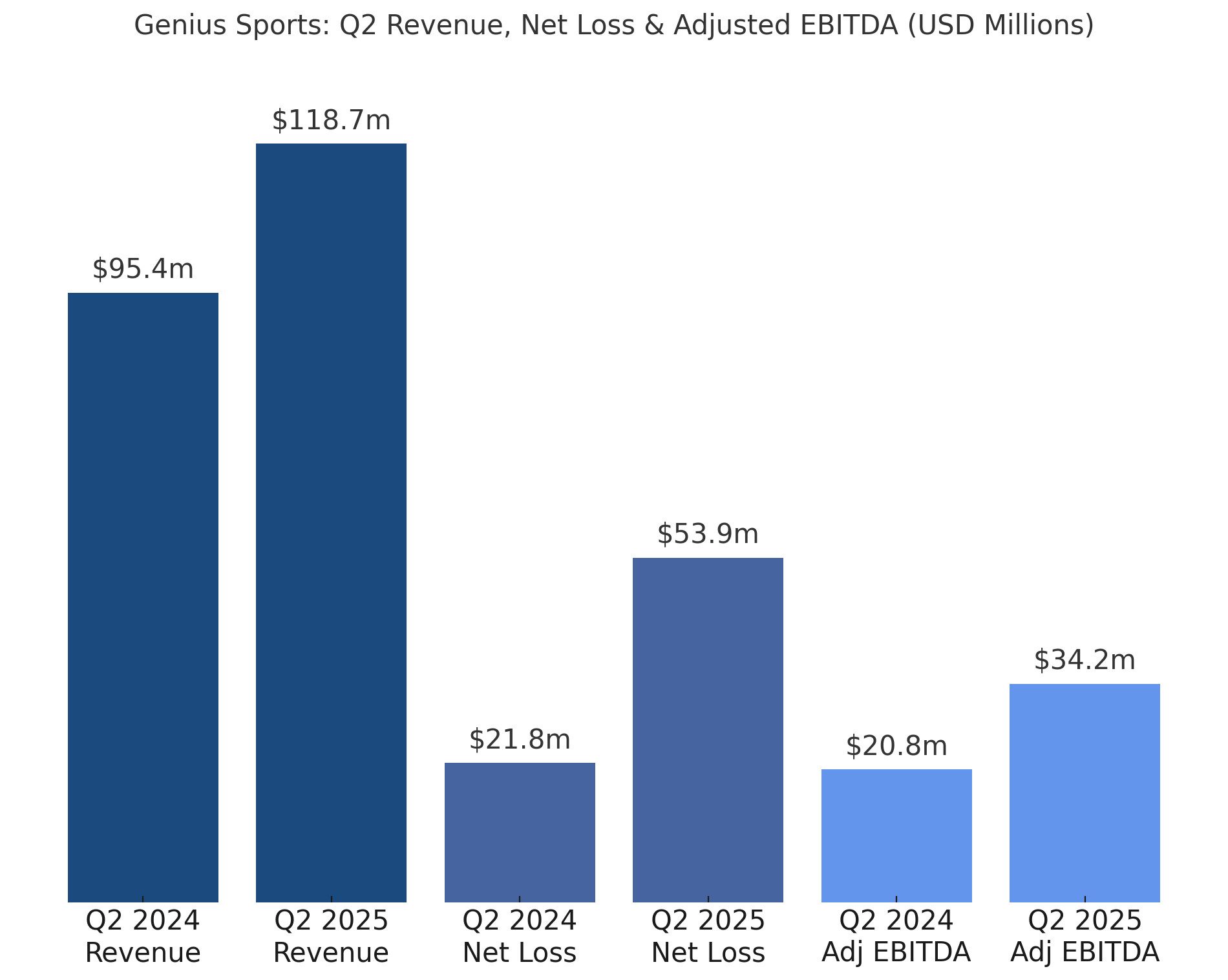

Genius Sports reported another quarter of solid group revenue growth, with Q2 2025 revenue climbing to $118.7m. Adjusted EBITDA hit a quarterly record, even as net losses widened due to one‑off expenses. The company raised its full‑year outlook, reflecting confidence across Betting, Media and Sports segments.

Q2 group revenue rose 24% year‑on‑year to $118.7m, driven mainly by Betting Technology, Content & Services. The segment grew 30% to $87.5m on higher betting volumes, price adjustments and expanded services.

Media Technology, Content & Services revenue increased 4% to $18.6m in Q2, supported by growth in programmatic advertising. Sports Technology & Services climbed 22% to $12.6m, with GeniusIQ products supporting the gains.

Group adjusted EBITDA reached $34.2m, a 64% increase year‑on‑year. The adjusted EBITDA margin expanded by 700 basis points to a quarterly record of 28.8%, reflecting operational leverage.

Group net loss widened to $53.9m compared with $21.8m in Q2 2024. This was largely due to a non‑recurring increase in stock‑based compensation linked to equity awards for management, employees and NFL warrants.

Year‑to‑date, group revenue sits at $262.7m, up 22% from 2024. Adjusted EBITDA over the same period nearly doubled to $53.9m, with margins improving from 12.9% to 20.5%.

The company extended and expanded its strategic technology deal with the NFL through the 2030 Super Bowl. Genius will continue distributing official data and video to power fan engagement products.

Partnerships secured after Q2 include exclusive data and streaming rights for Italy’s Serie A through 2029, plus official betting data rights for selected European Leagues competitions.

CEO Mark Locke said: “Our new partnerships with Serie A and European Leagues further demonstrate the strength of our technology… paving the way for continued margin expansion and cash flow growth for the foreseeable future.”

Full‑year 2025 guidance was raised to $645m in revenue (up 26% year‑on‑year) and $135m adjusted EBITDA (up 57%), with margin expansion expected to 21%.

Please find more news here.