Better Collective Q2 results show a company navigating tough comparisons and regulatory headwinds. Revenue slipped year-on-year, but the group’s cost cuts and recurring revenue streams played a stabilising role. The quarter also saw growth in esports and paid media despite lower new depositing customer volumes.

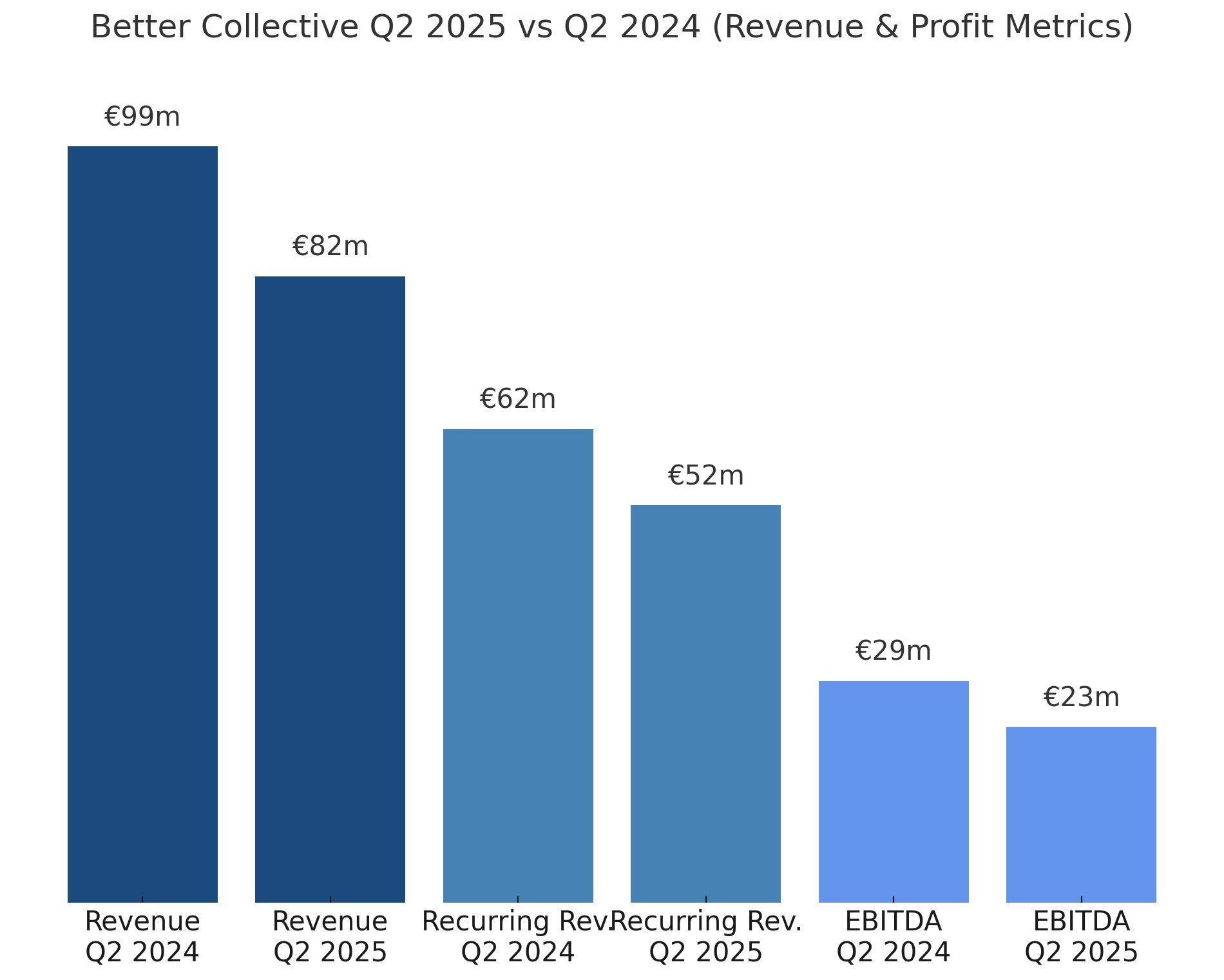

Revenue came in at €82m, down 18% compared to Q2 2024. Organic growth fell 19%, mainly due to Brazil’s regulatory shift and no major tournaments this year. North America revenue dropped €8m, though revenue-share income rose 7% from US partners.

Recurring revenue reached €52m, representing 64% of total revenue. This was down 15% year-on-year, largely tied to a 15% fall in revenue share from Brazil. Subscription income, however, grew 8%, supported by community-led platforms in North America.

EBITDA before special items stood at €23m, a 21% decline from last year. That translated to a margin of 28%, reflecting both lower top-line and cost savings achieved through restructuring.

Group costs fell by €12m versus last year, aligning with Better Collective’s cost efficiency program that targets €50m in annual savings. Most of these savings came from the Publishing segment, with further efficiencies reinvested to support growth.

Esports was reported separately for the first time, generating €5m in Q2 2025 compared to €20m for all of 2024. Platforms HLTV and FUTBIN remained the division’s key drivers, and sponsorship revenue rose 28%, highlighting brand demand.

Paid Media revenue slipped 10% to €25m, mostly due to Brazil’s regulatory changes. CPA income, however, grew 6% as the business continues to push for long-term revenue share contributions.

Publishing revenue dropped 22% to €52m, hit by weaker Brazil and US performance. Subscription income rose 15%, but CPA fell sharply, down 71% from last year’s Euro 2024 and Copa América boost.

New depositing customers dropped to 300,000 from 501,000 last year, heavily influenced by Brazil’s ban on welcome bonuses. Still, the “Value of Deposits” metric improved, showing higher quality traffic and player value despite fewer sign-ups.

Free cash flow was €13m in Q2, with €21m year-to-date. The company maintained guidance for €55-75m free cash flow in 2025 and confirmed its €320-350m revenue outlook for the year.

The board intends to launch a new €20m share buyback program once the current one concludes, continuing its shareholder return strategy.

Please find more news here.