Portugal’s regulated market kept moving in Q2 2025. Operators reported EUR 287m in gross revenue, driven mainly by online casino. Our read of the regulator’s SRIJ (Serviço de Regulação e Inspeção de Jogos) latest quarterly shows the Portugal online gambling mix skewing casino over sports – see more details:

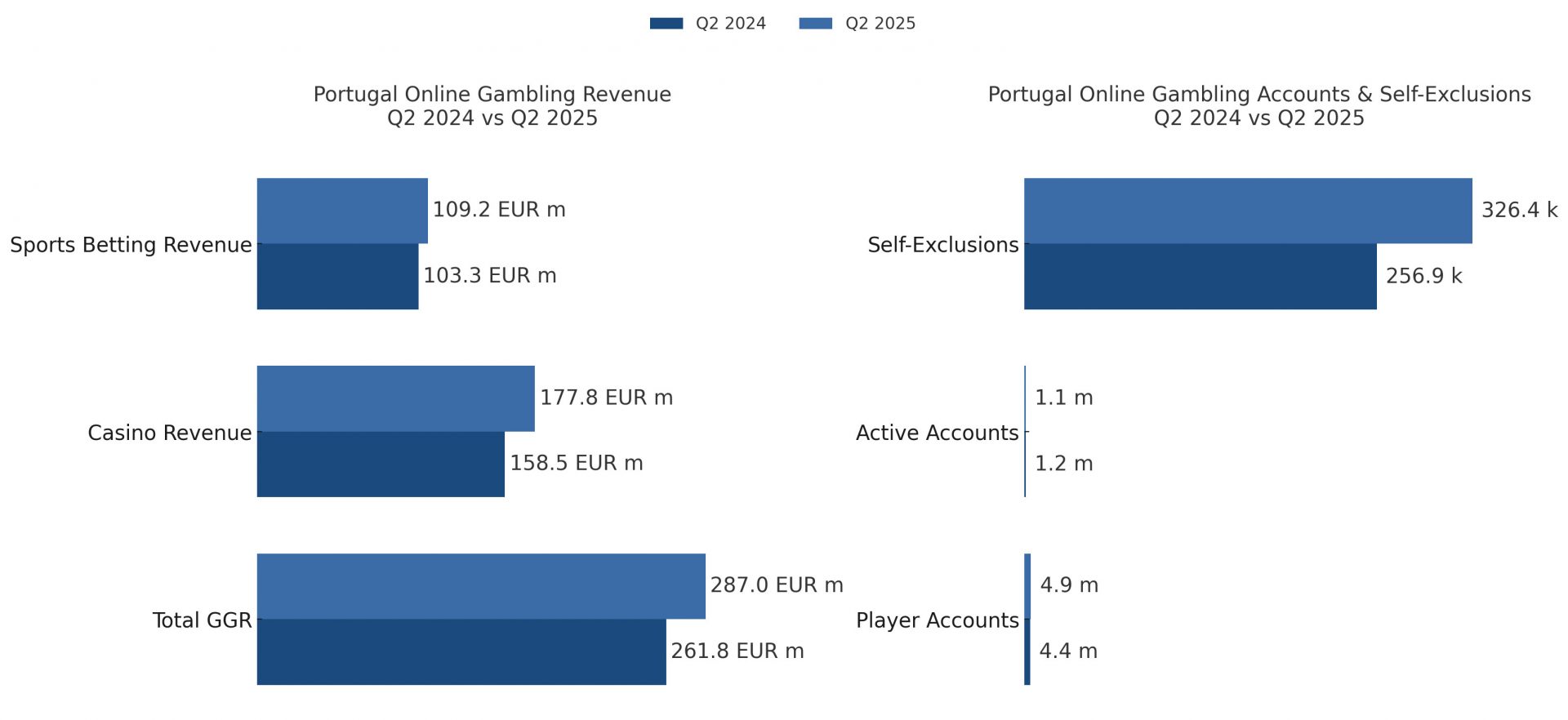

Gross revenue hit EUR 287.0m, up 9.6% year-on-year and broadly flat quarter-on-quarter. Casino (jogos de fortuna ou azar) delivered EUR 177.8m, or 62% of the total. Sports betting contributed EUR 109.2m, or 38%.

Sports betting stakes totaled EUR 457.3m, down 1.1% year-on-year and down 8.9% from Q1. Football dominated with 67.7% of betting handle, followed by tennis at 21.8% and basketball at 6.5%. The FIFA Club World Cup and Portugal’s Primeira Liga were the top football competitions by volume.

Casino stakes reached EUR 5.04bn, up 15.4% year-on-year and up 8.0% quarter-on-quarter. Slots accounted for 79.1% of casino play, ahead of Banca Francesa (7.0%) and Roleta Francesa (5.3%). Blackjack/21 held 4.5%, with Saque/Crash at 2.7% and poker at 1.3% combined.

Player accounts on record stood at 4.87m, up 9.9% year-on-year. New registrations were 211k in Q2, while cancellations were 136k. Active accounts (with at least one bet) were 1.12m, down 2.6% year-on-year and 6.5% quarter-on-quarter.

Self-exclusions reached 326.4k, up 27.0% year-on-year and 5.6% versus Q1. “Auto-exclusions rose 5.6% quarter-on-quarter in Q2 2025,” the report notes. The ratio of self-excluded to all registered accounts was 6.7% at quarter end.

The market counted 17 licensed operators holding 30 online licences. Portugal online gambling enforcement also continued, with 97 closure notices and 110 site blocks in Q2.

Football betting highlights included the FIFA Club World Cup at 10.5% of football volume and the Primeira Liga at 10.3%. In tennis, Roland Garros drew 20.3% of tennis bets. The NBA accounted for 45.5% of basketball betting.

Demographics skew younger: 77.8% of all registered accounts are under 45. The 25–34 bracket is the largest share at 33.5%, with 18–24 at 21.8% of total accounts but 36.0% of new sign-ups. Lisbon and Porto together make up nearly 43% of registrations.

Nationality mix is led by Portuguese players at 94.6% of registrations. Among foreign nationals, Brazil represents 49.0% of the non-Portuguese base. Cabo Verde, Nepal and Angola together contribute 23.4% of foreign registrations.

For product mix, Portugal online gambling continues to be casino-led by stakes and gross revenue. Slots remain the main driver, while football keeps the betting category anchored. Operators reported quarter-on-quarter softness in betting stakes despite the year-on-year revenue lift.

Please find more news here.