Bragg Gaming revenue picked up in Q2 2025, climbing to €26.1m despite tougher market conditions and rising gaming taxes in key regions. That’s a 4.9% lift on last year, with even stronger growth when The Netherlands is taken out of the equation. The company says it’s zeroing in on cash flow, tighter integration, and margin gains instead of chasing fast top-line growth.

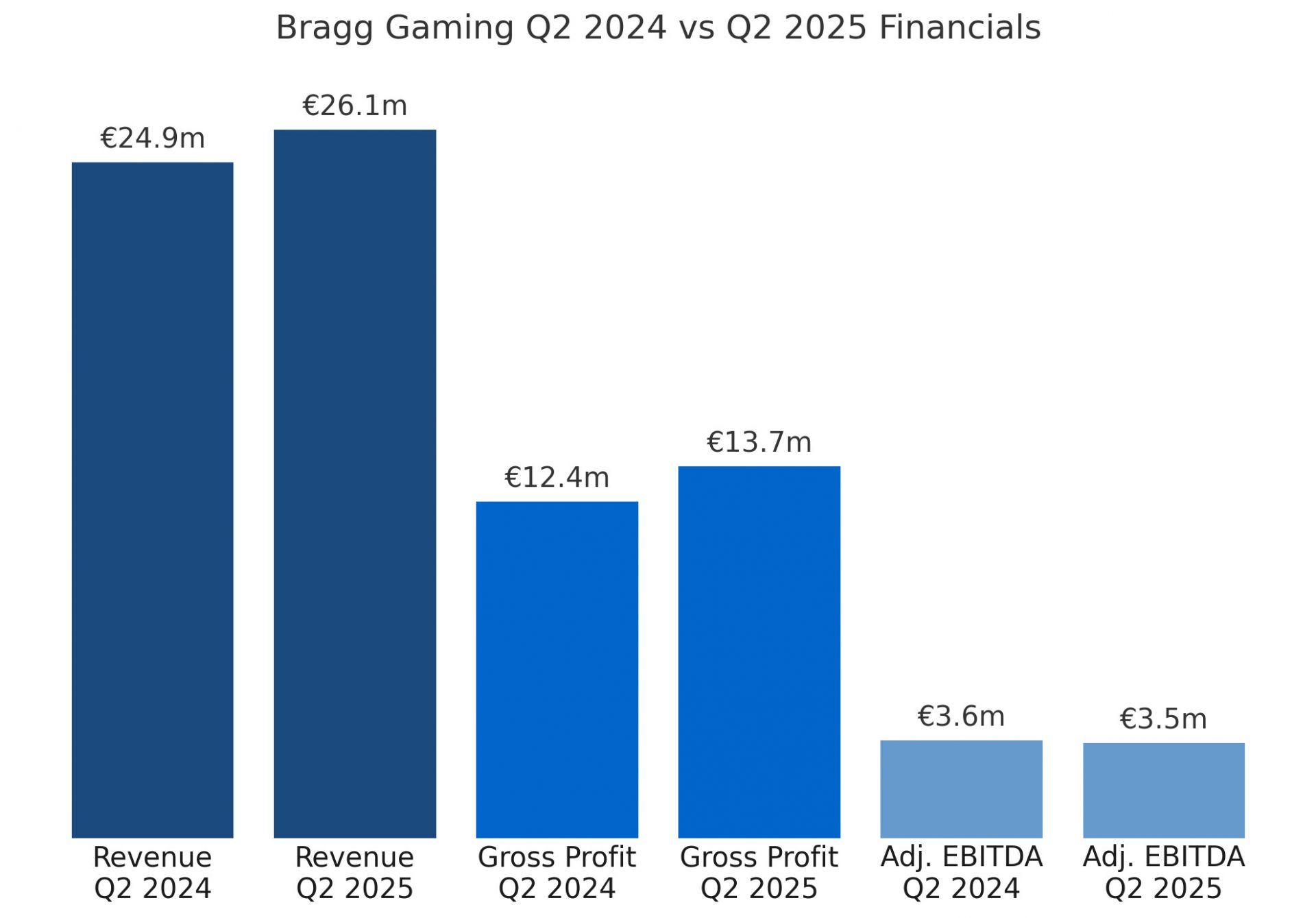

Revenue for the quarter hit €26.1m, up from €24.9m a year earlier. Without The Netherlands in the mix, growth came in at 21% year-on-year. Proprietary content sales were a standout, jumping 44%, driven mainly by expansion in the U.S. and Latin America.

Gross profit rose to €13.7m from €12.4m, pushing gross margin up 280 basis points to 52.7%. Adjusted EBITDA slipped slightly to €3.5m from €3.6m, with the margin easing from 14.5% to 13.3%.

CEO Matevž Mazij said Bragg has “optimized our cost structure and implemented strategies to leverage synergies from acquisitions” such as Spin Games and Wild Streak Gaming. Around €2m in annualised synergies have already been realised, with more expected in the second half.

The company widened its U.S. footprint, rolling out games with Fanatics Casino across the Tri-State area. It also signed an exclusive content development deal with Hard Rock Digital, adding another push in the U.S. proprietary content strategy.

In Brazil, Bragg boosted its presence through a partnership and investment in local studio RapidPlay. The move comes as the market brings in new gaming taxes, which the company factored into its updated outlook for 2025.

On the product side, Bragg launched Big Ticket Bonanza, a gamification feature designed to lift player engagement. Leadership hires included Luka Pataky as EVP of AI and Innovation, and Scott Milford as EVP of Group Content.

Debt repayments included $5m of a $7m secured promissory note, with the maturity extended to September 15, 2025. Talks are ongoing with a Tier 1 Canadian bank to finalise a new revolving credit facility.

Full-year 2025 guidance now points to revenue between €106.0m and €108.5m, and Adjusted EBITDA of €16.5m to €18.5m. Bragg aims to hit a 20% Adjusted EBITDA margin in the second half, reflecting its focus on higher-margin earnings and leaner operations.

Please find more news here.