DoubleDown Interactive earnings took a hit in the second quarter of 2025, with revenue sliding compared to last year. The Seoul-based games developer, now reporting under IFRS instead of US GAAP, said softer social casino results were balanced by a sharp jump in iGaming sales. Bosses pointed to solid cash generation and a record quarter for the SuprNation brand.

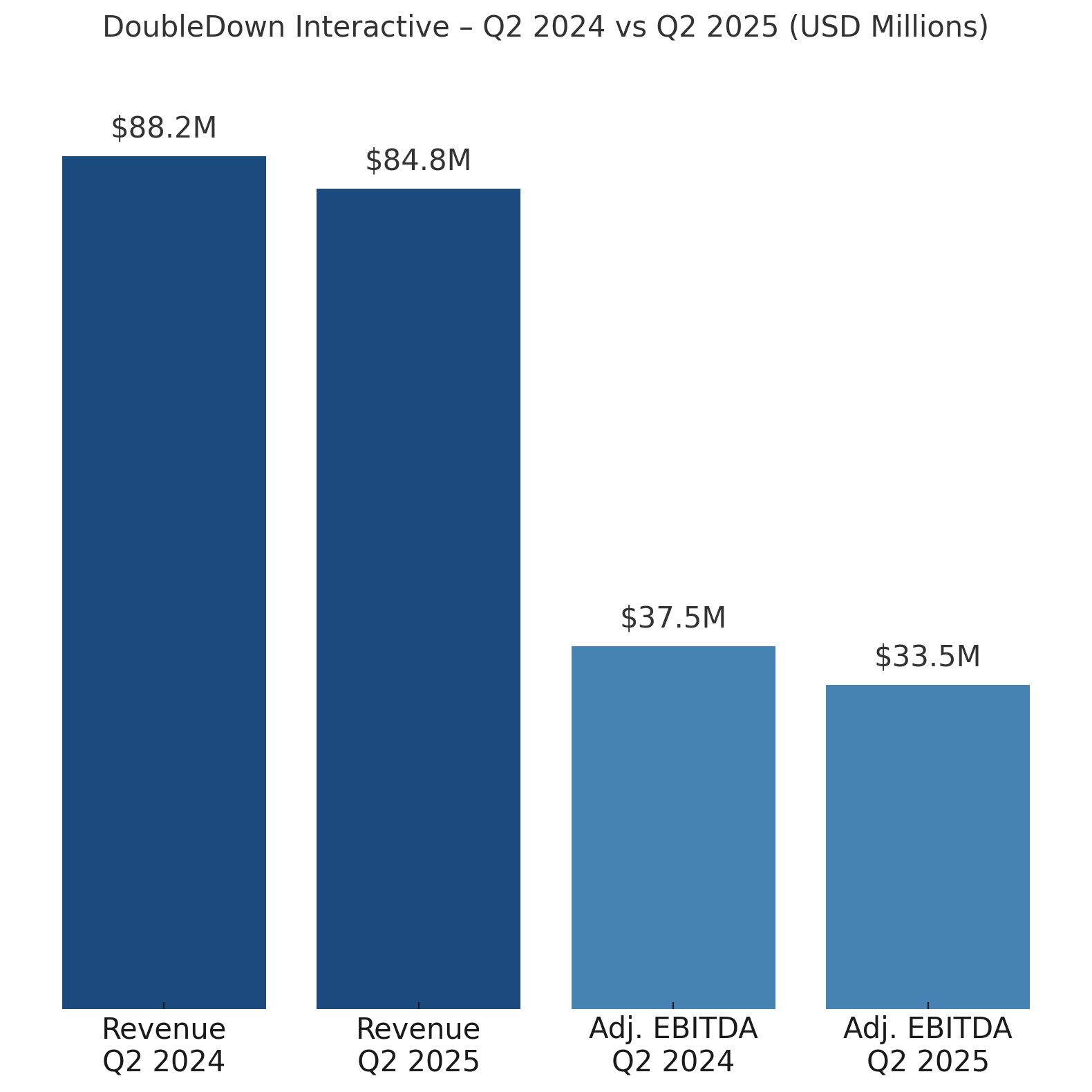

Q2 2025 revenue landed at $84.8m, down from $88.2m in the same period last year. Social casino and free-to-play titles brought in $69.3m, down 14% year-on-year, while iGaming revenue from SuprNation surged 96% to $15.5m after heavier investment in player acquisition.

Operating costs edged up to $52.4m from $51.9m a year earlier, mainly from spending tied to SuprNation. This was partly offset by lower revenue costs and trimmed R&D expenses.

Profit for the interim period fell to $21.8m, or $0.44 per ADS, from $33.1m, or $0.67 per ADS, last year. The decline was linked to lower revenue, a foreign currency loss, and higher admin costs, though reduced R&D spending provided some relief.

Adjusted EBITDA came in at $33.5m versus $37.5m last year, with a margin of 39.5% compared to 42.5%. Average revenue per daily active user for social casino and free-to-play games held steady at $1.33.

Monthly revenue per paying player dipped slightly to $286 from $288 in Q2 2024, but improved from $276 in the first quarter. Payer conversion for social casino and free-to-play products rose to 7.0% from 6.7% a year earlier.

Cash from operating activities dropped to $19.7m from $34.8m, driven by higher income tax payments. “We continue to drive strong monetization metrics for our flagship casino game, DoubleDown Casino,” said CEO In Keuk Kim.

DoubleDown ended the quarter with about $444m in net cash, or $8.96 per ADS. Management said the WHOW Games GmbH acquisition strengthens its reach in Germany’s social casino space and should create operational synergies.

Please find more news here.