Entain has started 2025 on the front foot, posting first-half numbers that came in ahead of forecasts and lifting its full-year guidance. The sports betting and gaming group recorded growth across both its main operations and BetMGM, its joint venture in the US. The Entain H1 2025 results also show stronger margins and a clear bounce-back in the UK market.

Net gaming revenue for the group, including Entain’s 50% stake in BetMGM, rose 7% year-on-year, or 10% at constant currency. The UK & Ireland market was up 9% at constant currency, driven by improved player activity, while Brazil’s newly regulated market delivered a 21% jump. BetMGM revenues climbed 35% at constant currency, with solid gains in both iGaming and online sports betting.

Online NGR, excluding the US, increased 5% on a reported basis and 8% at constant currency, helped by strong sports and gaming volumes. UK & Ireland online grew 21% at constant currency, regaining market share following a period of regulatory adjustment. Growth in Georgia, Spain, Canada and Greece helped offset drops in the Netherlands and Belgium.

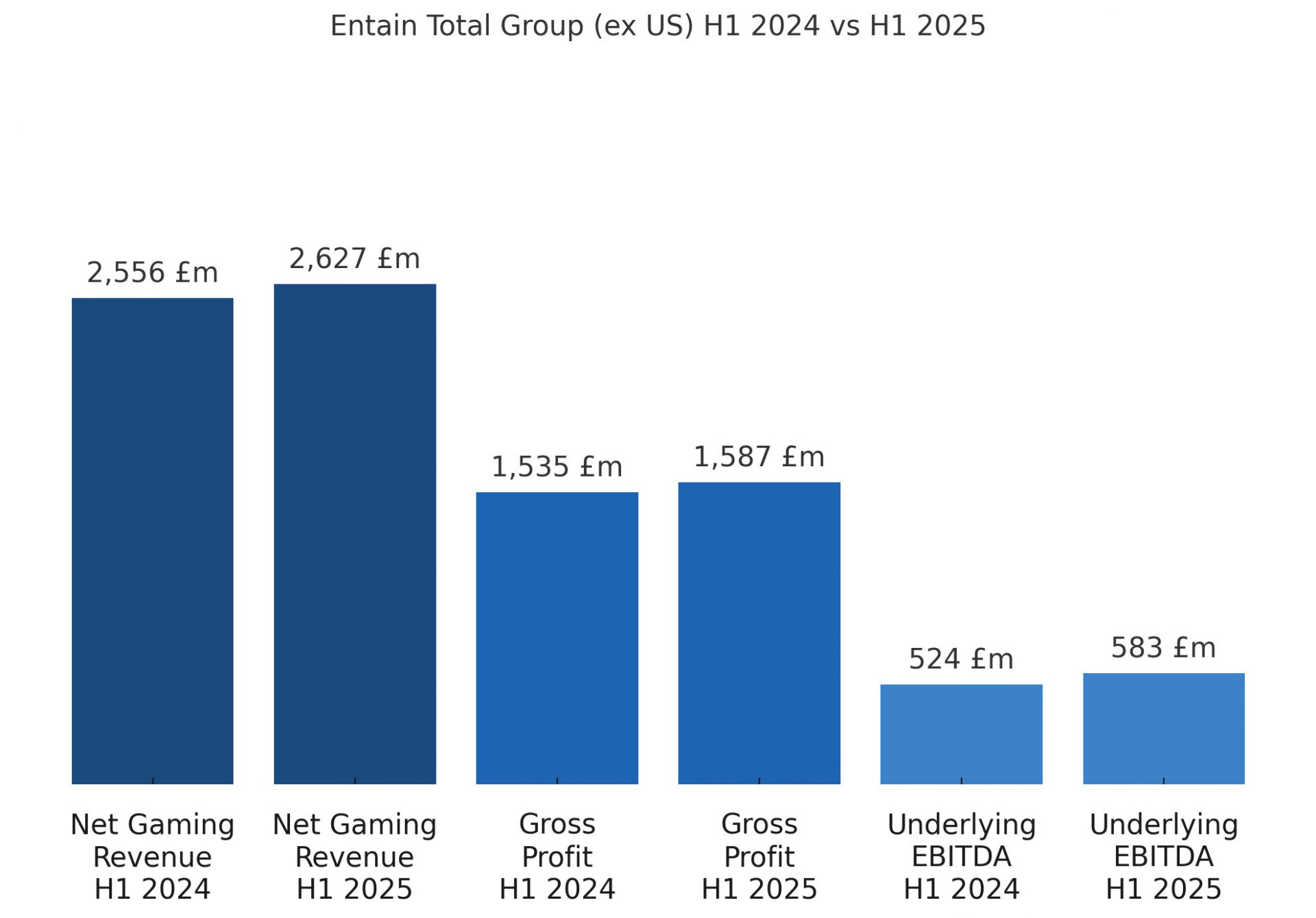

H1 group EBITDA came in at £583m, up 11% year-on-year, while total group EBITDA including BetMGM reached £625m, a 32% increase. Online EBITDA margins were stronger than expected thanks to a better mix of NGR and improved efficiencies, prompting an upgrade to full-year margin guidance to 25–26%. Retail EBITDA was flat, with a slight dip in UK & Ireland in line with expectations.

Revenue from operations outside the US came to £2.63bn, up 3% reported and 6% at constant currency, with gross profit at £1.59bn. Adjusted diluted EPS excluding the US rose to 26.1p from 21.0p last year. The group set aside around £50m in relation to AUSTRAC proceedings in Australia.

The board has declared an interim dividend of 9.8p per share, up 5% on last year, to be paid on 29 September 2025. Net debt at the end of June stood at £3.55bn, with £964m cash on hand and leverage at 3.1x (3.4x including DPA). Debt refinancing in July is expected to cut annual interest costs by about £10m.

For FY25, Entain now expects online NGR growth of roughly 7% at constant currency, with group EBITDA between £1.1bn and £1.15bn. This includes the impact of Brazil’s new taxes and additional second-half marketing spend. The company aims to generate over £0.5bn in annual adjusted cash flow in the medium term.

BetMGM has also upgraded its 2025 forecast to at least $2.7bn in revenue and $150m EBITDA. CEO Stella David said: “Our business is getting stronger, fitter and faster, with these results reinforcing our confidence in driving sustainable underlying growth.” The joint venture still has its sights set on hitting $500m EBITDA and beyond in the coming years.

Please find more news here.