Three months into summer and Intralot has put its numbers on the table. The company reported steady profitability and stronger cash generation in the first half. Intralot H1 2025 results also came with new U.S. lottery deals and a headline M&A move.

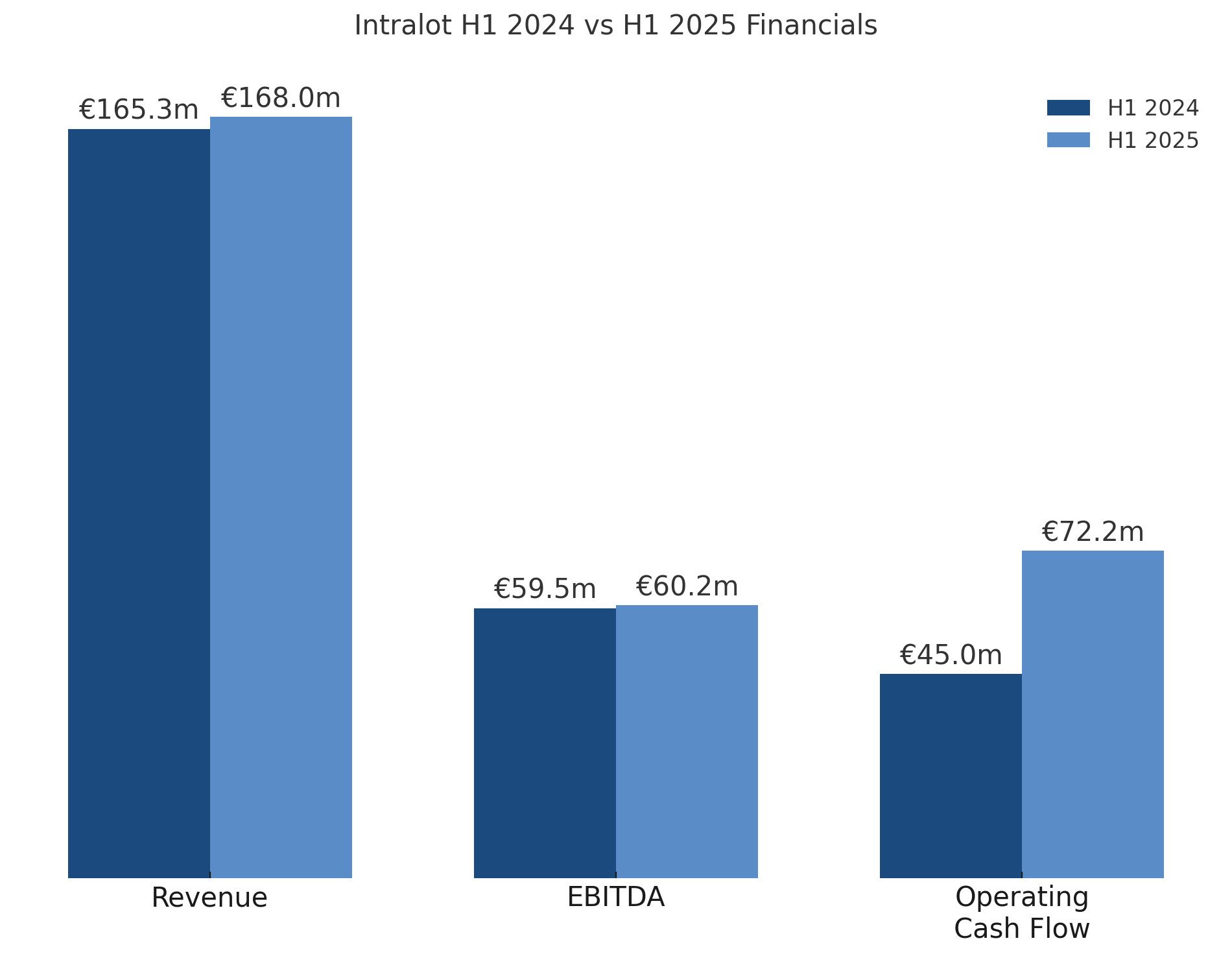

Group revenue reached €168.0m, up 1.7% year-on-year. EBITDA came in at €60.2m, a 1.2% increase, with a 35.8% margin. EBT was €9.8m and NIATMI was €-0.1m.

Operating cash flow rose to €72.2m, up €27.2m versus the same period last year. Group CAPEX totaled €14.2m during 1H25. Adjusted net debt stood at €303.0m with net leverage at 2.3x, down from 2.7x at FY24 close.

Revenue mix skewed to lottery at 53%, with sports betting at 22%, VLT monitoring at 12.8% and technology contracts at 12.2%.

Technology and support services increased by €2.9m, driven mainly by the U.S., including higher equipment sales. Licensed operations in Argentina added €2.0m, up 32% in Euro terms and 91.4% in local currency. Management contracts decreased by €2.2m, largely from Turkey due to hyperinflation accounting effects and higher acquisition/retention spend.

Operating expenses fell 13.6% to €47.6m, with a 30.1% drop in 2Q25 versus 2Q24. Other operating income was €15.3m, up 10.4% year-on-year. Interest and related expenses fell 34.6% to €14.4m, supporting the improvement in EBT.

Quarter-on-quarter detail shows 2Q25 revenue of €79.6m, down 4.8% versus 2Q24. EBITDA in the quarter was €30.0m, up 2.2% year-on-year. The AEBITDA margin in 2Q25 improved by 2.6pp to 37.8%.

The company highlighted “stable financial performance…, strengthened cash flows, and a significant reduction in debt and leverage.” It also framed the Bally’s International Interactive deal as transformative for scale and digital capability. This single quote reflects the board’s positioning of strategy during the period.

Intralot announced a €2.7bn agreement to acquire Bally’s International Interactive, expected to complete in Q4 2025. The consideration is a mix of cash and shares, with the combined business aimed at lottery, online gaming and data technology. The outlook section ties this to product innovation and broader international reach.

Contract activity included a 10-year extension with the Idaho Lottery effective 2027 and a New Hampshire Lottery systems extension through 2033. In New Zealand, the EMS contract was extended to 2032 with an added year on the current term; in Montana, Intralot won a new systems deal including Sports Bet Montana support. The VLT monitoring project in Nebraska also launched in July.

Intralot H1 2025 results also note cash at period end of €66.7m, or €97.3m including restricted cash. Free cash flow generation in 1H25 was €43.5m, while principal debt repayments were €19.8m and net interest payments €14.6m. The debt bridge on page 6 shows FX effects and other movements across the half.

Please find more news here.