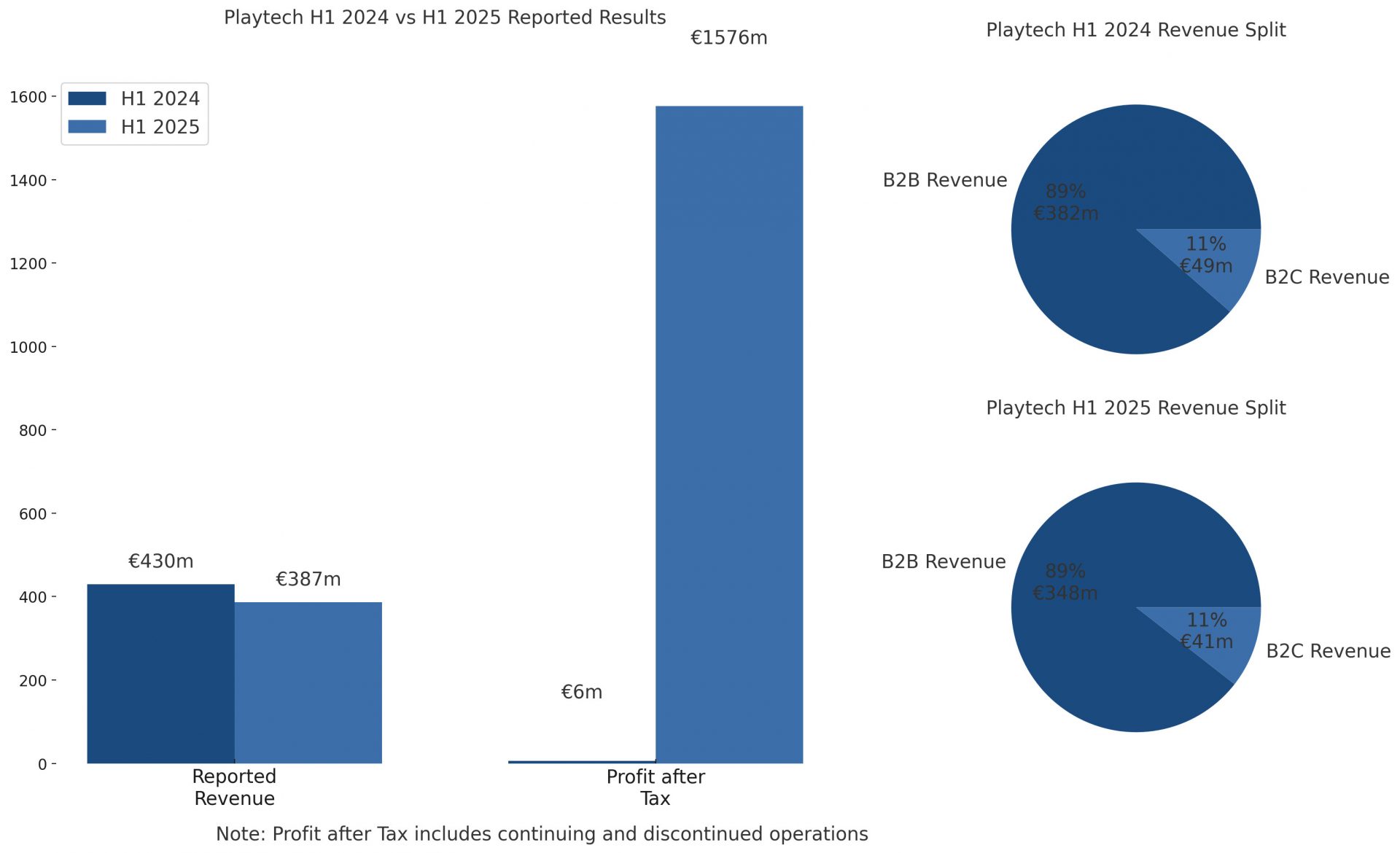

Playtech has shared its numbers for the first half of 2025. The update shows how the group is reshaping itself into a mainly B2B business. The Playtech H1 2025 results were also influenced by the EUR 2.3 billion sale of Snaitech and its restructured deal with Caliente Interactive.

Playtech closed the EUR 2.3 billion sale of Snaitech to Flutter in April, returning around EUR 1.8 billion to shareholders as a special dividend. That disposal pushed reported profit after tax up to EUR 1.58 billion, far above the EUR 5.9 million posted last year. The company also redeemed the remaining EUR 150 million on its 2026 bond, ending the period with EUR 77.1 million in net cash.

Adjusted EBITDA landed at EUR 91.6 million, down from €109.5 million a year earlier but in line with guidance given in August. B2B revenue dropped 9% to EUR 347.6 million, mainly due to the new Caliente structure. Without that impact, B2B revenue would have been up 3% year-on-year, showing steady underlying growth.

The Americas were a bright spot, with revenue of EUR 21.8 million – a 64% jump on H1 2024. Playtech went live in West Virginia, its fourth regulated US state, and kept expanding with major operators. US headcount topped 500 and new Live Casino studio investments are planned for the second half of the year.

Caliente Interactive contributed EUR 20.3 million in income under the revised terms, helping investment income rise to EUR 19.8 million from EUR 1.5 million last year.

In regulated LatAm markets, revenue slipped 32% to EUR 87.7 million, hit by the Caliente changes and tax issues in Colombia. Brazil, now counted as regulated, partly offset the drop. Meanwhile, the value of Playtech’s Hard Rock Digital stake rose to EUR 150.3 million from EUR 141 million at the end of 2024.

Live Casino kept up its momentum, with revenue up 9% year-on-year and strong demand in North America. Playtech also broadened its MGM Resorts partnership by launching seven new tables at MGM Grand Las Vegas. SaaS revenue climbed 73% to EUR 57.3 million, showing traction across multiple markets.

B2C revenue fell 17% to EUR 41 million, though adjusted EBITDA losses narrowed to EUR 1.5 million from EUR 4.3 million in 2024. HAPPYBET losses reduced thanks to shutting its Austrian arm and winding down Germany. Sun Bingo and other B2C brands saw lower revenue after new regulatory rules came into play.

CEO Mor Weizer said: “These results show the strong start Playtech is making in its transition back to its roots as a predominantly pure-play B2B business. America remains a core priority given the significant opportunities in the region, and Brazil’s transition to a regulated market represents a key milestone.”

Please find more news here.