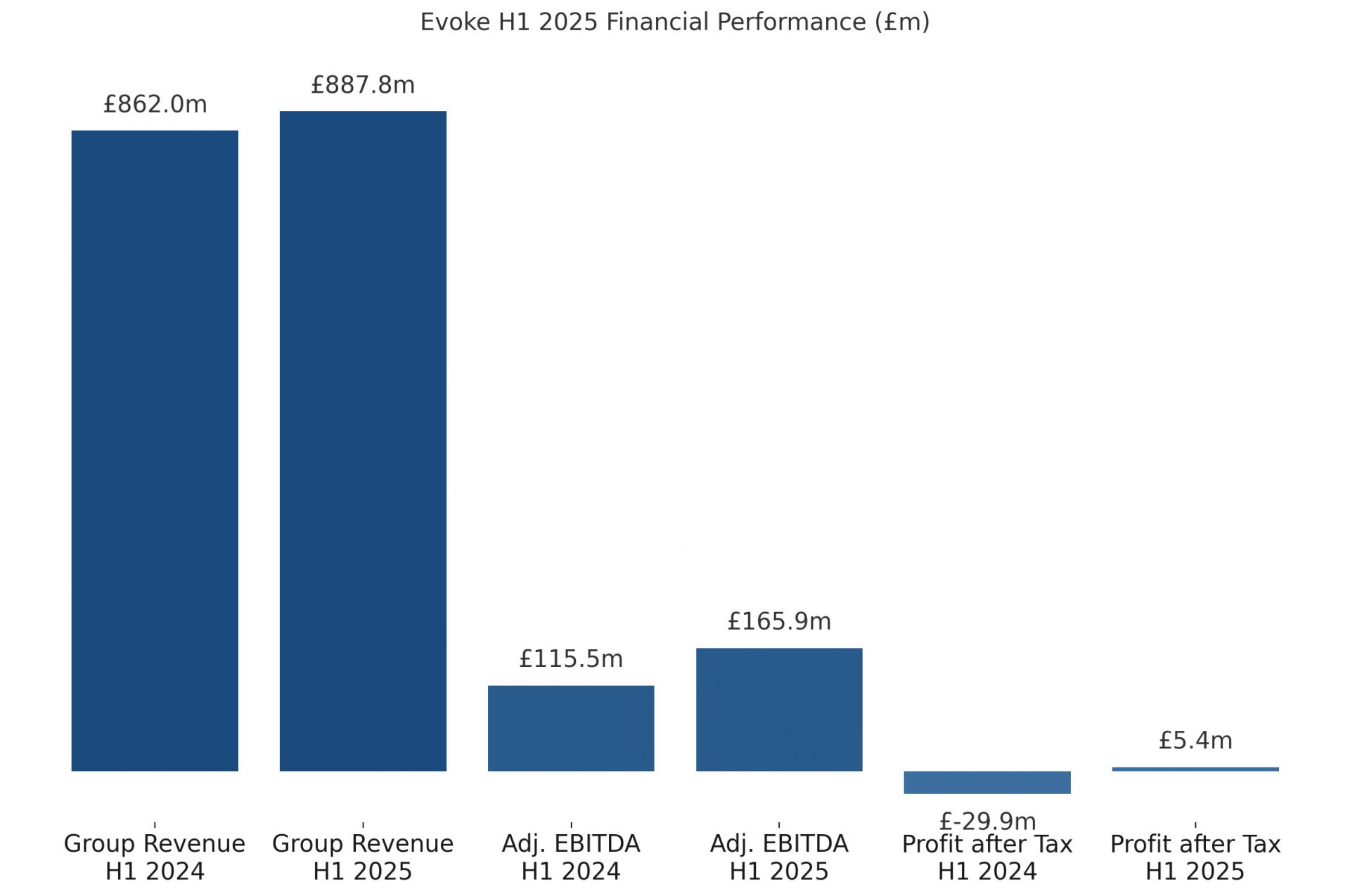

Evoke H1 2025 results point to another solid step in its turnaround. The betting and gaming group delivered its fourth straight quarter of growth and a marked boost in profitability. Adjusted EBITDA climbed 44% year-on-year to £166m, underpinned by efficiency gains and stronger gross margins.

Group revenue reached £888m in H1 2025, up 3% year-on-year, or 4% on a constant currency basis. UK & Ireland online revenue slipped 1% due to tough comparisons with the Euros and changes in marketing strategy, though profitability still rose sharply. Adjusted EBITDA for the UK & Ireland online unit was £60m, up 37% from last year.

International revenue climbed 13% (15% constant currency), driven by strong performances in key markets. The division’s adjusted EBITDA more than doubled to £86m. This growth was supported by product enhancements, marketing efficiencies and stronger customer engagement.

Retail revenue fell 2% overall but returned to growth in Q2 2025. The rebound was linked to the rollout of 5,000 new gaming cabinets. These installations improved customer experience and supported higher footfall.

Reported EBITDA jumped to £141m from £44m in H1 2024, mainly due to fewer exceptional costs. Prior year figures included higher transformation charges and costs from the US B2C exit. This year’s gains reflect the impact of restructuring and cost control measures.

Cash (excluding customer balances) stood at £121m at the end of June 2025, with total liquidity of £250m. The Group reduced net leverage to 5.0x, a 1.7x improvement on the year before. Management aims to reduce this further to below 3.5x by end of 2027.

Operational initiatives included expanding the use of AI and intelligent automation across the Group. These tools enhanced marketing returns through better customer segmentation and lifecycle management, contributing to an 11% rise in average revenue per user.

William Hill’s new customer value proposition, “betting done properly”, was rolled out. Online upgrades included simplified navigation, free-to-play games and the in-house launch of Jackpot Drop, moving marketing from promotion-led to product-led engagement.

CEO Per Widerström said: “We are seeing clear evidence of the transformation and operational reset we’ve undertaken, with the Group delivering continued revenue growth, significantly improved profitability and meaningful deleveraging during the first half of the year.”

For Q3 so far, revenue is tracking in line with expectations. Full-year 2025 revenue growth is still forecast at 5-9%, with an adjusted EBITDA margin of at least 20%. Management expects further profitability gains in H2 2025 from operational leverage and efficiency measures.

Please find more news here.