Kalshi Series E funding arrives during a major surge in demand for event trading. The company says its platform is reshaping how people use real-time probability data. And with weekly volumes already topping USD 1bn (ca. EUR 0.86bn), Kalshi is preparing for another step-change in scale.

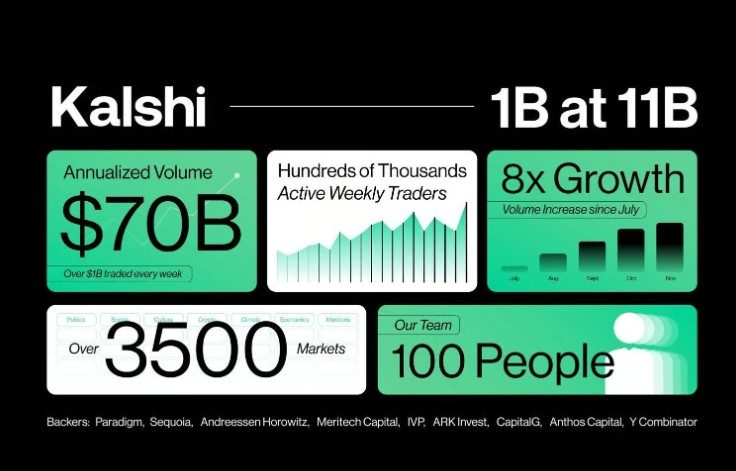

Kalshi raised USD 1bn in a Series E round valuing the business at USD 11bn (ca. EUR 9.4bn), backed by Paradigm, Sequoia, a16z and others. The company said the funds will support rapid scaling of its regulated prediction-market infrastructure. CEO Tarek Mansour noted the shift toward data-driven discussion, saying Kalshi replaces “debate, subjectivity, and talk with markets, accuracy, and truth.”

The firm operates what it describes as the world’s largest prediction market, offering more than 3,500 event-based contracts. Kalshi Series E momentum reflects rising interest from both retail and institutional users. The company says prediction markets are evolving into a recognised financial asset class.

Weekly trading volumes now exceed USD 1bn, up more than 1000% on 2024 levels. Millions of users access Kalshi each week to trade political, economic, and societal outcomes. The platform has also become a reference point for media and analysts, recently calling the NYC mayoral election minutes after polls closed.

Kalshi will use the new capital to accelerate user acquisition and expand integrations with brokerages. Additional product verticals and news partnerships are planned to increase reach and liquidity. Paradigm’s Matt Huang said demand for prediction markets represents an “uncapped cultural and economic phenomenon.”

Please find more news here.