PENN Entertainment has just released its second quarter results, and it’s clear the company is leaning hard into digital. While its brick-and-mortar casinos held steady, all eyes were on the Interactive segment. The PENN Entertainment Q2 2025 update shows iCasino and ESPN BET are doing some serious lifting.

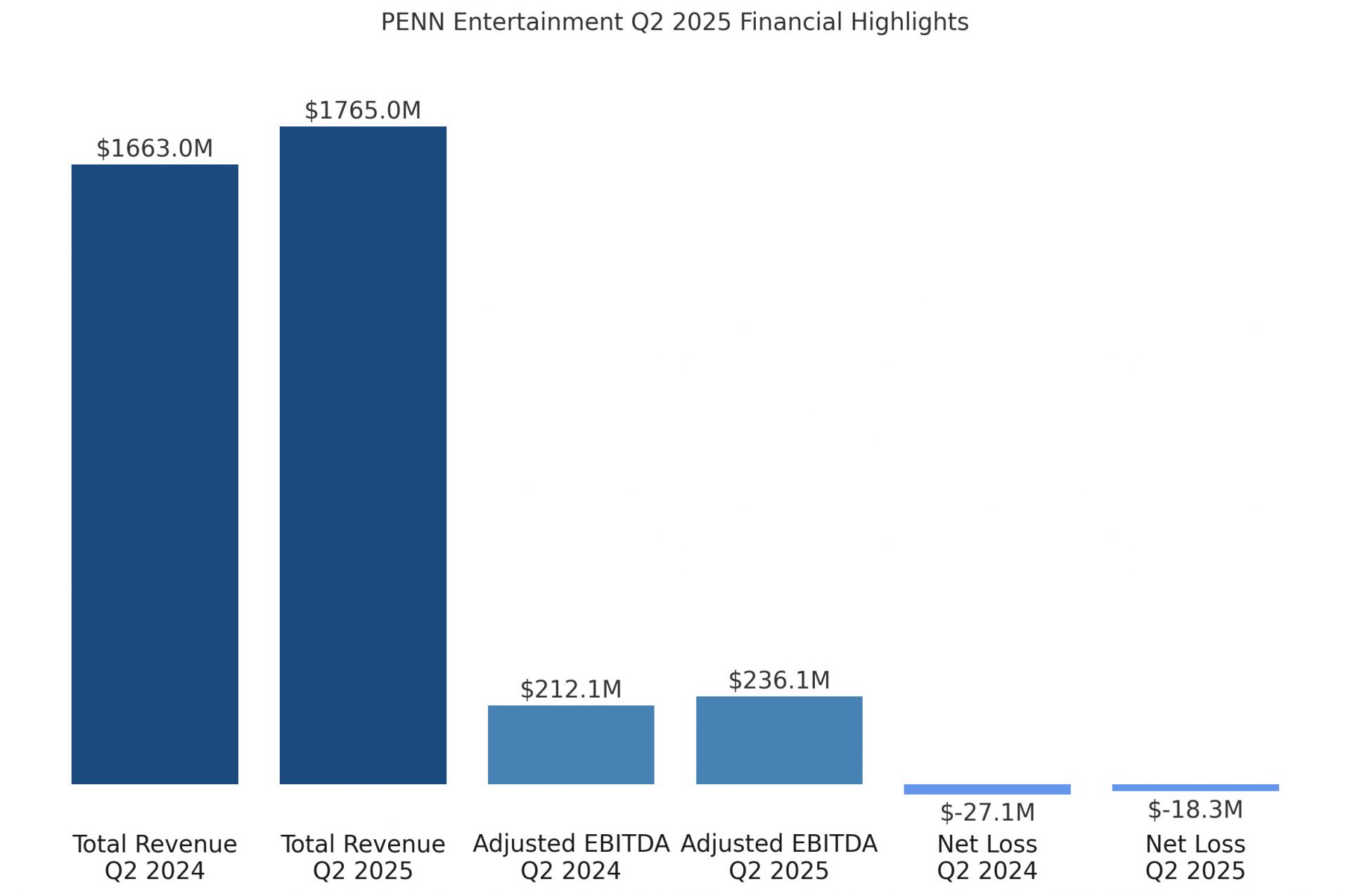

Total revenue for the quarter landed at $1.77 billion, up from $1.66 billion a year earlier. Adjusted EBITDA reached $236.1 million, a decent lift from $212.1 million last year. The company still posted a net loss of $18.3 million, but that’s narrower than the $27.1 million loss in Q2 2024.

The Interactive business pulled in $316.1 million in revenue, $178.2 million of that once tax gross-ups are stripped out. Adjusted EBITDA losses in digital shrunk to $62 million, helped by efficiency moves that included $2.9 million in severance costs. Management says those moves support a leaner, more scalable setup going forward.

“Record gaming revenues and operational discipline contributed to another quarter of strong year-over-year flow through,” said CEO Jay Snowden. He added that new features on ESPN BET, like Player Insights, are part of a broader push to sharpen the product before football kicks off.

PENN’s retail casinos delivered $1.4 billion in revenue and $489.6 million in Adjusted EBITDAR, with a margin of nearly 34%. Properties unaffected by new local competition saw revenue rise almost 4% year-over-year. Spend per visit and play from both rated and unrated guests was up across the board.

The company bought back over 7.2 million shares during the first half of 2025, spending $115.3 million at an average price of $15.90 per share. The team says it’s still on track to meet its $350 million full-year repurchase target. As of early August, it has $634.4 million in authorization left to use.

In June, PENN spent $233.5 million to repurchase a chunk of its 2.75% convertible notes due in 2026. That move cleared out around 9.6 million potentially dilutive shares from its balance sheet. Traditional net debt ended the quarter at $2.1 billion, with $1.2 billion in liquidity on hand.

Adjusted earnings per share for the quarter came in at $0.10, flipping from a $(0.18) result in Q2 2024. The GAAP loss per share improved slightly to $(0.12), helped by lower write-offs and one-off legal costs.

PENN says omnichannel strategy continues to pay off. Player crossover between online and retail grew, with an 8% increase in shared customers and a 28% jump in their theoretical revenue. Over 70% of iCasino revenue came from players who are either brand new, returning from a break, or originally started out in retail.

Hollywood Casino Joliet’s new land-based venue is set to open August 11, six months ahead of schedule. Projects in Aurora and Columbus are still tracking for early 2026, while Council Bluffs is on the books for late 2027. PENN says all timelines and budgets are intact.

Please find more news here.