The DraftKings FY2025 results show revenue above USD 6bn and a return to profit. A strong Q4 2025, especially in sportsbook, shaped the full-year outcome.

Revenue for FY2025 reached USD 6.05bn (ca. EUR 5.1bn), up 27% from USD 4.77bn (ca. EUR 4bn) in 2024. Adjusted EBITDA rose to USD 620m (ca. EUR 522m) from USD 181m (ca. EUR 153m), while net income came in at USD 3.7m (ca. EUR 3.1m) after a USD 507m (ca. EUR 427m) loss the year before.

In Q4 2025, revenue increased 43% to USD 1.99bn (ca. EUR 1.68bn) and Adjusted EBITDA totalled USD 343m (ca. EUR 289m), showing the importance of this quarter’s result for FY 2025.

Sportsbook handle continued to grow during the year. In Q4 2025, handle was USD 16.8bn (ca. EUR 14.2bn), compared with USD 11.5bn (ca. EUR 9.7bn) in Q4 2024. Sportsbook revenue rose to USD 1.35bn (ca. EUR 1.13bn) from USD 825m (ca. 695m) with net revenue margin improving to 8.0% from 5.5%.

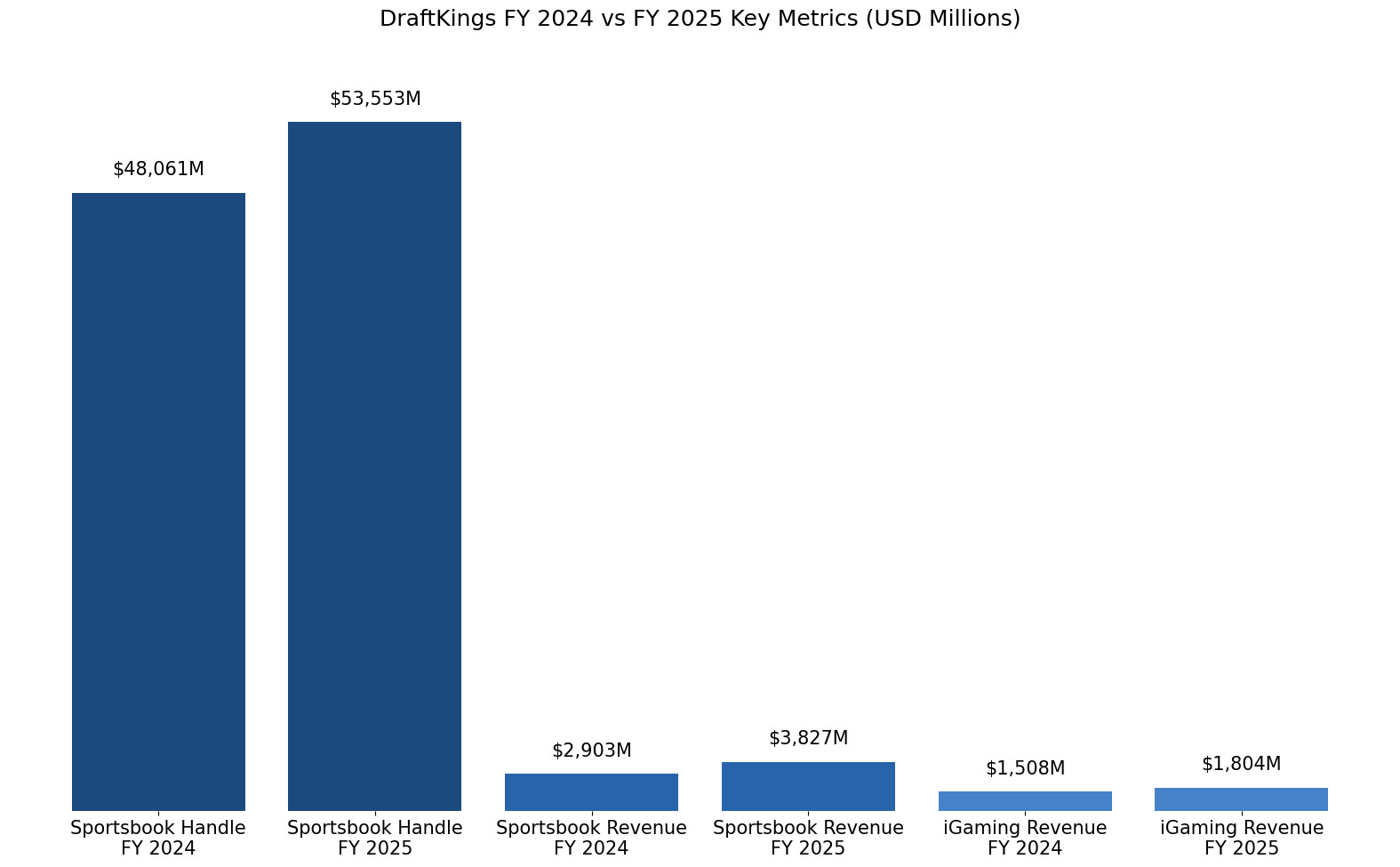

Across 2025, each quarter showed higher handle than the prior year. Revenue followed the same pattern, reflecting stronger staking volumes. This steady sportsbook growth was central to the DraftKings FY2025 results.

iGaming revenue also moved higher. Q4 2025 revenue reached USD 500m (ca. EUR 421m), up from USD 426m (ca. EUR 359m) in Q4 2024. Online casino remains an important and recurring part of total group revenue.

Total unique customers over the prior twelve months reached 10.9 million by Q4 2025. Average monthly unique payers in Q4 2025 were 4.8 million, while ARPMUP increased to USD 139 (ca. EUR 117) from USD 97 (ca. EUR 82). Higher spend per customer supported both sportsbook and iGaming in the DraftKings FY2025 results.

CEO Jason Robins said: “We closed 2025 on a high note. Fourth quarter revenue increased 43% year-over-year and we achieved records for revenue and Adjusted EBITDA.” DraftKings expects FY2026 revenue of USD 6.5bn (ca. EUR 5.5bn) to USD 6.9bn (ca. USD 5.8bn) and Adjusted EBITDA of USD 700m (ca. EUR 589m) to USD 900m (ca. EUR 758m).

Please find more news here.