Cirsa Q2 2025 results landed with higher revenue and profit. The group also trimmed leverage after its July IPO. Investors will note the free float and the path to 2.68x Ebitda – see more details:

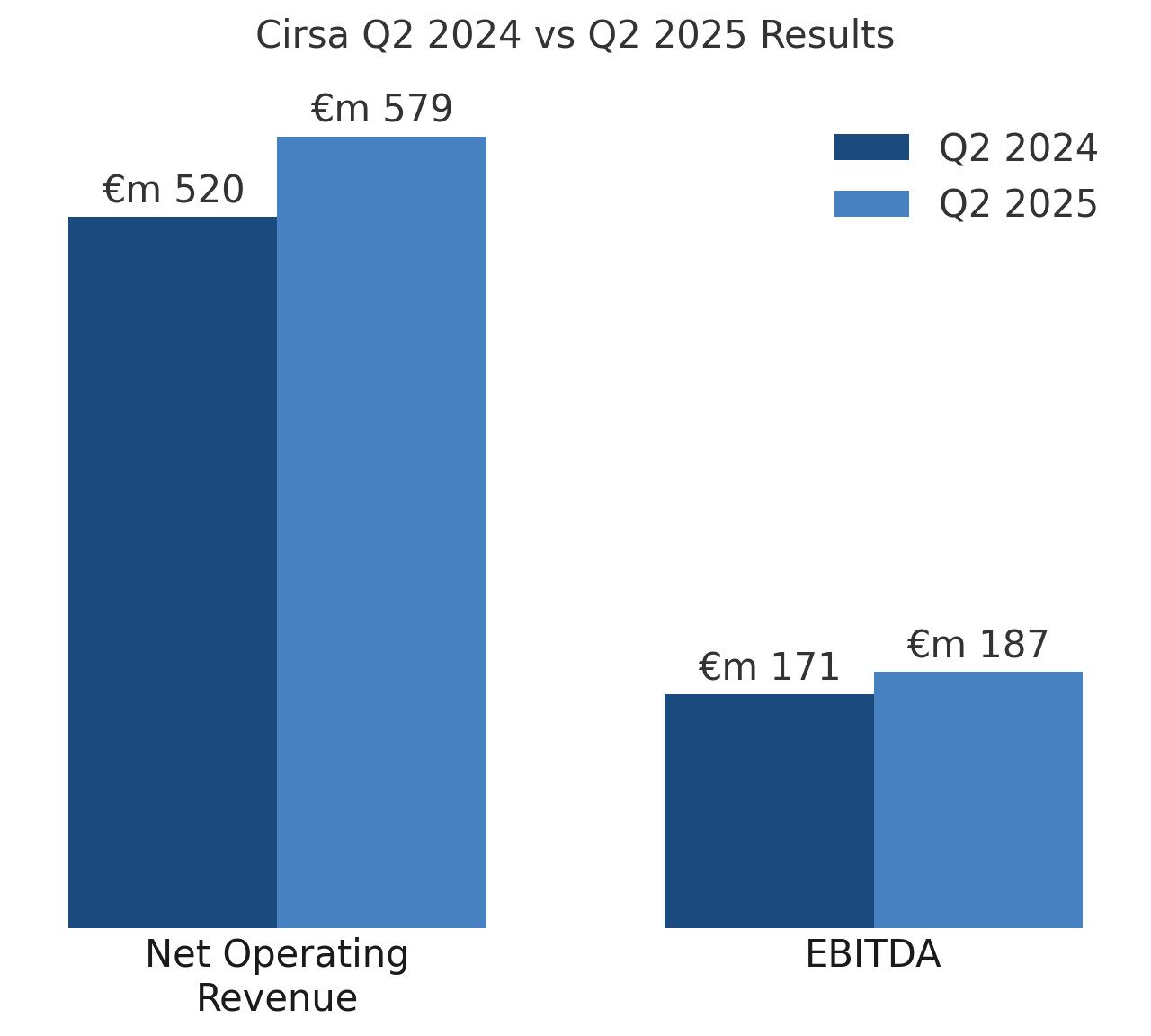

Cirsa reported EUR 579m in net operating revenue and EUR 187m in EBITDA for Q2 2025. That’s up 11.3% and 9.2% year on year, respectively. Cirsa Q2 results extend its record of quarterly growth, excluding the Covid period.

The group listed on 9 July at EUR 15 per share. Demand reportedly exceeded the offer over eight times, with more than 250 institutions participating. The deal mixed a EUR 400m primary raise and a EUR 53m secondary sale, bringing free float to 18%.

Post-IPO, EUR 373m went to debt repayment alongside a prior capital injection. Total deleveraging exceeded EUR 700m, reducing leverage to 2.68x Ebitda. Management said results were “strong and consistent” with past performance, citing execution and productivity.

The business unit On-line Gaming & Betting was the growth driver in Q2 2025: Net operating revenue increased by 54% up to EUR 139m (compared to Q2 2024: EUR 85m); EBITDA was up +17% reaching almost EUR 32m (Q2 2024: EUR 14.4m). Growth came from Spain and Italy, plus the 2024 additions of Apuesta Total in Peru and Casino Portugal. A new sponsorship with Liverpool FC adds brand assets and digital activations across operating geographies.

The company highlighted its ESG profile, ranking first globally in Morningstar Sustainalytics’ sector rating. The recognition relates to environmental, social and governance risk management. Cirsa Q2 results materials positioned sustainability as a strategic focus across operations.

Please find more news here.