Svenska Spel ended FY 2025 a little ahead of where it started the year. Revenue moved only slightly, but profit did more of the lifting. Online continued to edge higher through the year, and the final quarter of 2025 helped to pull the numbers into shape – see more details for FY 2025:

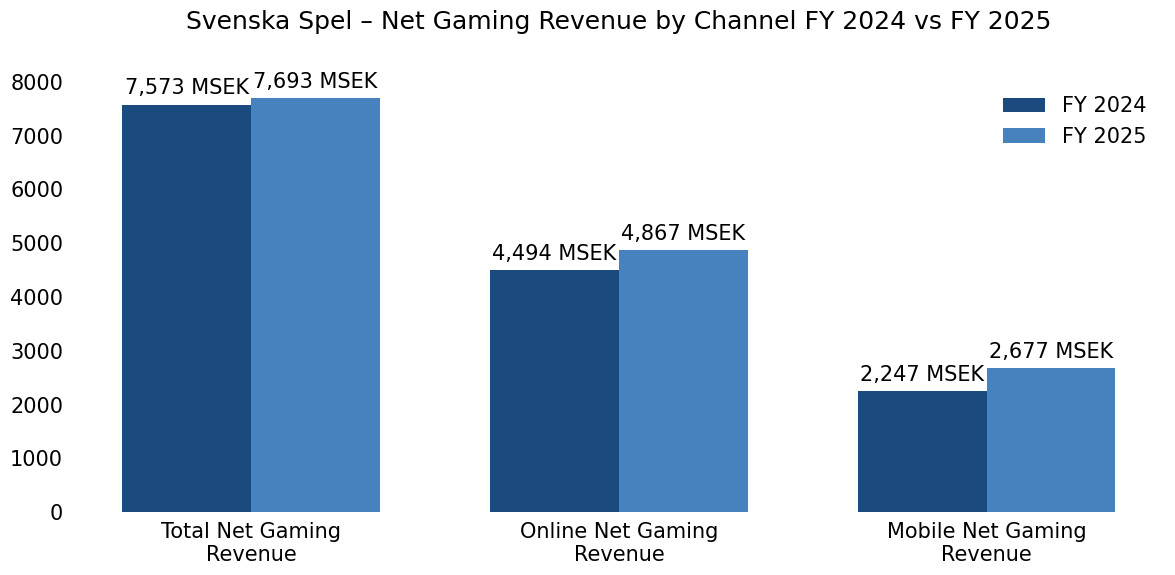

- For FY 2025 net gaming revenue came in at ca. SEK 7.7bn (ca. EUR 722 million), around 2% higher than in FY 2024. Lotteries and online casino held up better than the rest of the portfolio. Land-based play continued to lose ground, leaving digital with around 63% (2024: 59%) of total net gaming revenue by year-end.

- Digital net gaming revenue reached ca. SEK 4.9bn (ca. EUR 459 million), up 8% year-on-year. Mobile was the clear driver and accounted for 55% of total digital net gaming revenue in 2025 (FY 2024: 50%).

- Operating profit rose 10% to ca. SEK 2.5bn (ca. EUR 234 million), while the operating margin widened to 33%, compared with 31% a year earlier. Costs were lower, and gaming tax weighed less heavily than in the prior year.

- The fourth quarter stood out. Net gaming revenue in Q4 2025 increased 2% to ca. SEK 2.1bn (ca. EUR 197 million), while operating profit jumped 16% to SEK 641m (ca. EUR 60m). Online made up 62% of quarterly revenue, helping lift the Q4 2025 operating margin to 30%.

- On the back of the year’s result, Svenska Spel’s board proposed a dividend of SEK1.8bn (ca. EUR 169 million) for 2026. This compares with SEK1.6bn (ca. EUR 150 million) paid out last year and represents 92% of profit for FY 2025. The group’s equity position also strengthened, ending the year at 41%.

Please find more news here.