The company posted higher revenue, stronger margins, and a sharp turnaround in EBITDA. Backed by a refined player engagement strategy and upgraded sportsbook and iGaming platforms, BetMGM is raising its full-year targets once again.

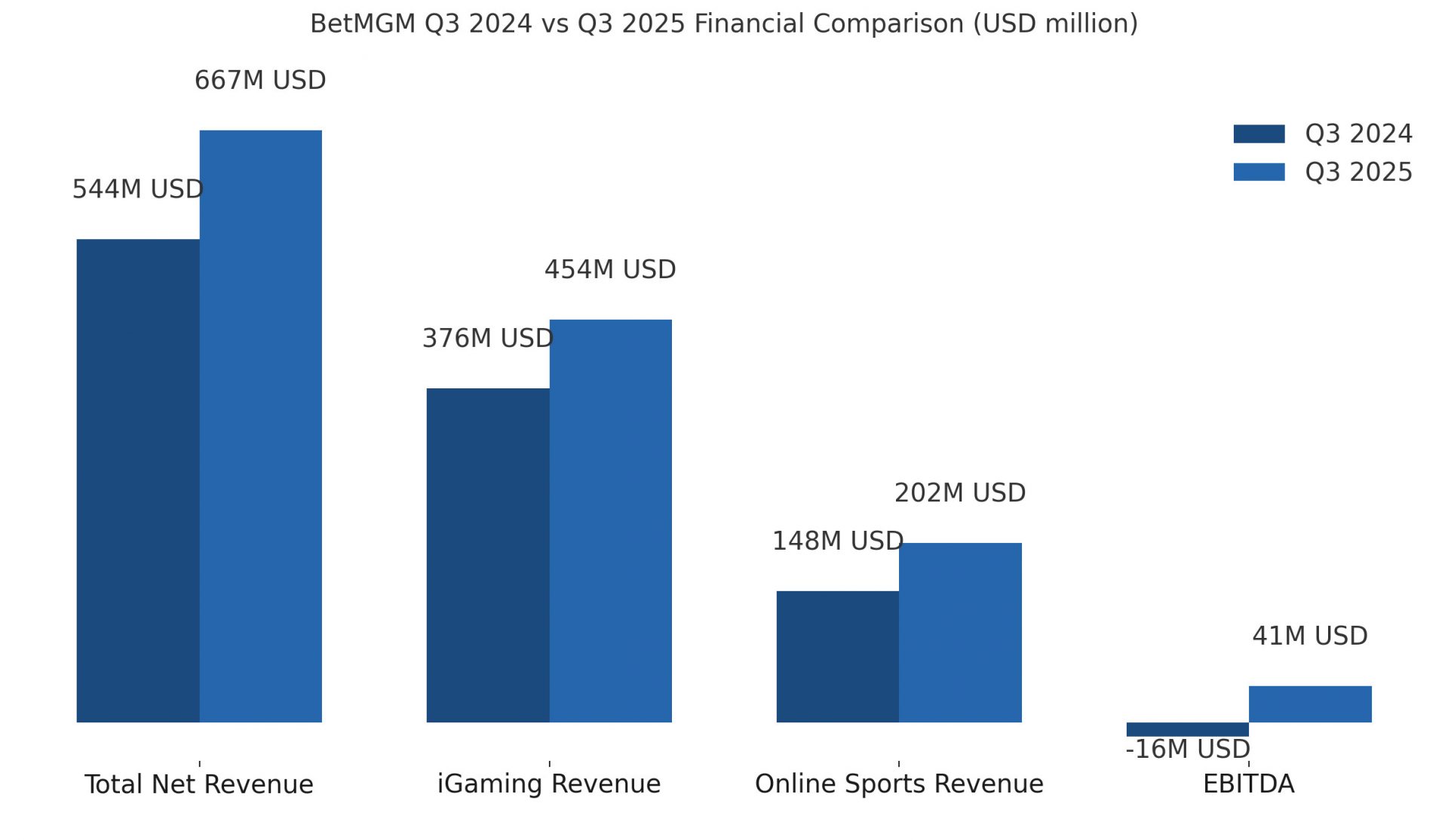

Total Q3 net revenue hit USD 667 million (ca. EUR 574 million), up 23% year-on-year, while year-to-date revenue climbed to USD 2 billion (ca. EUR 1.7 billion), up 31%. Both iGaming and sports betting contributed to the gains, with growth driven by product upgrades and stronger player retention.

Q3 2025 iGaming revenue rose 21% to US 454 million (ca. EUR 391 million), underlining BetMGM’s market-leading position in regulated states. The company highlighted exclusive game launches such as The Wizard of Oz and The Price Is Right titles, boosting player activity by 21% in the quarter.

Q3 2025 online sports revenue grew 36% to USD 202 million (ca. EUR 174 million), supported by improved app design, live same-game parlays, and cashout features. Player handle increased 13% to USD 3.16 billion (ca. EUR 2.72 billion) , while NGR (Net Gaming Revenue) per active jumped 49% year-on-year.

BetMGM delivered EBITDA of USD 41 million (ca. EUR 35 million) in Q3 2025, up from a loss of USD 16 million (ca. EUR 14 million) in Q3 2024. Year-to-date EBITDA reached USD 150 million (ca. EUR 129 million), reflecting disciplined spending, better margins, and gains from both iGaming and sports.

The company maintained a 15% GGR share across active markets, including 21% in iGaming and 8% in online sports. Average monthly actives rose 6% year-on-year to 902,000 in Q3 2025.

Following its stronger performance, BetMGM raised FY25 guidance to at least USD 2.75 billion (ca. EUR 2.37 billion) in net revenue and around USD 200 million (ca. EUR 172 million) in EBITDA. Contribution is expected to exceed USD 500 million (ca. EUR 430 million) for the year, with both verticals in positive territory.

BetMGM plans to return at least USD 200 million to Entain and MGM Resorts by the end of 2025, marking the first time it will distribute excess cash to its parent companies. The operator expects to maintain at least USD 100 million (ca. EUR 86 million) in unrestricted cash and has access to an undrawn USD 150 million (ca. EUR 129 million) credit facility.

CEO Adam Greenblatt said BetMGM’s momentum “reflects the consistent execution of our strategic plan” and that the company is “healthier than it has ever been,” setting up for further growth into 2026.

Please find more news here.