Sportradar Q2 2025 results show the company continuing its growth streak with record quarterly revenue. The business also delivered improved profitability and raised its full-year outlook. Management points to strong uptake in the U.S. and sustained customer retention as key drivers.

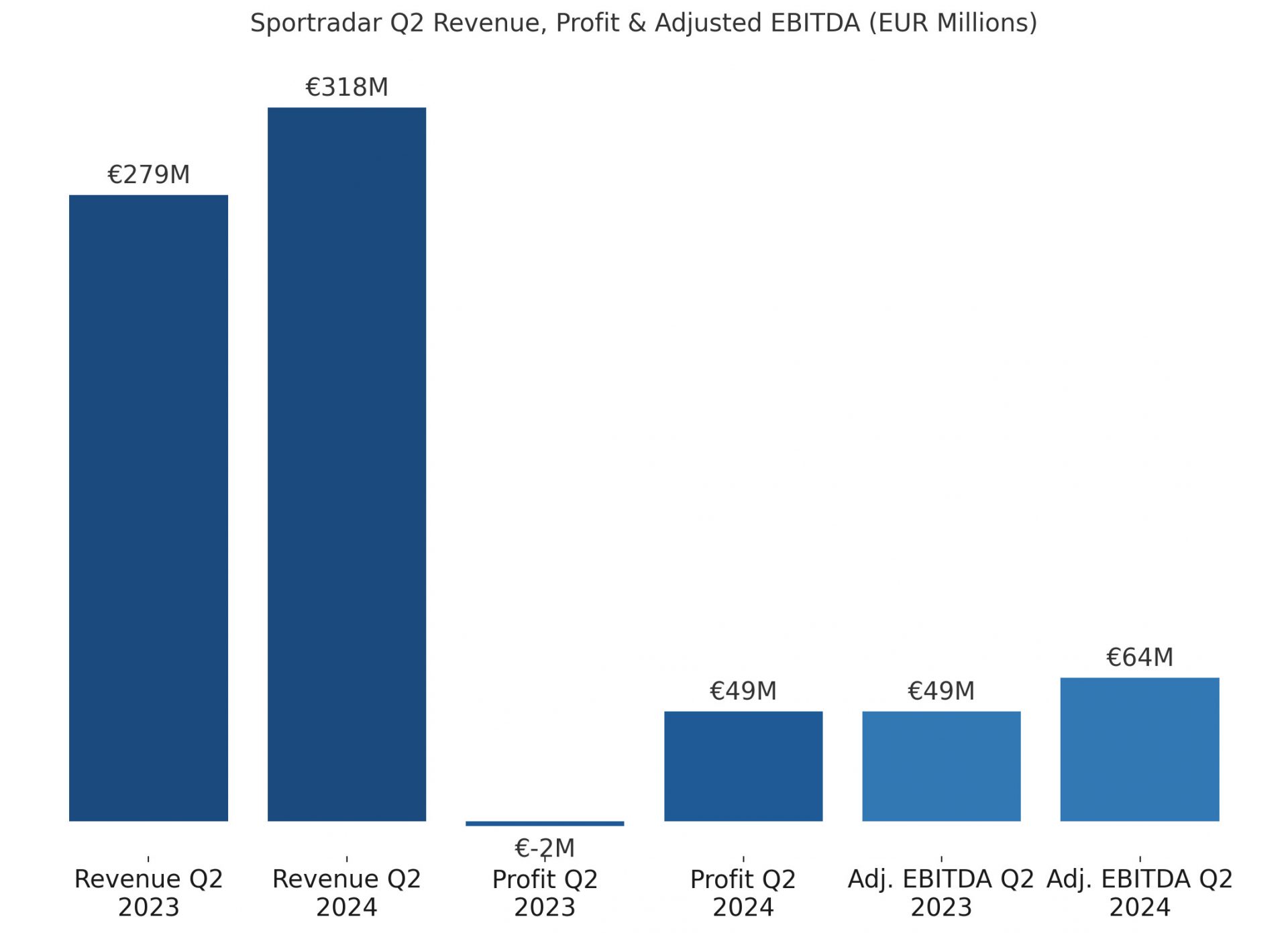

Revenue came in at €318 million for the quarter, a 14% increase year-on-year, mainly supported by 12% growth in Betting Technology & Solutions. The U.S. market stood out, with revenue up 30% to €88 million. Rest of World revenue rose 9% to €230 million.

Profit for the period reached €49 million, compared to a €2 million loss in the same quarter last year. This included a €54 million foreign currency gain, offset partly by higher tax expenses of €12 million.

Adjusted EBITDA was €64 million, a 31% year-on-year increase, with margins expanding to 20.1%. This improvement reflects the leverage in the business as well as efficiency efforts.

Betting Technology & Solutions posted €259 million in revenue, up 12% from last year. Managed Betting Services also grew strongly, up 21% to €59 million, driven by higher trading margins and turnover.

Sports Content, Technology & Services revenue increased 22% to €59 million. Growth in Marketing & Media Services, supported by expanded affiliate marketing, played a key role.

Integrity Services almost doubled revenue to €5.8 million, supported by demand from league partners. Sports Performance also grew 24% due to pricing increases.

The company achieved a Customer Net Retention Rate of 117%, reflecting strong cross-selling and upselling activity. This metric signals strong existing customer engagement.

Free cash flow for the quarter was €52 million, supported by net operating cash flow of €97 million. Liquidity stood at €532 million including an undrawn credit facility, with no debt outstanding.

Sportradar repurchased $65.5 million worth of shares under its ongoing buyback programme. Since March 2024, the company has repurchased 4.8 million shares for $86 million in total.

The full-year 2025 outlook now calls for at least €1,278 million in revenue, representing 16% growth. Adjusted EBITDA guidance was raised to at least €284 million, up 28% year-on-year.

Please find more news here.