Kambi has closed the year with a modest revenue decline but steadier margins in the final quarter. The Kambi Q4 2025 results reflect ongoing customer migrations and tax pressure in several markets. CEO Werner Becher said the group is “turning the corner towards a period of gradual growth.”

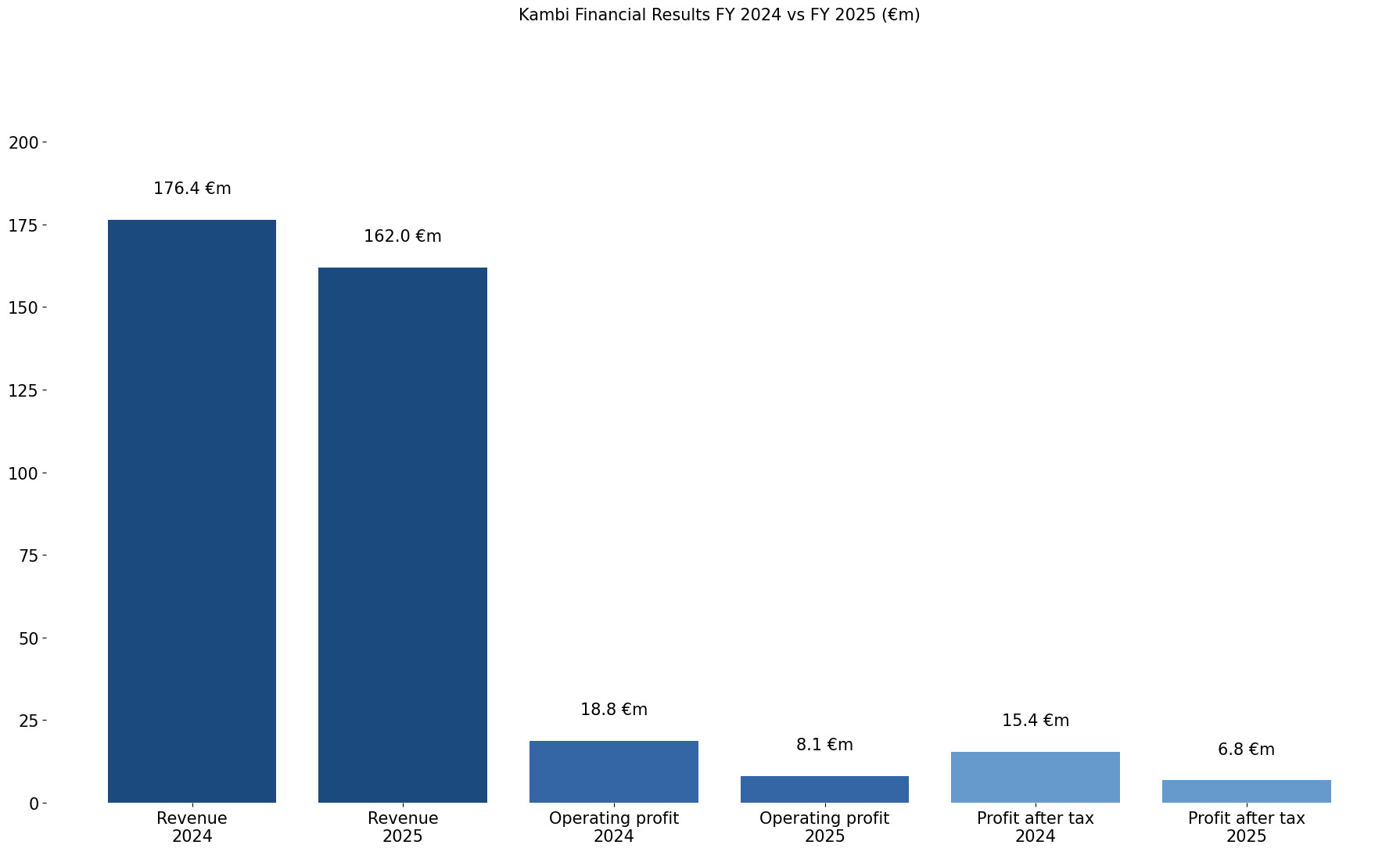

Revenue in Q4 2025 reached EUR 42.7m, down 3.9% from EUR 44.5m a year earlier. Excluding EUR 1.3m in transition fees recorded in Q4 2024, revenue fell by 1.1%. Full-year revenue came in at EUR 162m, down 8.2%, or 1.2% lower when adjusting for EUR 12.5m in prior-year transition fees.

Adjusted EBITA (acq) for the quarter totalled EUR 6.2m, compared to EUR 7.1m in Q4 2024, at a margin of 14.4%. Excluding FX revaluations, quarterly EBITA was EUR 7.4m, while full-year Adjusted EBITA (acq) reached EUR 15.5m at a 9.6% margin. Operating profit stood at EUR 4.1m in Q4 and EUR 8.1m for the year, with earnings per share of EUR 0.174 in the quarter and EUR 0.240 for 2025.

Commercially, Kambi signed five new Turnkey Sportsbook partnerships in Q4 2025, including Pickwin in Mexico, and added SuomiVeto and 4 Bears Casino & Lodge in early Q1. The supplier also extended agreements with Paf, PENN Entertainment and Churchill Downs, and expanded its Odds Feed+ client base with Coolbet, FDJ UNITED, Superbet and ComeOn Group. In January 2026, Kambi completed its online and retail launch with Ontario Lottery and Gaming Corporation under the PROLINE+ brand.

Looking ahead, Kambi expects Adjusted EBITA (acq) of EUR 20-25m in 2026, excluding FX revaluations. The company said the guidance assumes no new sports betting tax in Colombia and reflects growth from new customers offsetting ongoing migrations, including FDJ UNITED and LeoVegas. Product development remains focused on AI-driven trading, which accounted for nearly half of all bets in 2025, according to the Kambi Q4 2025 results statement.

Please find more news here.