Gaming Realms H1 2025 landed with growth on core metrics and cash generation. Gaming Realms H1 2025 emphasizes distribution scale: more operators in more markets mean more launches and more bets, feeding the revenue flywheel.

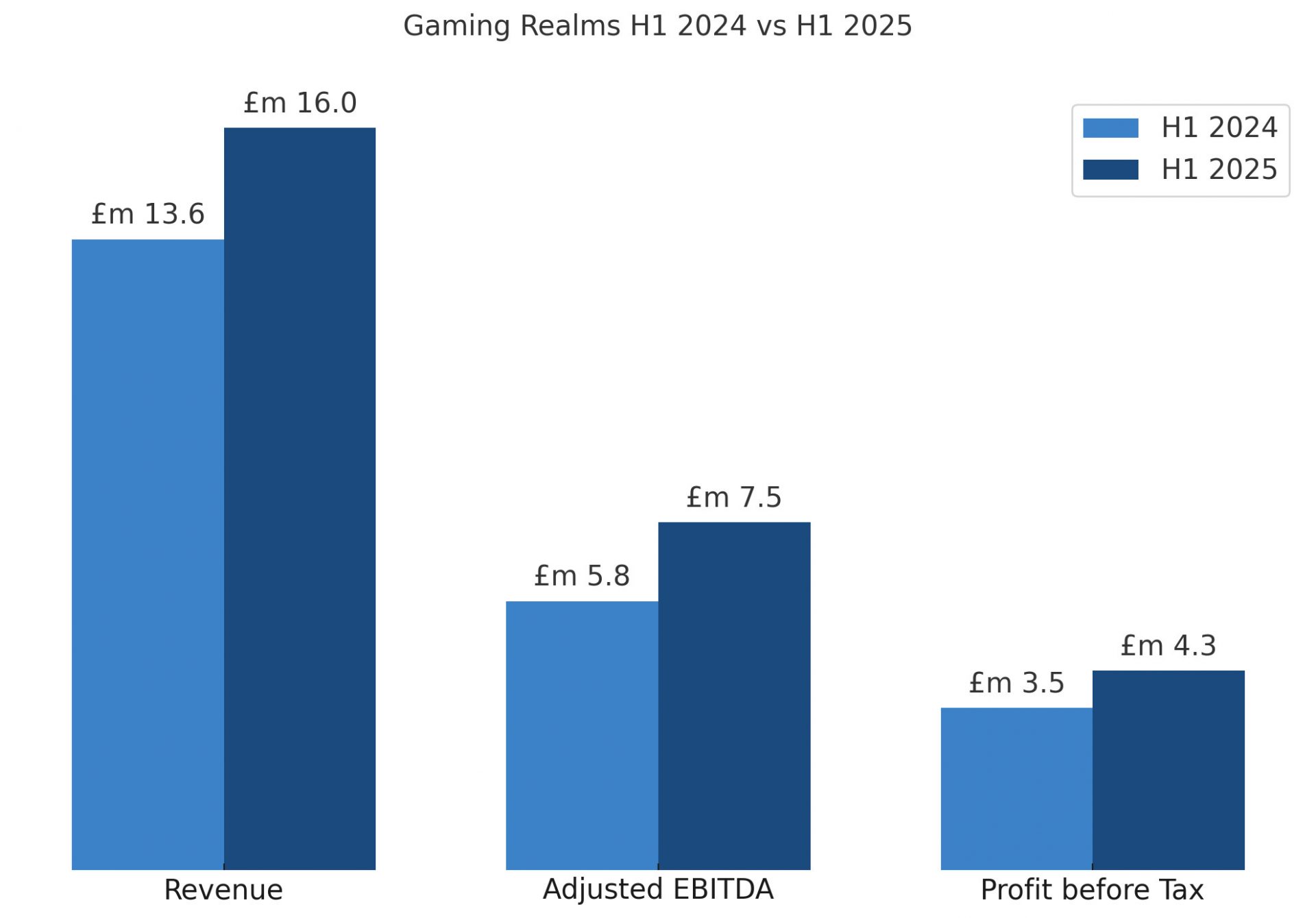

Revenue reached £16.0m, up 18% year-on-year, supported by high-margin content licensing;

Adjusted EBITDA came in at £7.5m, up 30%, and PBT rose to £4.3m. Variable costs were 19% and marketing spend decreased to £0.2m. Management highlighted continued cash conversion, with 73% of adjusted EBITDA turning into cash.

Cash and cash equivalents closed at £19.0m versus £13.5m at year-end 2024. Free cash flow was helped by positive working capital and partly offset by £3.5m capex, mainly on games and platform development. A £0.4m share buyback was executed during the period.

North America accounted for 61% of content licensing revenue, with U.S. growth of 26% at constant currency and Canada up 13%. The company now distributes 95 games to 225+ brands across 24 regulated markets and reached 5.8m unique players in the last 12 months.

The UK declined year-on-year after £2/£5 staking limits took effect in April 2025. A gradual recovery is underway via a new wager tool, “SuperSpin Wheel,” now live across an expanding slate and built into all new titles. The recovery trajectory is shown on page 15, with 48 games targeted by August 2025.

Territorial mix shifted: USA +22% vs H1 2024, Italy +29%, Canada +8%, while UK fell 13% and RoW dipped 6%.

Brand licensing contributed £2.4m in H1 2025 and £8.0m since 2020. Slingo-branded lottery scratchcards in the U.S. and Canada have driven more than $1.9bn in retail sales since 2001. The slingo.com domain licence and an Entain multiplayer bingo collaboration broaden the brand footprint.

Please find more news here.