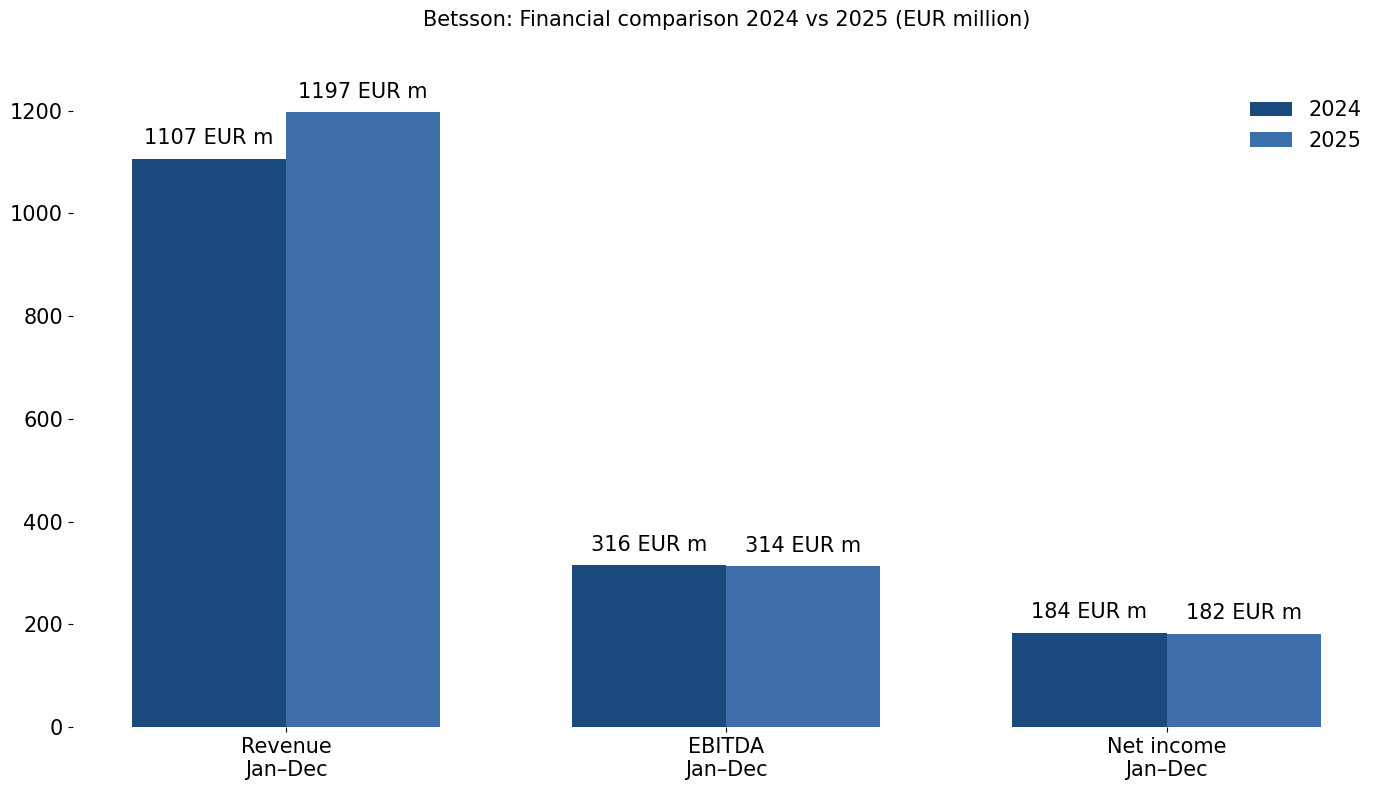

Betsson finished 2025 with higher annual revenue while Q4 2025 results showed clear differences in performance across regions and products – see more details:

Full-year group revenue was ca. EUR 1.2bn, up 8% compared to 2024 while EBITDA slipped slightly to ca. EUR 314 m, down 1% year-on-year. Operating income edged lower to ca. EUR 253m.

Revenue in Q4 2025 declined 1% to almost EUR 304m, while EBITDA dropped 20% to around EUR 69m. Operating income fell 24% to ca. EUR 53m. Betsson said higher gaming taxes and rising personnel costs had a clear impact on quarterly profitability.

Casino continued to carry the business, with Q4 2025 revenue rising 3% to almost EUR 220m and accounting for 72% of total group revenue. Sportsbook revenue fell 9% to around EUR 83m, while the sportsbook margin after free bets declined to 8.8%. Lower betting activity, particularly in Nordic markets, contributed to the year-on-year drop.

Active customers increased 5% year-on-year to around 1.4 million by the end of December, even as deposits fell 6% to around EUR 1.5bn. Western Europe and Latin America delivered growth during the quarter, while the Nordics and CEECA saw declines. Revenue from locally regulated markets rose to a record 68% of group revenue.

B2B licence revenue dropped to ca. EUR 71m in Q4 2025, mainly due to lower activity from one customer compared to last year. The board proposed an ordinary dividend of EUR 0.66 per share for 2025 and continued its EUR 40m share buyback programme. CEO Pontus Lindwall said: “Lower B2B revenue, higher gaming taxes and continued investments in product and technology had a negative impact on profitability in the quarter.”

Please find more news here.