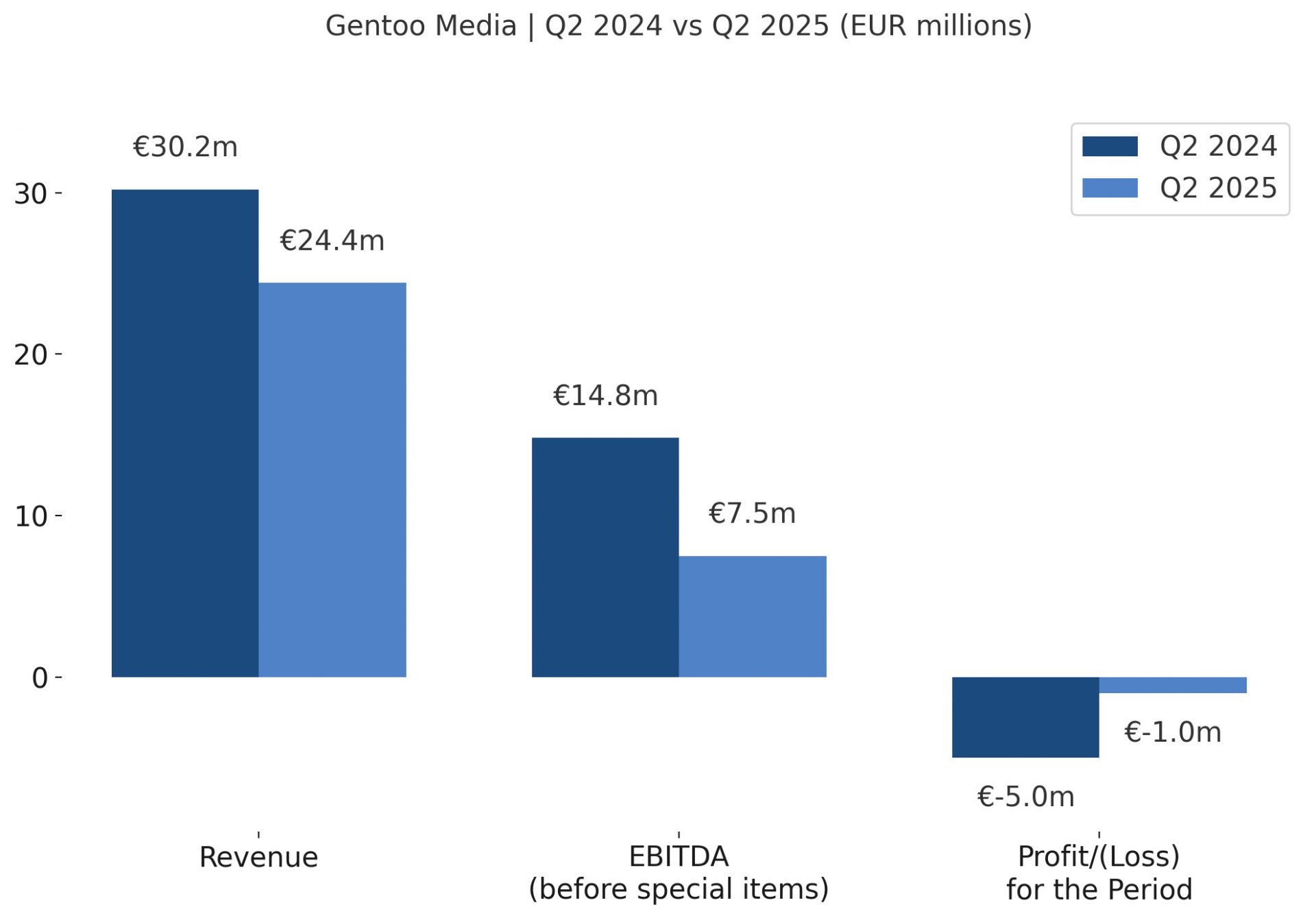

Gentoo Media Q2 results are in, and they show both progress and pressure. The company cut costs and streamlined operations, but revenue slipped year-on-year. Management has now adjusted its full-year guidance to reflect the slower pace of improvement.

Revenue in Q2 2025 came in at EUR 24.4 million, down 19% compared to last year but flat against Q1. EBITDA before special items was EUR 7.5 million, leaving the margin at 31%. Cash flow from operations improved to EUR 7.7 million versus EUR 6.2 million last year.

The quarter was hit by softer trading in Brazil and the absence of major sports events. However, deliberate operational recalibration and cost reductions were executed as planned. EBITDA margins returned above 40% in June, showing the efficiency measures are taking hold.

Marketing spend was ramped up, which helped boost player intake by 43% compared to Q1. Deposit values rose to EUR 195 million, reflecting stronger engagement despite revenue lagging expectations. The company sees this as a sign of improving fundamentals.

Full-year 2025 guidance has been updated, with revenue now expected at EUR 100–105 million. EBITDA before special items is projected between EUR 40–43 million, with a margin of 40–41%. Free cash flow from operations is forecast at EUR 27–30 million.

Cash flow from investing activities reached EUR -38 million, mostly tied to M&A and demerger costs initiated in 2024. By the end of July, EUR 34.3 million of these outflows had already been paid, and management noted these costs are now largely behind the business.

Looking ahead, the company says it enters H2 as “leaner, sharper, and more agile.” Growth in player intake, improved marketing efficiency, and early signs of recovery in Brazil support a stronger outlook. Gentoo Media also highlighted gains in Publishing and Paid Media, including benefits from a positive Google Core update and a recalibrated acquisition model.

Please find more news here.