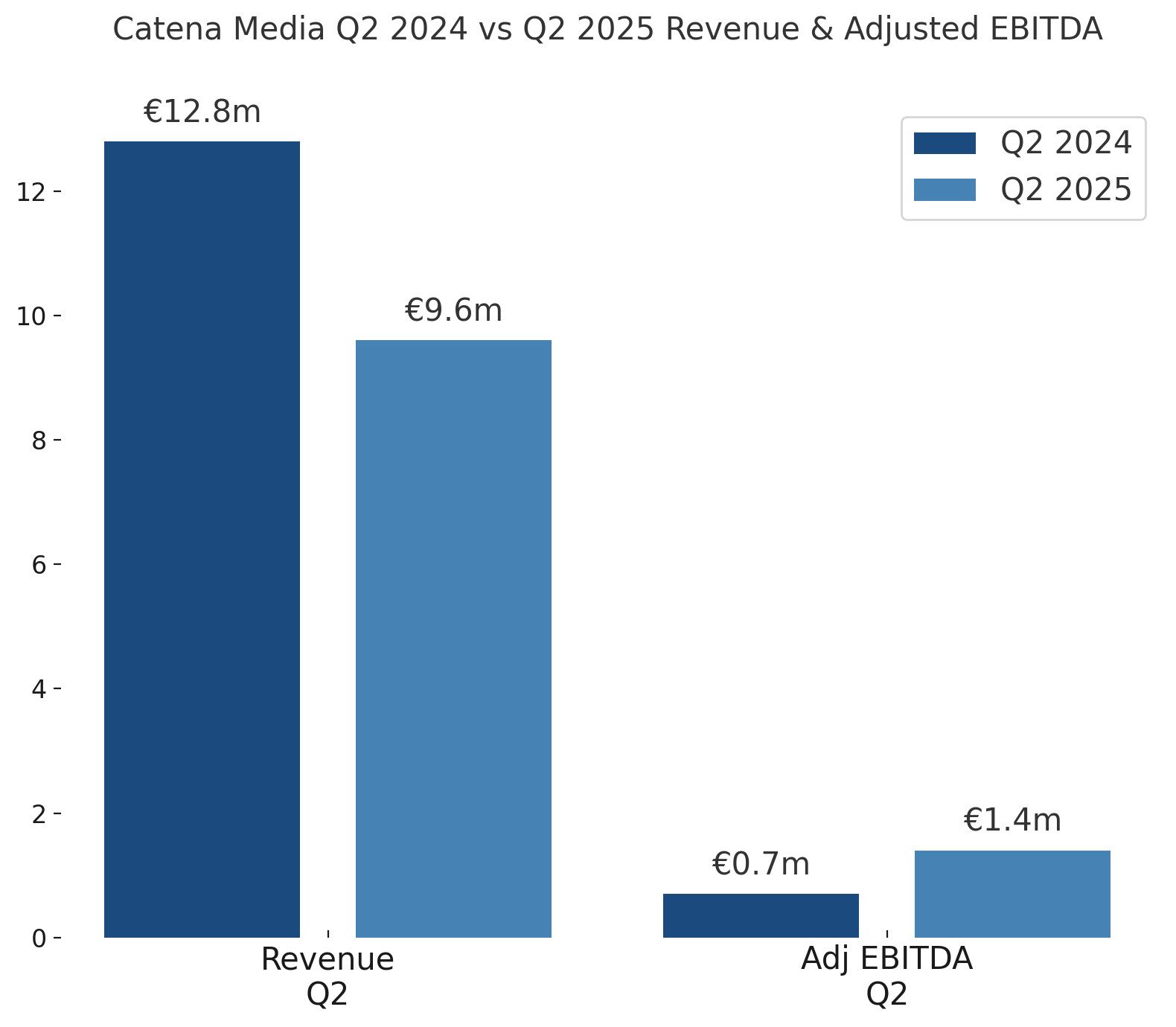

Revenue stayed flat for the third quarter in a row, but profits have taken a big step forward. Catena Media revenue came in at €9.6m for Q2 2025, with the company’s cost-cutting drive starting to show in the bottom line. Management says the real impact will be clearer in the months ahead.

Q2 2025 revenue from continuing operations landed at €9.6m, 25% lower than a year ago but only 2% down from Q1. Stripping out currency shifts from a weaker US dollar, that’s actually a 6% increase. North America brought in €8.7m, making up 90% of the total.

The number of new depositing customers slid 36% year-on-year to 20,229. It’s another drop from Q1, showing acquisition is still under pressure. The plan is to make up for this through more paid media, subaffiliation, and CRM activity.

Adjusted EBITDA more than doubled to €1.4m, lifting the margin to 14%. CEO Manuel Stan said the boost was “driven by underlying business improvements rather than state launches or seasonal tailwinds.” Total EBITDA hit €2.2m, turning around last year’s €0.6m loss.

Across the first half of 2025, revenue from continuing operations reached €19.4m, down 33% on last year. Adjusted EBITDA dipped 9% to €2.3m, while overall EBITDA jumped to €2.8m from €0.3m. Earnings per share moved up to €0.003 compared to a €0.07 loss.

In May, Catena Media announced a big shake-up, cutting around 25% of its workforce and removing a management layer. The aim is to trim annual costs by €4.5-5.0m, with most of the savings expected to show from Q3.

The company has also streamlined operations by merging its tech stack into a single scalable platform and consolidating software licences. As older contracts wind down, these steps should bring more savings without hurting revenue streams.

Efforts to diversify beyond SEO are picking up pace, with paid media, subaffiliation, and CRM now a bigger slice of income. These channels do come with higher direct costs, but they rise in step with revenue growth.

Casino revenue inched up from Q1 despite the usual summer slowdown and tighter rules on social sweepstakes. Sports betting slipped 10%, reflecting the thin sports calendar in Q2, but Q3 should get a lift from the new football season.

During the quarter, Catena sold its esports assets, booking a €1.4m gain. The deal frees up cash and resources to double down on its main business lines.

In June, the group cleared its senior bond, leaving it in a net cash position (excluding the hybrid capital security). This puts it in a stronger place to invest in AI-ready content, CRM, and loyalty tools aimed at deepening customer engagement.

Please find more news here.